EURUSD: Nagel’s and Powell’s speeches may give hope for the euro’s strengthening

The EURUSD pair continues strengthening ahead of officials’ speeches and amid the rising US national debt.

EURUSD trading key points

- A speech by the President of the Deutsche Bundesbank Joachim Nagel

- A speech by Deutsche Bundesbank official Sabine Mauderer

- A speech by US Federal Reserve Chair Jerome Powell

- A speech by US Federal Open Market Committee (FOMC) official Michelle Bowman

- EURUSD price targets: 1.0888 and 1.0900

Fundamental analysis

Wednesday, 10 July 2024, is rich in speeches from the central bank and Fed’s chiefs and officials. A speech by the president of the Deutsche Bundesbank (concurrently a member of the ECB Governing Council) may shed light on the future EU monetary policy and help strengthen the euro against the US dollar. A subsequent speech by Deutsche Bundesbank official Sabine Mauderer may bolster the words of the Deutsche Bundesbank president.

Comments from the Federal Reserve Chair Jerome Powell are due after the US trading session opens, potentially adding to the market volatility and providing insight into the future of US interest rates. The increasing US national debt also works against the US dollar.

Although any market movements can be expected in this environment, the general situation does not favour the US currency at this stage. The euro is more likely to strengthen than the US dollar.

EURUSD technical analysis

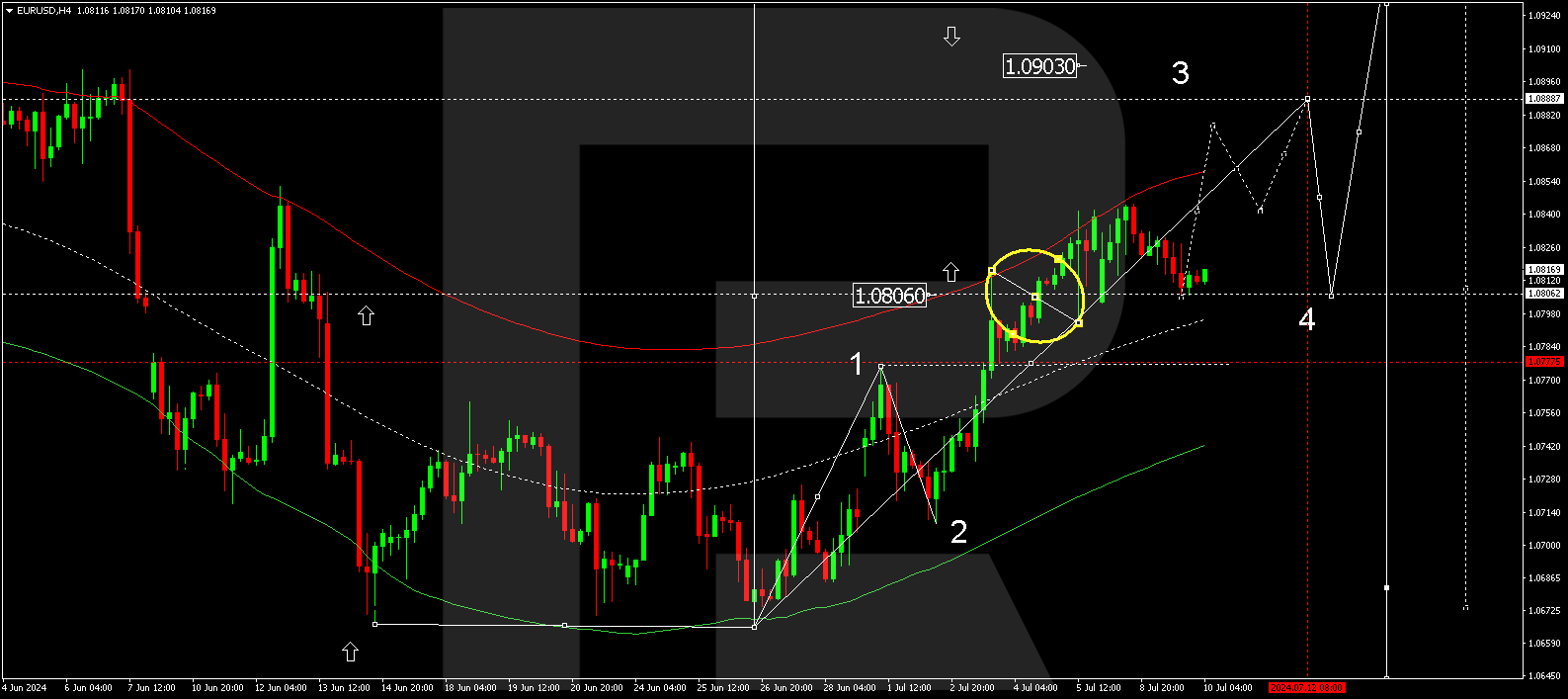

On the EURUSD H4 chart, a consolidation range continues to develop above 1.0806. This level is considered crucial for the EURUSD pair today, 10 July 2024, with the market receiving support at this level. A rise to 1.0844 is expected. If this level breaks, the price could climb to the local target of 1.0888. After reaching this target, the price is expected to decline to 1.0840 (testing from above). Subsequently, another growth structure could follow, aiming for 1.0900.

Summary

The Federal Reserve chair’s speech, rising US national debt, and technical indicators suggest a potential correction towards the 1.0888 and 1.0900 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.