AUDUSD at the start of an upswing, US economic data will determine the trend

A potential rise in US inflation and increased personal consumption expenditures may propel the AUDUSD pair to 0.6325 after the current correction is complete. Discover more in our analysis for 28 March 2025.

AUDUSD forecast: key trading points

- The University of Michigan US inflation expectations: previously at 4.3%, projected at 4.9%

- US core Personal Consumption Expenditures price index (core PCE) for January: previously at 2.6%, projected at 2.7%

- AUDUSD forecast for 28 March 2025: 0.6325 and 0.6262

Fundamental analysis

At the beginning of the US trading session, the market will see the release of inflation expectations data from the University of Michigan. The previous figure was 4.3%, and the forecast for 28 March 2025 suggests a possible increase to 4.9%. Inflation growth often negatively affects the national currency.

The US core PCE price index for January, a key inflation gauge closely watched by the Federal Reserve, measures changes in the prices of goods and services, excluding volatile food and energy categories. These figures reflect shifts in consumer spending and inflationary pressure. Higher values may suggest the need for tighter monetary policy, while lower readings point to easing inflation.

Today’s AUDUSD forecast factors in a potential rise in the core PCE price index to 2.7%. While the change is not critical, the actual result could still impact the AUDUSD rate.

Overall, the AUDUSD forecast for today appears positive for the Australian dollar. However, traders should remain cautious as a broad set of US data due today could shift market sentiment.

AUDUSD technical analysis

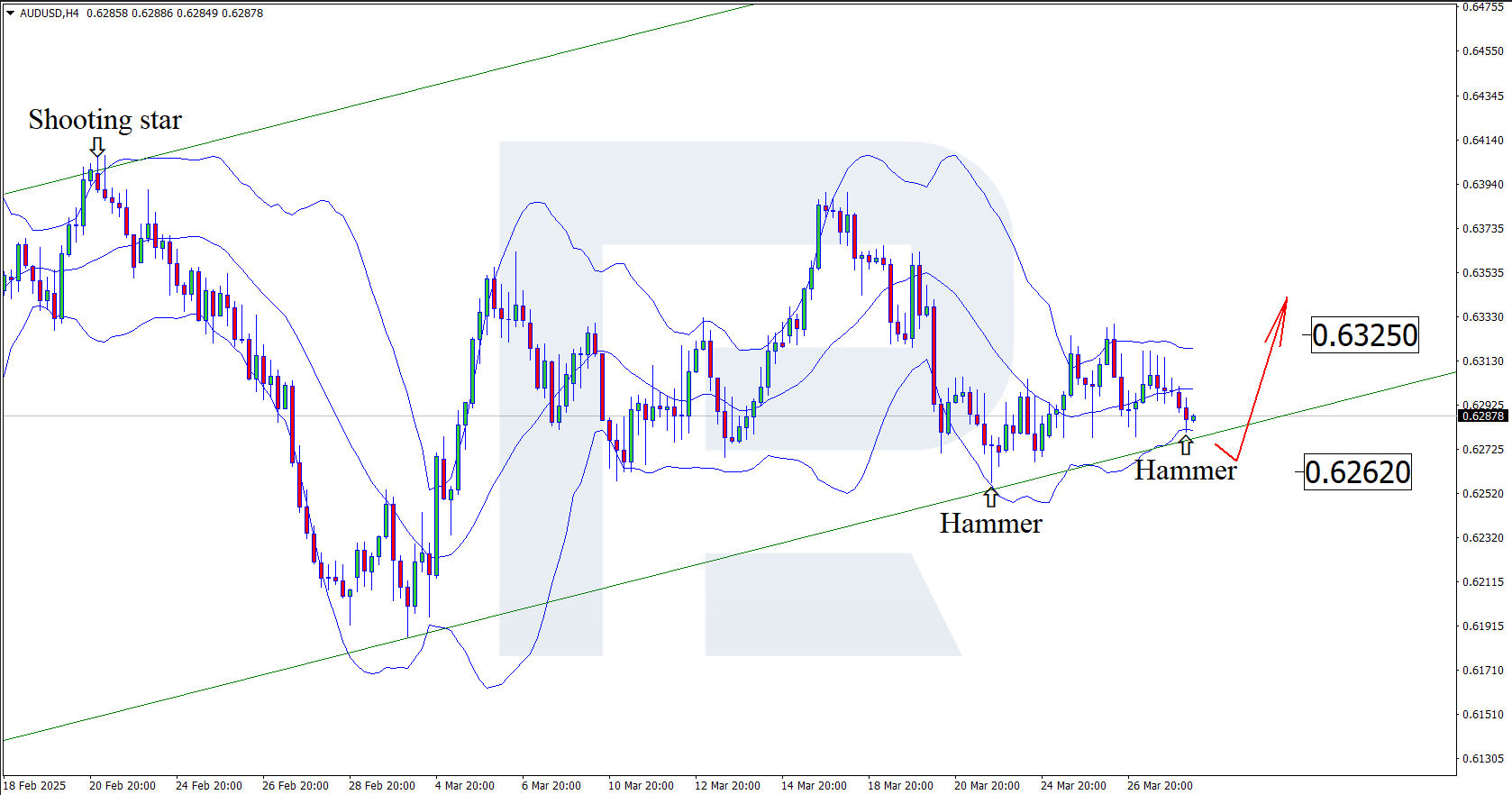

Having tested the lower Bollinger band, the AUDUSD price has formed a Hammer reversal pattern on the H4 chart. At this stage, it could begin an upward wave following the received signal. Since the price remains within an ascending channel, it could climb further to the 0.6325 resistance level. A breakout above this level would open the way for an extended uptrend.

However, the AUDUSD rate could correct towards the 0.6262 support level before a rise.

Summary

A potential rise in US inflation could weaken the US dollar against the Australian dollar. The AUDUSD technical analysis suggests further growth towards the 0.6325 resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.