AUDUSD is falling: the market does not believe in interest rate hikes

The Australian dollar is declining for the second consecutive day. The AUDUSD pair is returning to fluctuations within the traded range.

AUDUSD trading key points

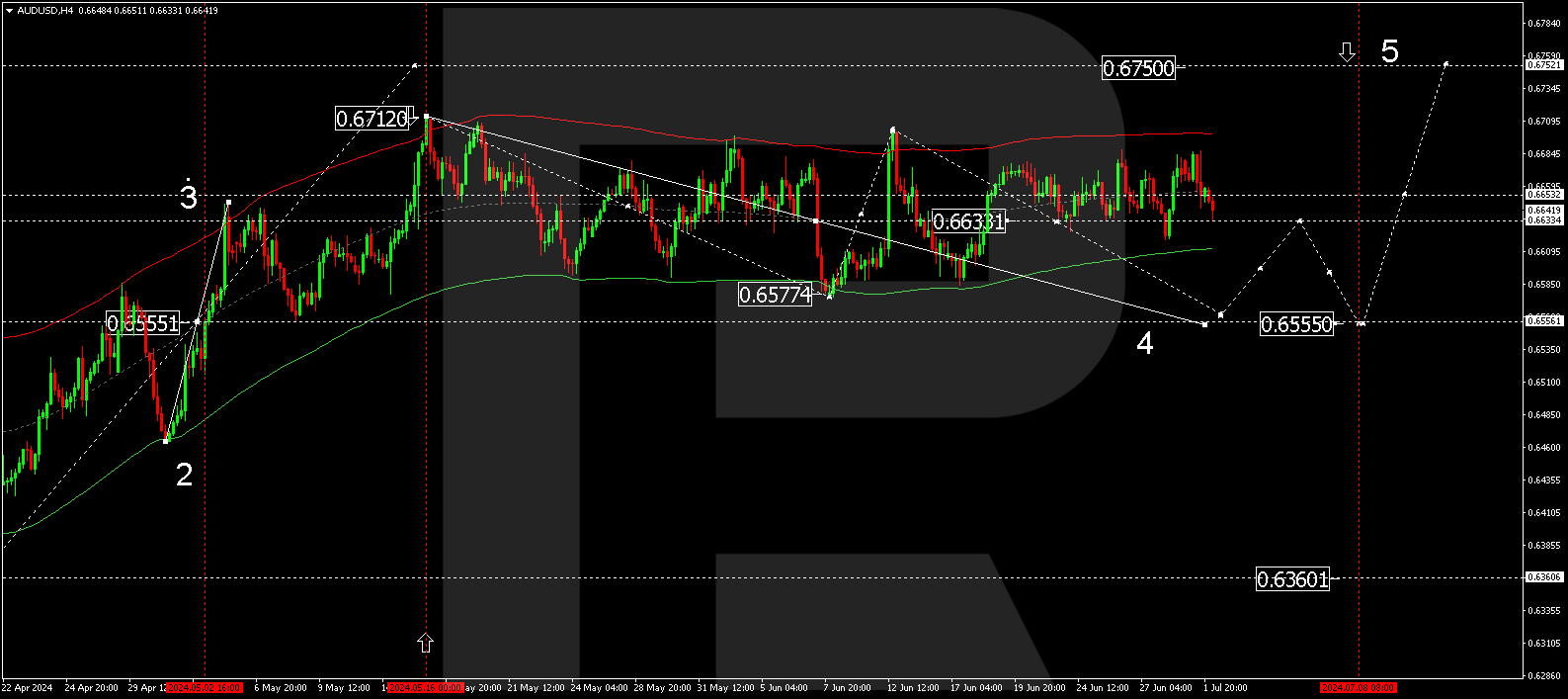

- AUDUSD targets: 0.6555, 0.6750

- The odds of an RBA interest rate hike in August are one in three

AUDUSD fundamental analysis

The AUDUSD pair declines to 0.6638 on Tuesday, retreating from a two-week high despite the recent hints from the Reserve Bank of Australia about a potential interest rate increase.

According to the RBA’s June meeting minutes, monetary policymakers prefer to remain vigilant about inflation risks. They believe that significant price rises may necessitate a noticeable rate hike. However, the RBA is confident it can bring inflation down to the 2% target while maintaining economic and employment stability.

Investors estimate a one-in-three chance of an RBA interest rate hike at its August meeting.

On a global level, the Aussie is under pressure from the US dollar due to increased treasury bond yields.

AUDUSD technical analysis

On the H4 chart, the AUDUSD pair has formed a consolidation range above 0.6630 and, after breaking above it, extended the range to 0.6677. Subsequently, the quotes returned to the 0.6633 level, crucial for the AUDUSD forecast for 2 July 2024. A downward breakout will open the potential for a decline in the AUDUSD rate to 0.6555, representing the estimated target.

Summary

The Aussie is under pressure from the USD due to increased treasury bond yields. The AUDUSD technical analysis points to a further correction towards 0.6555.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.