The US dollar rises despite negative data

Today, 21 June 2024, the EURUSD pair is declining despite several negative US economic data releases.

Decline in the US construction sector

The number of new housing starts in May 2024 decreased by 5.5% to 1.277 million year-on-year, the lowest figure since February 2023. A decline is also observed in the single-family home segment, with construction falling by 5.2% to 982,000, hitting its lowest level since last October. Building permits are also decreasing, with 1.386 million permits issued in May, down 3.8% from April. This is the lowest level since June 2020.

The number of jobless claims in the US decreased: in the second week of June 2024, it fell by 5,000 to 238,000, higher than expectations. It was reported earlier that 242,000 claims were recorded in the previous week, while economists, on average, had predicted a decrease to 235,000. It is worth noting that the previous figure was the highest since August last year.

However, despite a series of not-so-positive data, the EURUSD exchange rate is declining, reaching the low of last week. Helen Given, associate director of trading at Monex USA, reiterates that the US dollar will continue to strengthen as the US economic situation is currently better than in many other countries.

EURUSD technical analysis

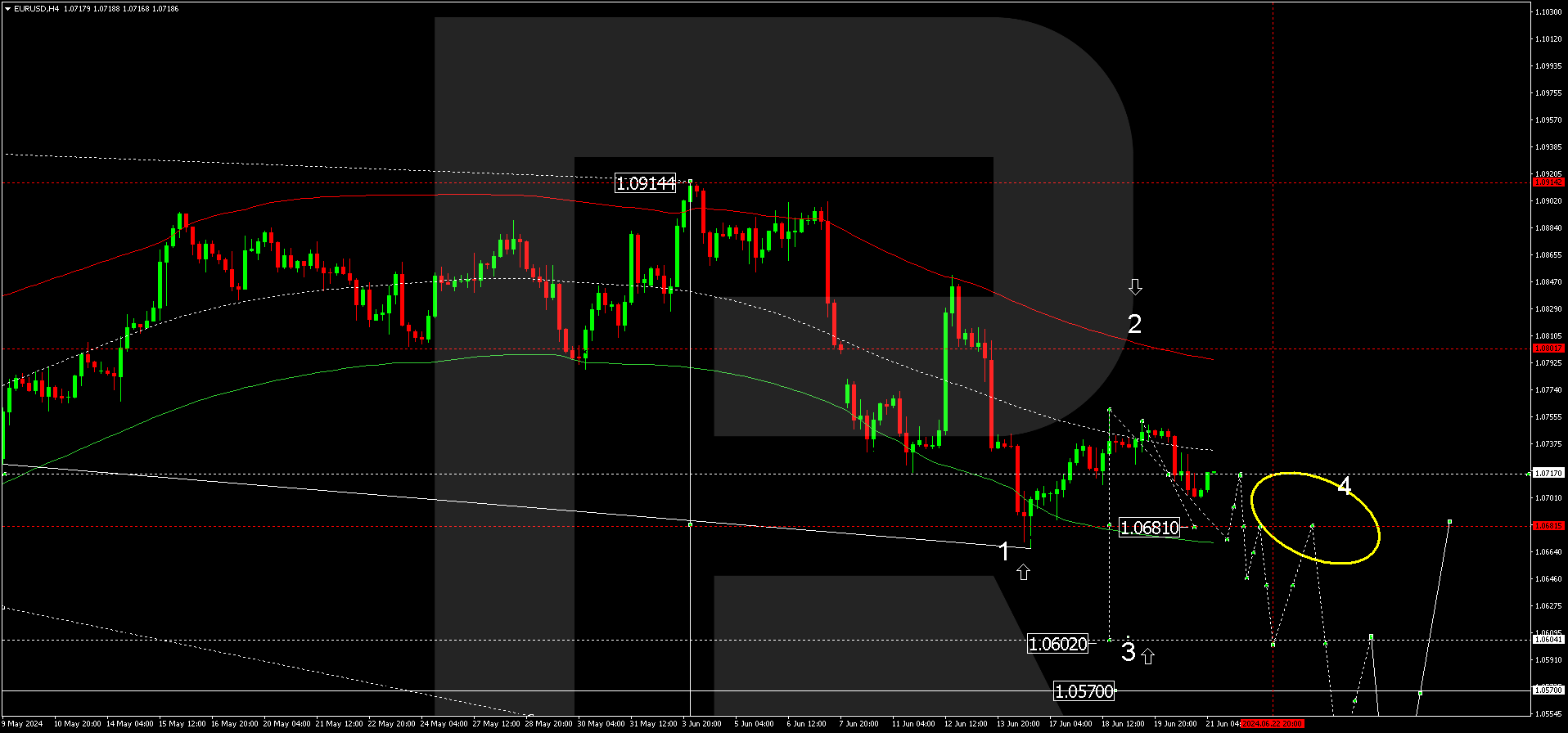

On the EURUSD H4 chart, the market failed to gain a foothold above 1.0750, with the price breaking below the 1.0722 level. A small consolidation range has formed around this level, which is crucial for the EURUSD forecast for 21 June 2024. EURUSD quotes are expected to continue their downward trajectory, aiming for 1.0680. Subsequently, the price might rise to 1.0720 (testing from below). After it reaches this level, a new decline wave might start, aiming for 1.0630 and potentially continuing to 1.0570 as the local target.

EURUSD technical analysis 21.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.0680. This level is considered crucial for a downward wave in the EURUSD rate. The market has received a downward rebound from the Envelope’s centre. Practically, the wave might continue to its lower boundary. After the price tests this boundary, a growth wave is expected to develop, aiming for the Envelope’s upper boundary.

Summary

The US construction sector is experiencing a recession, with a decline in both the number of new homes and building permits. However, the country's economic situation remains relatively stable. The EURUSD technical analysis suggests that the corrective wave is completed at 1.0760, with an expected onward decline to the targets of 1.0675 and 1.0570. Collectively, the news factor may contribute to this scenario.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.