USD is falling amid expectations of weak employment data

The EURUSD rate has reached a three-week high following the release of the ECB meeting minutes. The current EURUSD rate is 1.0822.

EURUSD trading key points

- Eurozone inflation remains above the 2% target

- US job growth is expected to slow down

- The likelihood of a Federal Reserve interest rate cut in September increased to 73%

- EURUSD price targets: 1.0710, 1.0600, 1.0550

Fundamental analysis

The ECB minutes reflect a potential shift to a tighter monetary policy. Inflation in the region continues to rise, exceeding the 2% target despite the recent interest rate cut. The US employment market is showing signs of a slowdown. Nonfarm payroll data due today is expected to demonstrate the addition of 190,000 jobs in June, down from 272,000 in May.

Weak economic data, including decreasing consumer spending and manufacturing activity, have heightened expectations that the US Federal Reserve will lower the interest rate soon. While the Fed has already projected one interest rate cut in 2024, markets currently anticipate two reductions. Traders estimate the likelihood of a September rate cut at 73%. Additional weakness in earnings data in the employment report may amplify these expectations and exert pressure on the US dollar.

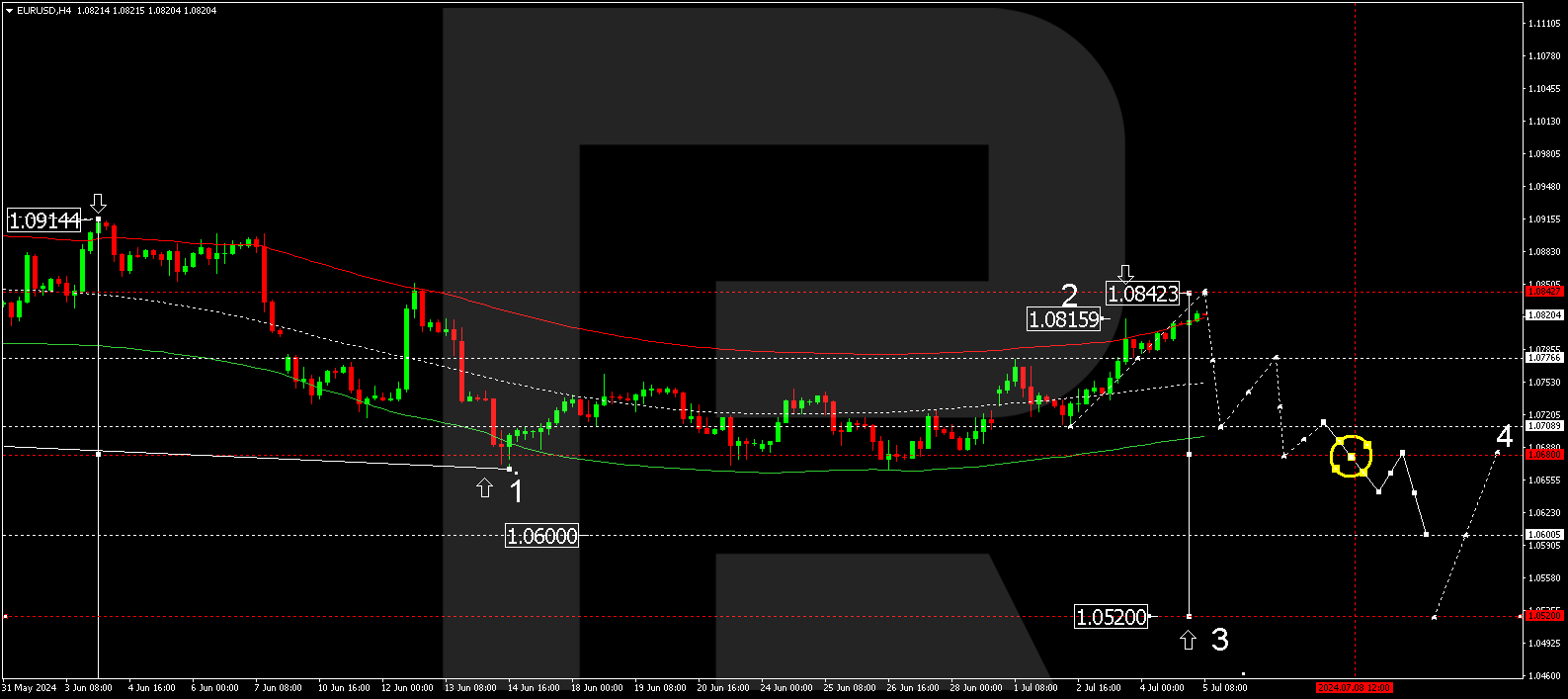

EURUSD technical analysis

On the H4 chart, EURUSD received support at 1.0777, with a growth structure continuing to develop. Today, 5 July 2024, the wave could expand to 1.0828. Once this correction is complete, a new decline wave could start, aiming for 1.0770. A breakout of this level will open the potential for a downward movement to 1.0711, representing the first target.

Summary

Weak employment data may send the US dollar down. Technical indicators point to the completion of the correction in the EURUSD pair and the beginning of another decline wave to the 1.0710, 1.0600, and 1.0550 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.