EUR is under pressure: despite the ECB maintaining rates unchanged, investors expect cuts

The EURUSD rate is declining for the second consecutive day on Friday morning following the ECB’s decision. The current EURUSD exchange rate is 1.0887.

EURUSD trading key points

- The ECB kept key interest rates unchanged

- The decision reflects the regulator’s caution due to uncertainty about inflation slowdown rates

- Despite the central bank’s decision, markets expect an imminent interest rate cut, estimating the likelihood of this measure at 80%

- Christine Lagarde stated that decisions will be based on incoming economic data

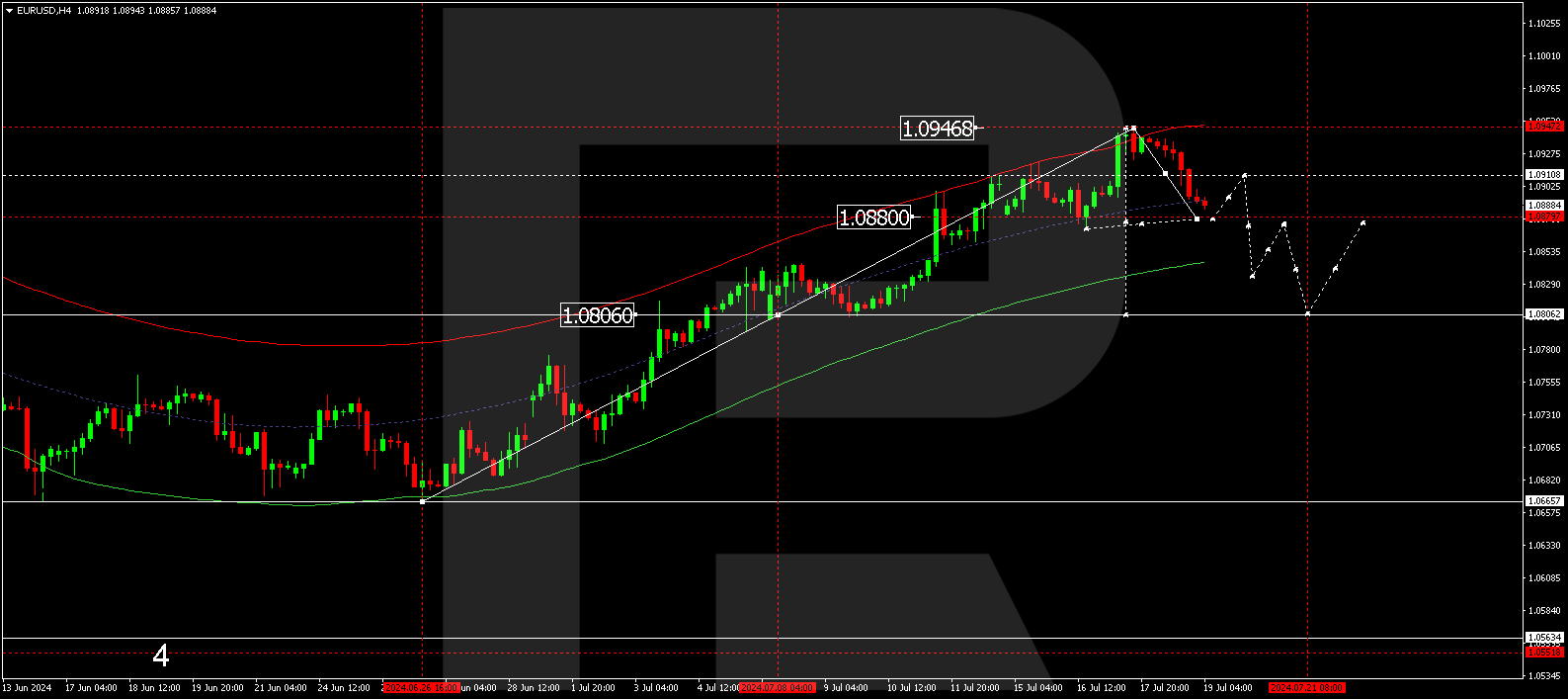

- EURUSD price targets: 1.880, 1.0840, and 1.0806

Fundamental analysis

As expected, the European Central Bank maintained key interest rates at the current level. The euro responded to the news with a decline, with the EURUSD pair moving away from four-month highs. This decision reflects the ECB’s caution due to uncertainty about inflation slowdown rates in the eurozone. Despite an overall recent fall in inflation, it remains significantly higher than the central bank’s target.

ECB President Christine Lagarde did not provide specific guidance about future meetings, emphasising that the September decision will be based on incoming data. The central bank’s leadership noted that interest rates would be decided at each meeting separately, without a predefined plan on rate levels.

Although interest rates remained unchanged, markets expect the ECB to lower them soon, estimating the likelihood at 80%. High inflation and the economic slowdown pose challenges for the regulator, prompting it to find a balance between combating inflation and supporting the economy.

According to Amelie Derambure, senior multi-asset portfolio manager at Amundi, Paris, the difference between the eurozone and US interest rates will diminish, potentially leading to a weaker US dollar against the euro in the mid-term.

EURUSD technical analysis

On the H4 chart, the EURUSD pair continues to develop a decline wave towards 1.0880, representing the first estimated target. The price is expected to reach the target today, 19 July 2024. Subsequently, the price could correct to 1.0910 (testing from below) before falling to the local target of 1.0840. Once the price reaches this level, a correction to 1.0880 might follow.

Summary

The ECB’s decision to keep key rates unchanged and leave the question of a future cut open is exerting pressure on the euro rate. In their assessment of the current developments, markets expect monetary policy easing as early as September. Technical indicators suggest a corrective wave continues in the EURUSD pair, with a target at 1.0806.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.