AUDUSD: the Australian dollar has a chance of strengthening

Amid positive data from Australia, the AUDUSD rate may continue its ascent to the 0.6444 level. More details in our analysis for 12 December 2024.

AUDUSD forecast: key trading points

- Australia’s employment change in November: previously at 12.2 thousand, currently at 35.6 thousand

- Australia’s unemployment rate in November: previously at 4.1%, currently at 3.9%

- US initial jobless claims: previously at 224 thousand, projected at 221 thousand

- AUDUSD forecast for 12 December 2024: 0.6444

Fundamental analysis

Australia’s employment change reflects the difference in the number of officially employed citizens over the reporting period. The previous value was 12.2 thousand, while the actual figure came in at 35.6 thousand, exceeding both expectations and the earlier reading. This could indicate some improvement in Australia’s economic climate. Following the release of the employment data, the AUDUSD pair underwent a correction.

Australia’s unemployment rate dropped to 3.9%, down from the previous reading. Fundamental analysis for 12 December 2024 shows that this improvement in unemployment figures became a positive factor for the Australian dollar.

The forecast for 12 December 2024 suggests that US initial jobless claims for the previous week are likely to fall to 221 thousand from the previous 224 thousand. The decrease is expected to be minor, serving as a neutral factor for the US dollar.

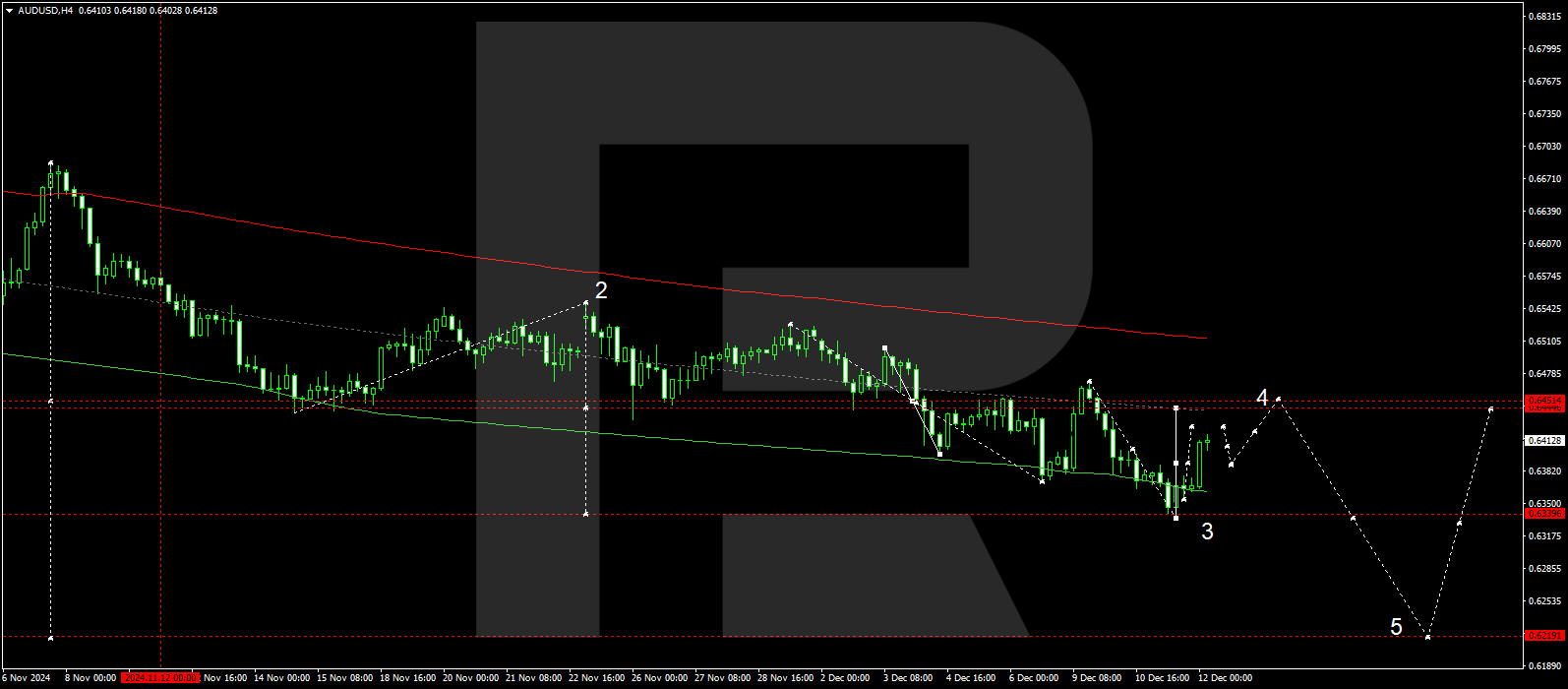

AUDUSD technical analysis

The AUDUSD H4 chart shows that the market has completed a downward wave, reaching the local target of 0.6340. Today, 12 December 2024, a corrective wave is forming, targeting 0.6444 (testing from below), with a broad consolidation range developing around this level. After this, another downward wave is anticipated, targeting 0.6222 as the main target.

The Elliott Wave structure and growth wave matrix, with a pivot point at 0.6444, technically support this scenario for the AUDUSD rate. The market has reached the lower boundary of a price envelope at 0.6340. Today, a growth wave may begin, targeting the envelope’s central line at 0.6444. Subsequently, a consolidation range is likely to form around this line. With a downward breakout, another wave will likely develop in line with the trend, targeting the envelope’s lower boundary at 0.6222.

Summary

Together with technical analysis for today’s AUDUSD forecast, the uptick in the employment rate and decreased unemployment in Australia suggest that the growth wave could continue towards the 0.6444 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.