EURUSD has risen significantly, and statistics have nothing to do with it

Risk appetite is pushing up the EURUSD pair. US statistics came out mixed, providing no clear signals.

EURUSD trading key points

- The ADP signal was neutral in June

- Today is a public holiday in the US, so activity will be lower

- EURUSD targets: 1.0730, 1.0680, 1.0555

EURUSD fundamental analysis

The EURUSD pair has risen markedly over the last two sessions and stabilised at 1.0785 on Thursday.

Yesterday, the market had a plethora of macro statistics to consider, which have been factored into prices overall. The first signals about the state of the employment market have been received and analysed: the ADP number of jobs in the US private sector increased by 150,000 in June compared to the forecasted 163,000 and the previous 152,000, providing a neutral signal. Let us see what Friday’s NFP release will bring.

The services PMI appears uneven. The official PMI report showed a decrease to 48.8 points in June from 53.8 points in May, a warning signal. At the same time, Markit observations reflected an increase to 55.3 in June from the previous 54.8. Readings over 50.0 points indicate improvement and expansion.

Risk appetite looks favourable, positively impacting the EUR position. Today is the Independence Day holiday in the US. Volatility in the EURUSD pair is expected to be subdued, but only until tomorrow’s release of crucial employment statistics.

EURUSD technical analysis

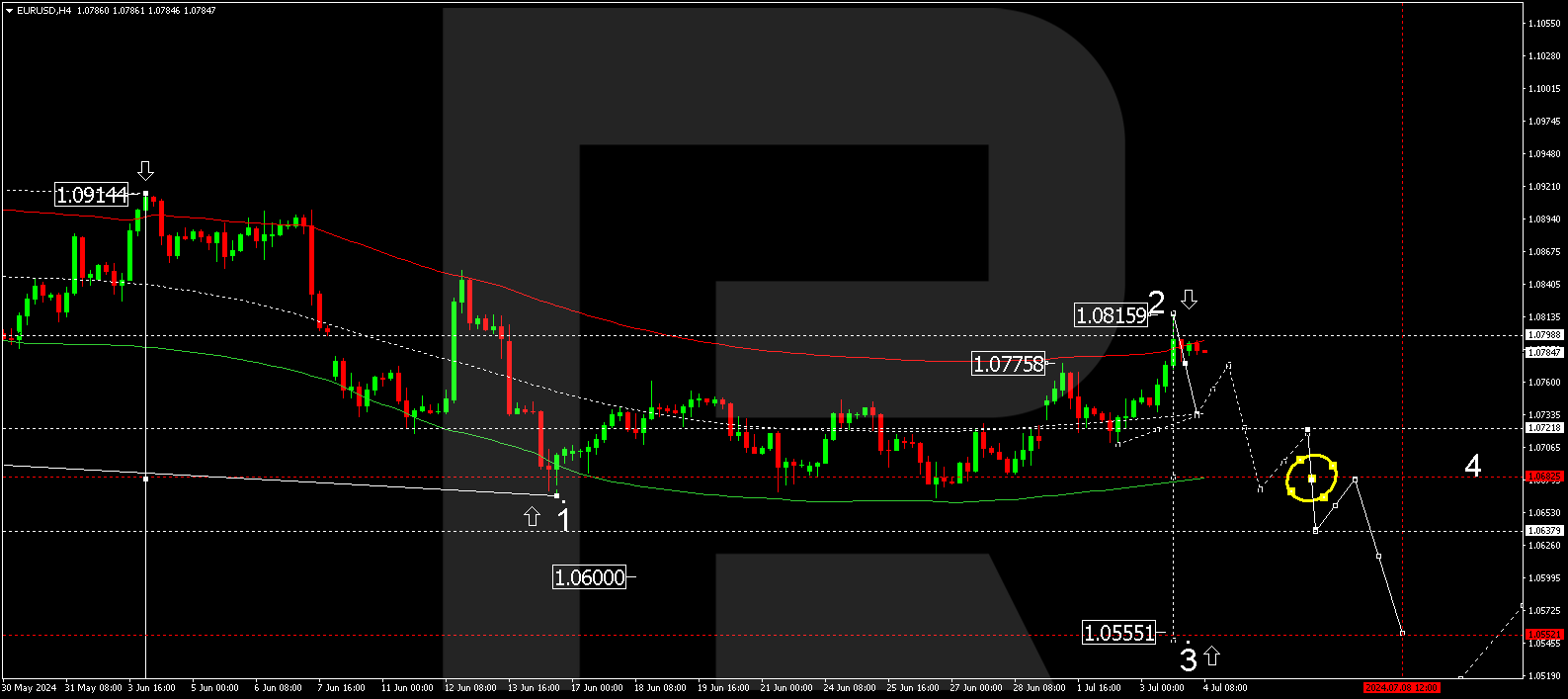

On the H4 chart, EURUSD has corrected to 1.0815. Today, 4 July 2024, a consolidation range could form below this level. With a downward breakout of the range, a new decline wave might start, aiming for 1.0730, a crucial level for this wave. Once the price reaches this level, it could correct to 1.0777 (testing from below). Subsequently, the decline structure might develop, targeting 1.0677 and potentially continuing to 1.0630.

Summary

Risk appetite supports the EUR position. Technical indicators for today’s EURUSD forecast point to a further decline to the 1.0680, 1.0600, and 1.0555 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.