EURUSD returns to June levels, strengthening further

The EURUSD pair is strengthening amid the eurozone’s news. US negative data will drive a further rise.

EURUSD trading key points

- The eurozone’s core consumer price index (y/y): previously at 2.9%, forecasted at 2.9%

- The eurozone’s consumer price index (y/y): previously at 2.6%, forecasted at 2.5%

- US industrial production (m/m): previously at 0.9%, forecasted at 0.3%

- A speech by Federal Reserve’s Christopher Waller

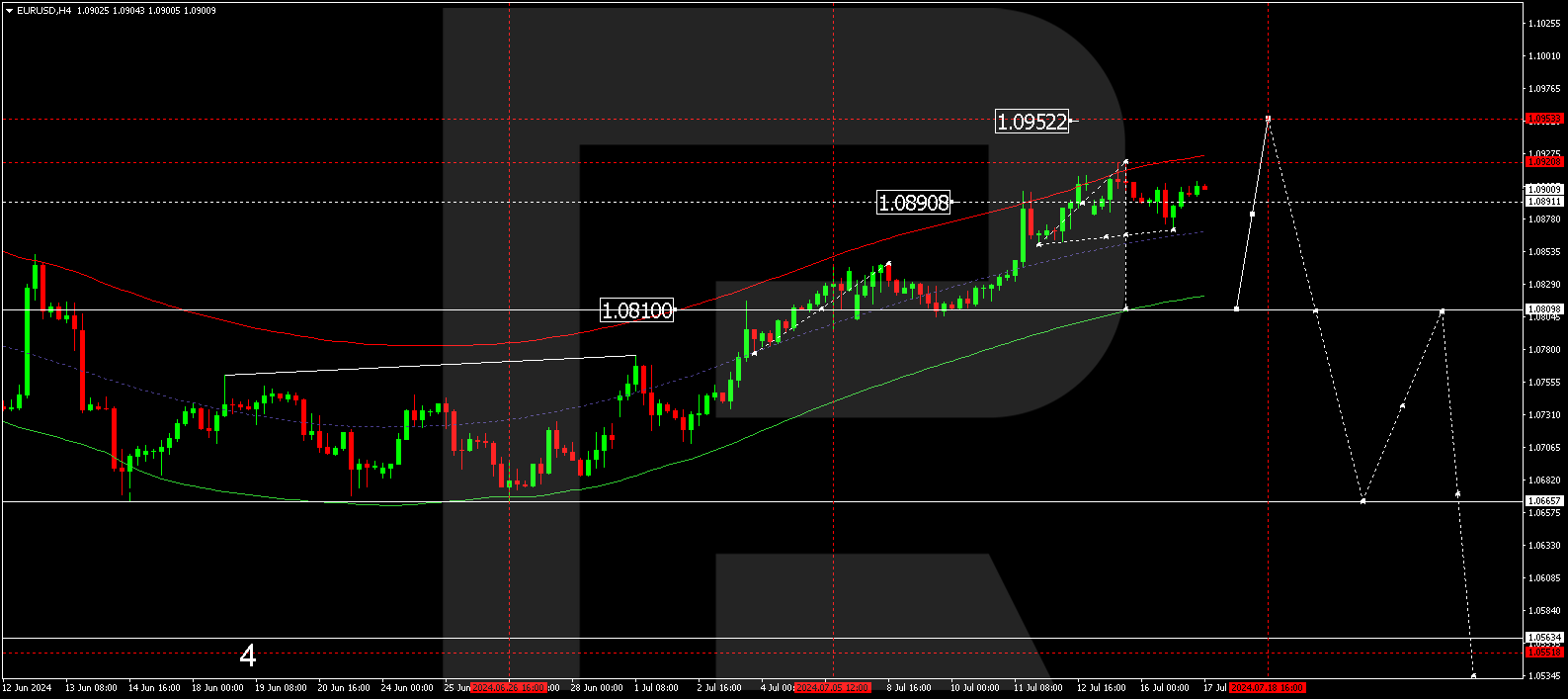

- EURUSD price targets: 1.0809 and 1.0950

Fundamental analysis

The eurozone’s core consumer price index is projected at 2.9%; the indicator may remain at the previous level, which could be a positive factor for the euro.

The eurozone’s consumer price index (y/y) is projected to decline slightly to 2.5%, which could help strengthen the euro against the US dollar.

US industrial production (m/m) is forecasted to decrease to -0.3%, with Christopher Waller’s speech potentially contributing to the weakening of the US dollar and a further rise in the EURUSD rate following a correction.

EURUSD technical analysis

On the EURUSD H4 chart, a consolidation range continues to develop around 1.0880 without any clear trend. The price declined to 1.0870, with a growth link towards 1.0906 formed today, 17 July 2024. An upward breakout of the range will open the potential for a growth wave towards 1.0950. A downward breakout will enable a fall to 1.0809.

Summary

Technical indicators align with the eurozone’s data and Christopher Waller’s speech, suggesting a further correction towards the 1.0809 target. Once the correction is complete, a growth wave could start, targeting 1.0950.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.