EUR continues to fall: the US dollar is to blame. Overview for 17.06.2024

The EURUSD pair has declined for the third consecutive day, with unpromising prospects.

The EURUSD position appears weak on Monday. The current EURUSD exchange rate stands at 1.0702.

The EUR faces serious pressure due to the political imbalance in Europe and a rather mixed outlook. The euro-dollar exchange rate has declined by 0.8% over the last week, marking the maximum weekly fall since April and giving a reason for a detailed forecast for EURUSD on 17 June 2024.

The market is speculating on the risks of a budget crisis in the eurozone. This pertains to the situation in France, where the confrontation between the right and left parties is reaching a new level ahead of snap parliamentary elections, with increasing pressure on President Emmanuel Macron’s centrist administration.

All these factors increase the likelihood of implications for the economy in the heart of the eurozone. This situation appears significant and dubious and is unlikely to be resolved soon.

A fall in the euro rate indirectly benefits the US dollar.

Despite a massive sell-off in the French financial markets last week, the European Central Bank does not plan to initiate an emergency purchase of French bonds.

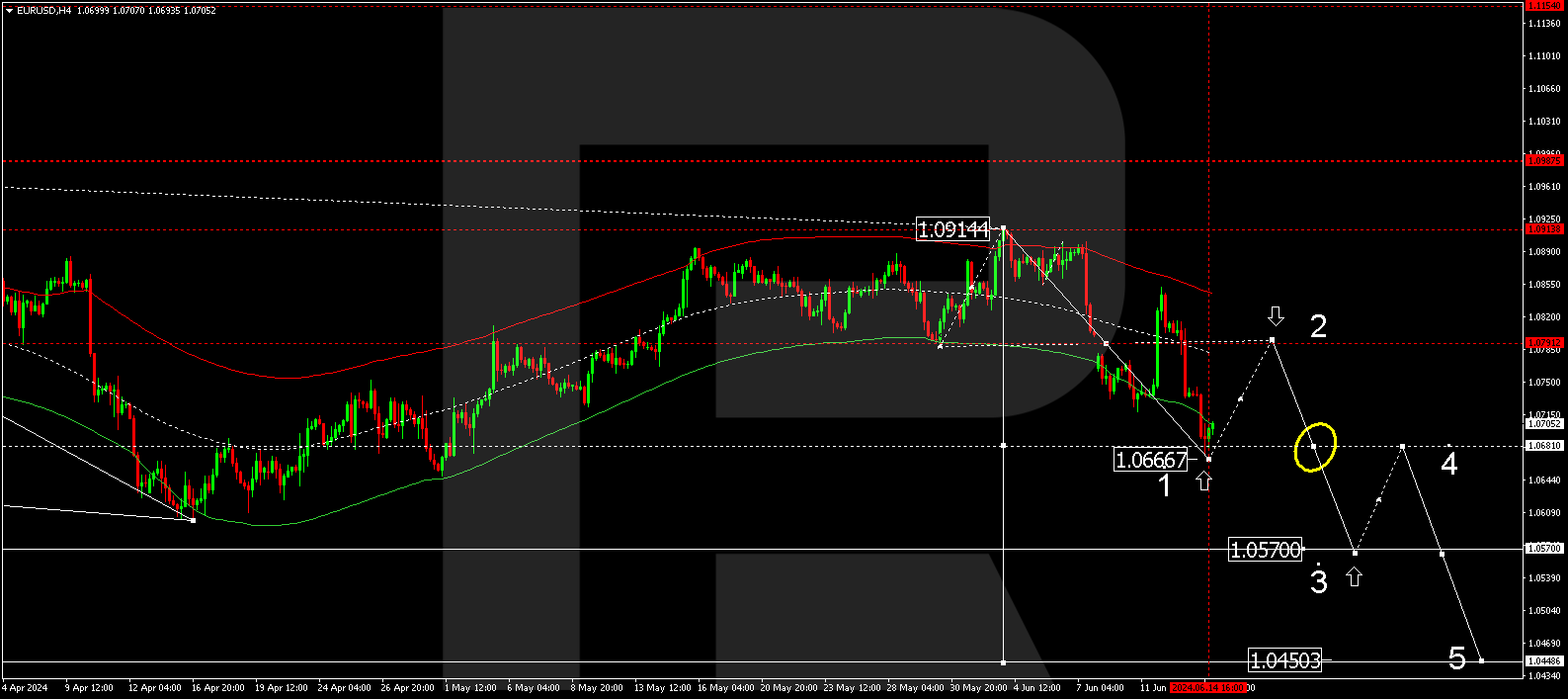

Technical analysis EURUSD

As the analysis for 17 June 2024 shows, EURUSD is developing another decline wave towards 1.0450. On the H4 chart, the market formed the first structure of this wave, with a target at 1.0666. Today, a consolidation range is expected to form above this level. With an upward breakout, a correction towards 1.0790 might follow. Once the correction is complete, a new decline structure in the EURUSD exchange rate could start, aiming for 1.0680. A breakout of this level will open the potential for a decline wave towards the local target of 1.0570. With a downward breakout of the range, a decline wave to 1.0570 is possible. Technically, this scenario is confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.0680. The market has completed a decline to the lower boundary of the Envelope, with a rise to its upper boundary being expected.

Summary

The EURUSD technical analysis points to a potential decline wave, with targets at the 1.0790, 1.0570, 1.0680, and 1.0450 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.