EUR rises again

The EURUSD pair is gradually rising. The market will be cautious ahead of the US CPI data release.

EURUSD trading key points

- Investors are cautious in anticipation of US inflation data

- Core CPI is expected to remain unchanged

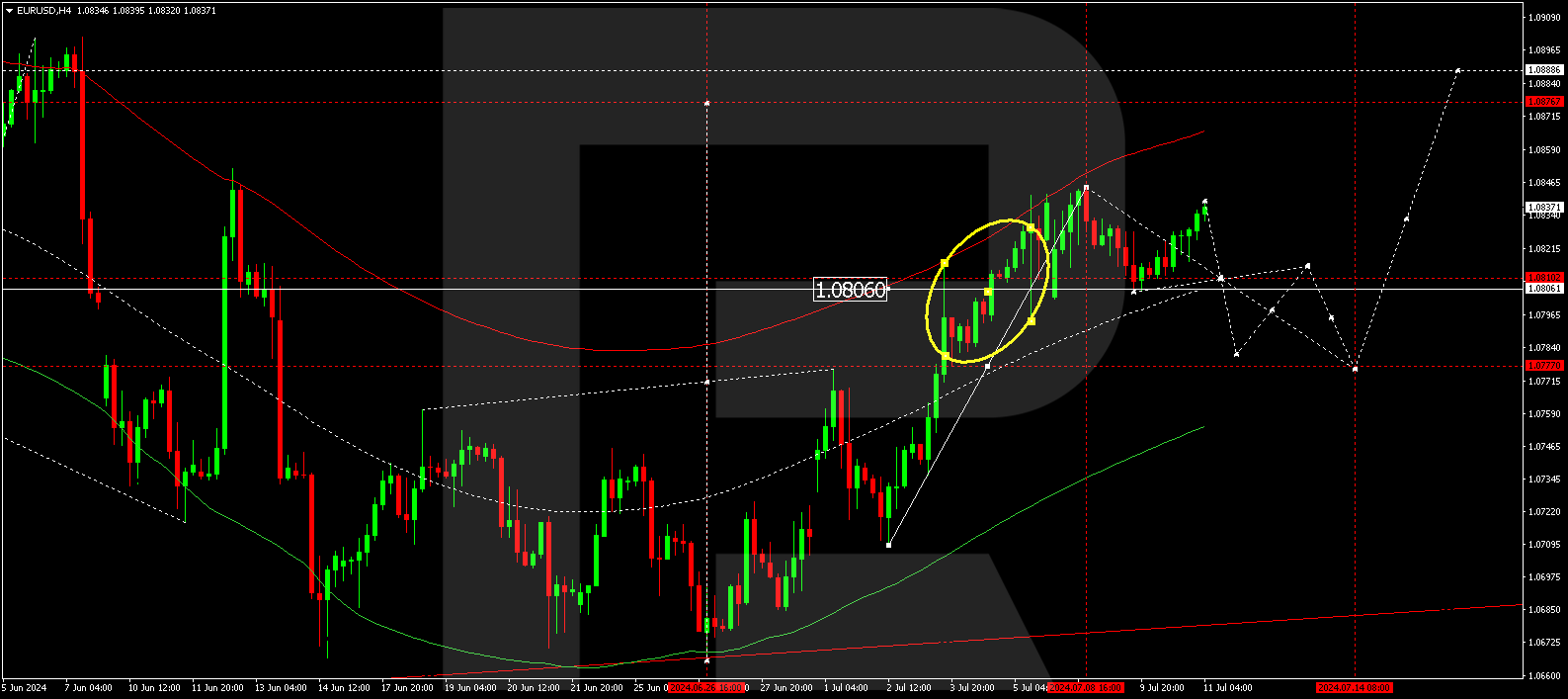

- EURUSD price targets: 1.0777 and 1.0888

Fundamental analysis

The EURUSD pair regained strength and rose to 1.0836 on Thursday.

Today is crucial for the currency market. US June consumer price index statistics and a corresponding basic report are due in the afternoon. The figures will provide the market with more insight into what to expect from the Federal Reserve in the near term.

Inflation is expected to have fallen to 3.1% y/y from the previous 3.3% and is projected to have risen by 0.1% month-over-month from a zero value in May.

It will be essential to monitor core inflation figures as they will show whether there are significant changes in groups of goods and services excluding volatile items. The annual and monthly core CPIs are expected to remain at 3.4% and 0.2%, respectively.

The degree of price pressure will show whether the Federal Reserve will lower interest rates in September or postpone this action to a more favourable time.

EURUSD technical analysis

On the EURUSD H4 chart, a consolidation range continues to develop above 1.0806 without any clear trend, with the market receiving support at this level. Today, 11 July 2024, the price rose to 1.0839 and is expected to decline to 1.0811, a crucial level for the EURUSD pair. With a breakout below this level, a correction could continue to 1.0777. If a growth wave develops and the price breaks above 1.0840, the trend might continue to the local target of 1.0888.

Summary

EURUSD appears confident and is rising. Technical indicators suggest a potential correction in the EURUSD pair towards the 1.0777 target. Once the correction is complete, a new growth wave might start, aiming for 1.8888.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.