EUR has risen: all eyes on French policy

The EURUSD pair partially recovered its previous decline on Monday. The far-right party was not strong enough in the first round of the French election, which was positive for the market.

EURUSD trading key points

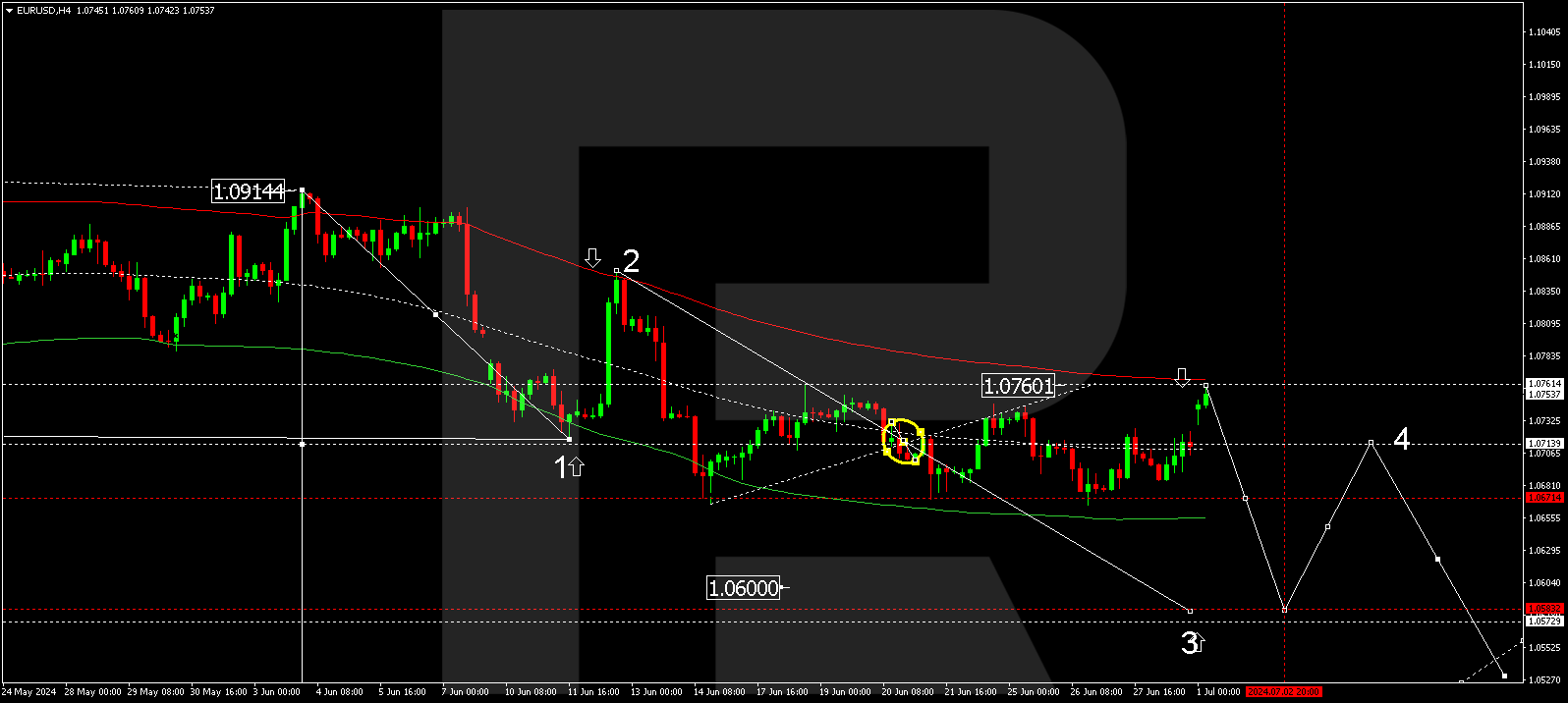

- The EURUSD targets are 1.0600 and 1.0573

- The French elections remain one of the critical subjects

- Investor sentiment is positive, with a favourable risk attitude

EURUSD fundamental analysis

EURUSD starts the week rising. The EURUSD pair increased to 1.0753 and returned to levels seen on 13 May.

Investors are now primarily focused on data from the first round of the French snap election. Although the far-right was again winning, it did not appear as strong as before, favouring observers and boosting the EUR rate.

Marine Le Pen’s far-right National Rally (RN) won the first round of the parliamentary election on Sunday. However, the party secured fewer votes than expected.

The euro has declined since France’s President Emmanuel Macron called snap elections.

EURUSD technical analysis

On the H4 chart, EURUSD is currently in a consolidation phase around the 1.0714 level. This level is considered crucial for the current decline wave in the EURUSD pair. Today, 1 July 2024, a corrective phase is expected, targeting 1.0760. Subsequently, a decline wave might start, aiming for 1.0600 and potentially continuing to the local target of 1.0573. The Elliott Wave structure with the centre at 1.0714 technically confirms this scenario.

Summary

From the fundamental analysis perspective, the EURUSD pair is supported. Upcoming economic reports will be crucial for determining short-term movements in the EURUSD rate. Technical indicators point to a further decline to the 1.0600 and 1.0573 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.