AUDUSD found temporary support near 0.6700

AUDUSD quotes have halted their decline and are attempting to reverse upwards after encountering demand from buyers near 0.6700. More details can be found in our analysis for 10 October 2024.

AUDUSD forecast: key trading points

- The AUDUSD pair has found support and is trying to reverse upwards

- The AUD rate is under pressure due to the strengthening of the US dollar after strong US labour market statistics for September

- AUDUSD forecast for 10 October 2024: 0.6682

Fundamental analysis

The AUDUSD rate tumbled to 0.6700 on Thursday but after encountering strong buyer demand at that level, it reversed upwards again.

The US dollar continues to strengthen against the AUD and other major currencies amid stronger-than-expected US private sector employment statistics for September. The AUDUSD pair remains within a daily downward correction, which could end at any moment.

The Aussie is under additional pressure from decreased risk appetite in the market due to the escalating conflict in the Middle East and falling gold prices, with which the pair correlates. The Reserve Bank of Australia is expected to lower interest rates in December. US inflation data, with the Consumer Price Index ( CPI) scheduled for release, may influence the pair’s moves today.

The AUDUSD forecast currently appears neutral for the Australian dollar.

AUDUSD technical analysis

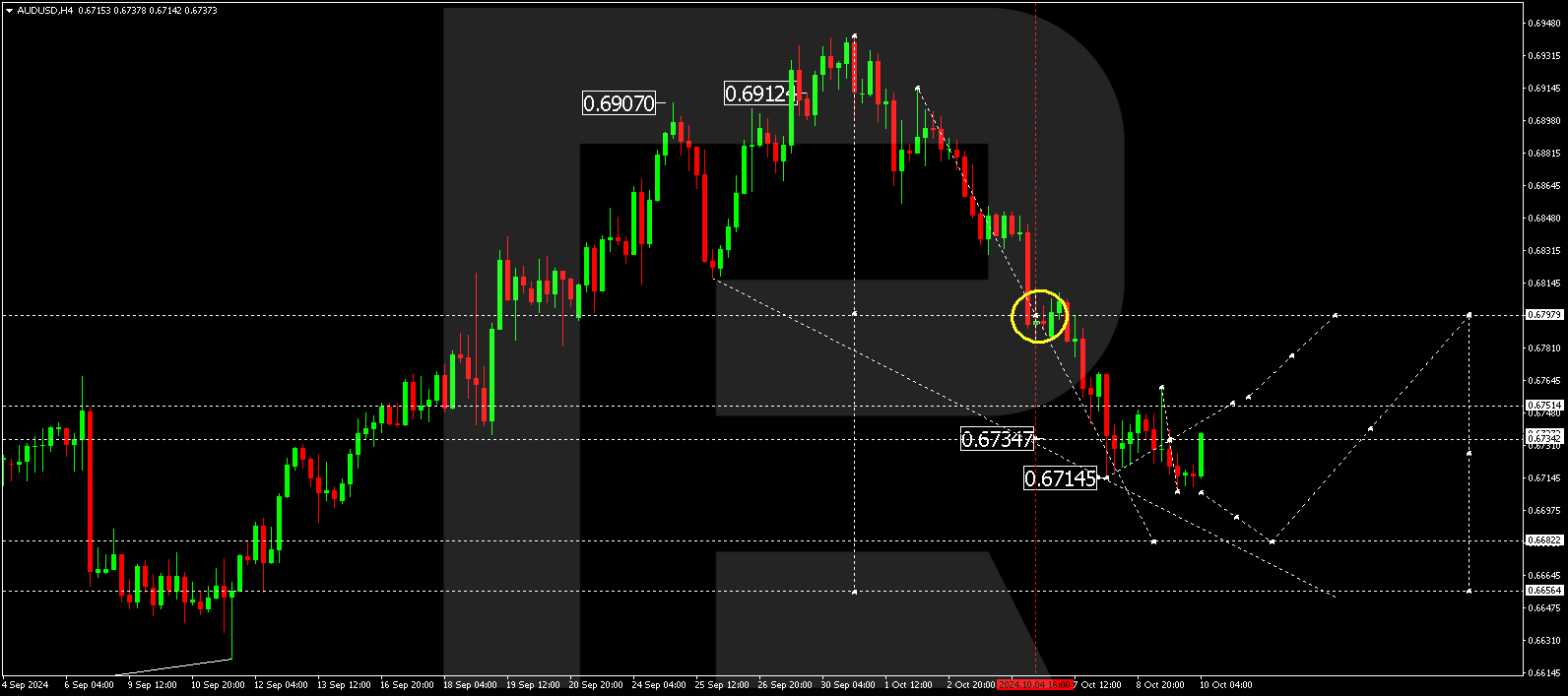

The AUDUSD H4 chart shows that the market is forming a consolidation range around 0.6735. The AUDUSD rate is expected to break below this range and reach the target level of 0.6682 today, 10 October 2024. Subsequently, a correction is possible, targeting 0.6797 (testing from below). A new downward wave could then start, aiming for 0.6655 as the first target.

Summary

The AUDUSD pair is still trading within a downward correction. Technical indicators in today’s AUDUSD forecast suggest that the downward wave could continue towards the 0.6682 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.