EUR declines: inflation in Germany and EU eases

The EURUSD rate has corrected after an initial rise and is now testing the strong support area at 1.0725.

EURUSD trading key points

- German inflation declined to 2.2%

- US ISM manufacturing PMI fell unexpectedly to 48.5

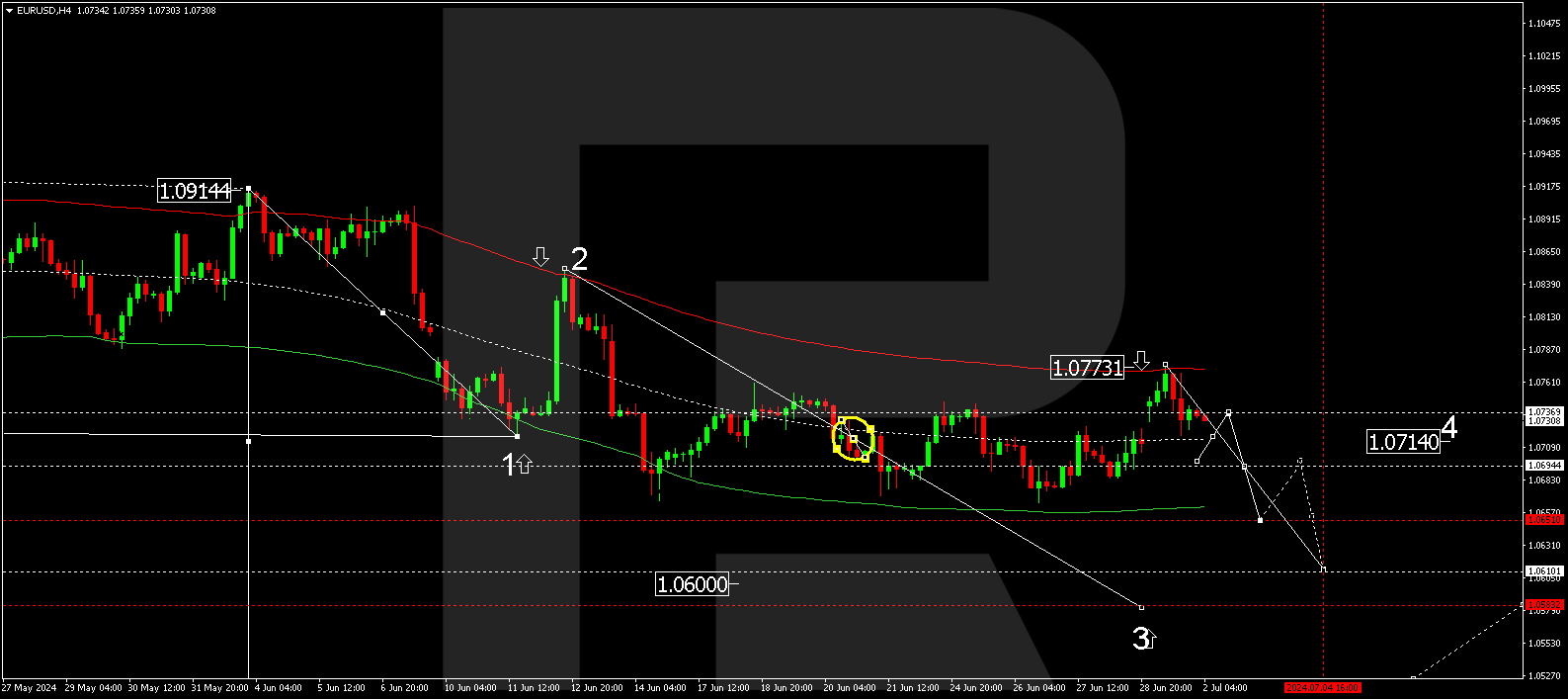

- EURUSD targets: 1.0600, 1.0573

- Resistance: 1.0770. Support: 1.0665

EURUSD fundamental analysis

With the far-right party receiving fewer votes than expected, the results of the first round of the French parliamentary election helped strengthen the euro at the start of the week. However, inflation in Germany and the EU turned out to be lower than forecasted, prompting speculations about a potential ECB interest rate cut. Inflation in Germany fell to 2.2% in June, with overall EU inflation easing to 2.5%. The EURUSD pair was under additional pressure from the US ISM manufacturing PMI, which has decreased for the third consecutive month, coming in at 48.5 points in June. This signals a downturn in the manufacturing sector and currently prevents the EURUSD pair from breaking below the support level

EURUSD technical analysis

On the Н4 chart, the EURUSD quotes have broken above the consolidation range and corrected towards 1.0773. A decline wave is expected to develop today, 2 July 2024, towards the 1.0695 level, which is considered crucial for a further decline wave towards the local target at 1.0600. The Elliott Wave structure with the centre at 1.0695 technically confirms this scenario.

Summary

The downturn in the US manufacturing sector supports the EURUSD pair. Technical indicators point to the EURUSD pair declining further towards the 1.0600 and 1.0573 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.