EURUSD maintains equilibrium: Fed’s decisions align with expectations

The EURUSD pair remains stable. The Fed did not surprise the market. Find out more in our analysis dated 1 August 2024.

EURUSD trading key points

- The Federal Reserve’s interest rate remains at 5.50% per annum

- The Fed may lower borrowing costs in September

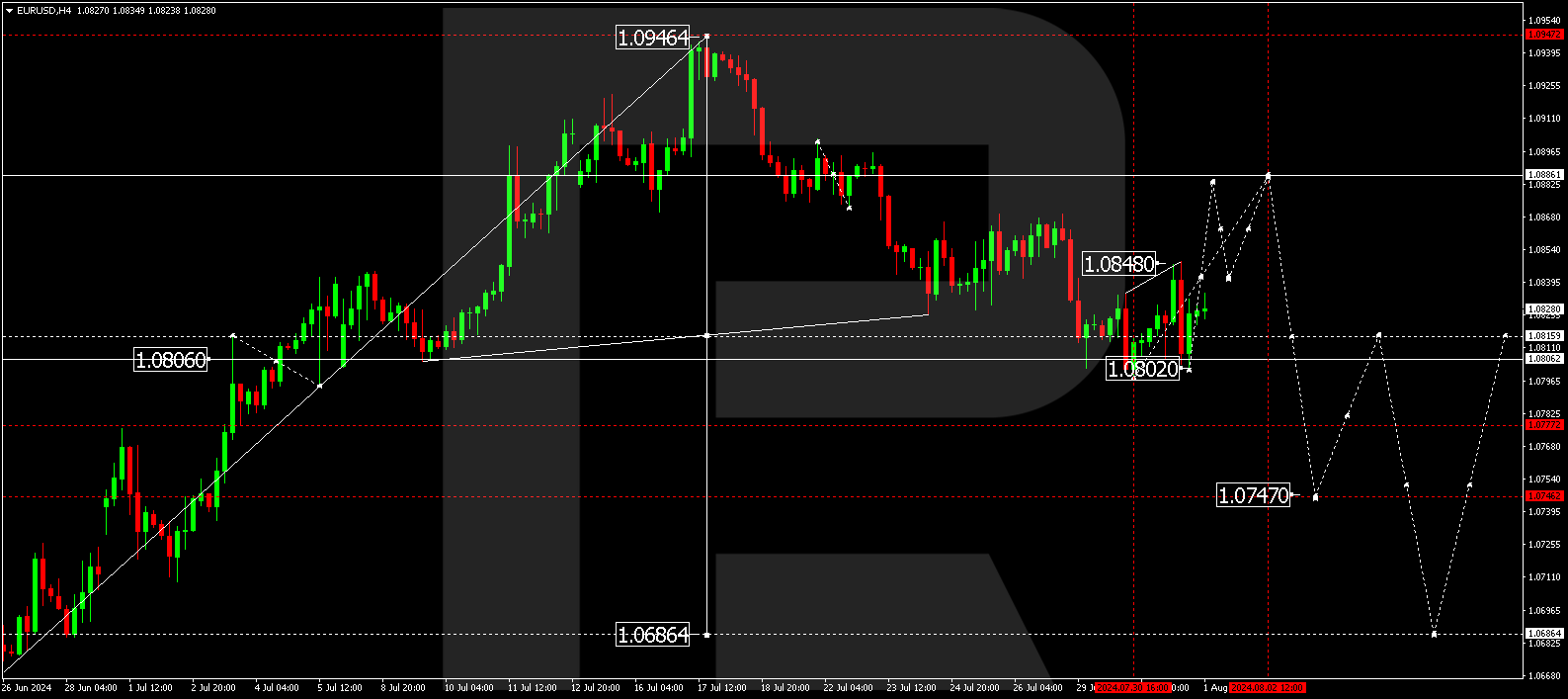

- EURUSD forecast for 1 August 2024: 1.0880, 1.0777, and 1.0747

Fundamental analysis

The EURUSD rate remained stable at 1.0828 on Thursday. The primary currency pair reacted cautiously to the outcome of the US Federal Reserve’s meeting.

This time, the Federal Reserve maintained interest rates within the target range of 5.25-5.50% per annum. These are the highest levels in 23 years and have remained unchanged for eight consecutive meetings.

According to the Federal Reserve’s commentary, the US economy continues to grow at a steady pace, while the employment sector is gradually cooling. Although inflation has eased over the observed year, it remains relatively high. Maximum employment and a 2.00% CPI stay the Federal Reserve’s long-term targets. While the Fed may lower interest rates in September, no specific decision has been made yet.

Everything unfolded as anticipated, with no surprises from the Federal Reserve.

EURUSD technical analysis

On the H4 chart, the EURUSD pair rose to 1.0848 before declining to 1.0820, effectively outlining the boundaries of the consolidation range. Since the entire decline wave has not yet seen a correction, it is reasonable to consider an upward breakout from the consolidation range today, 1 August 2024, with the correction target (at least) at 1.0880. With a downward breakout, the decline wave could continue towards 1.0747, representing the local estimated target.

Summary

The EURUSD rate appears neutral following the Federal Reserve’s interest rate decision. Technical indicators for today’s EURUSD forecast suggest a correction towards 1.0880. Subsequently, preference is given to continuing the downtrend to the 1.0777 and 1.0747 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.