Gold (XAUUSD) hit a new all-time high today, hovering above 2,780 USD

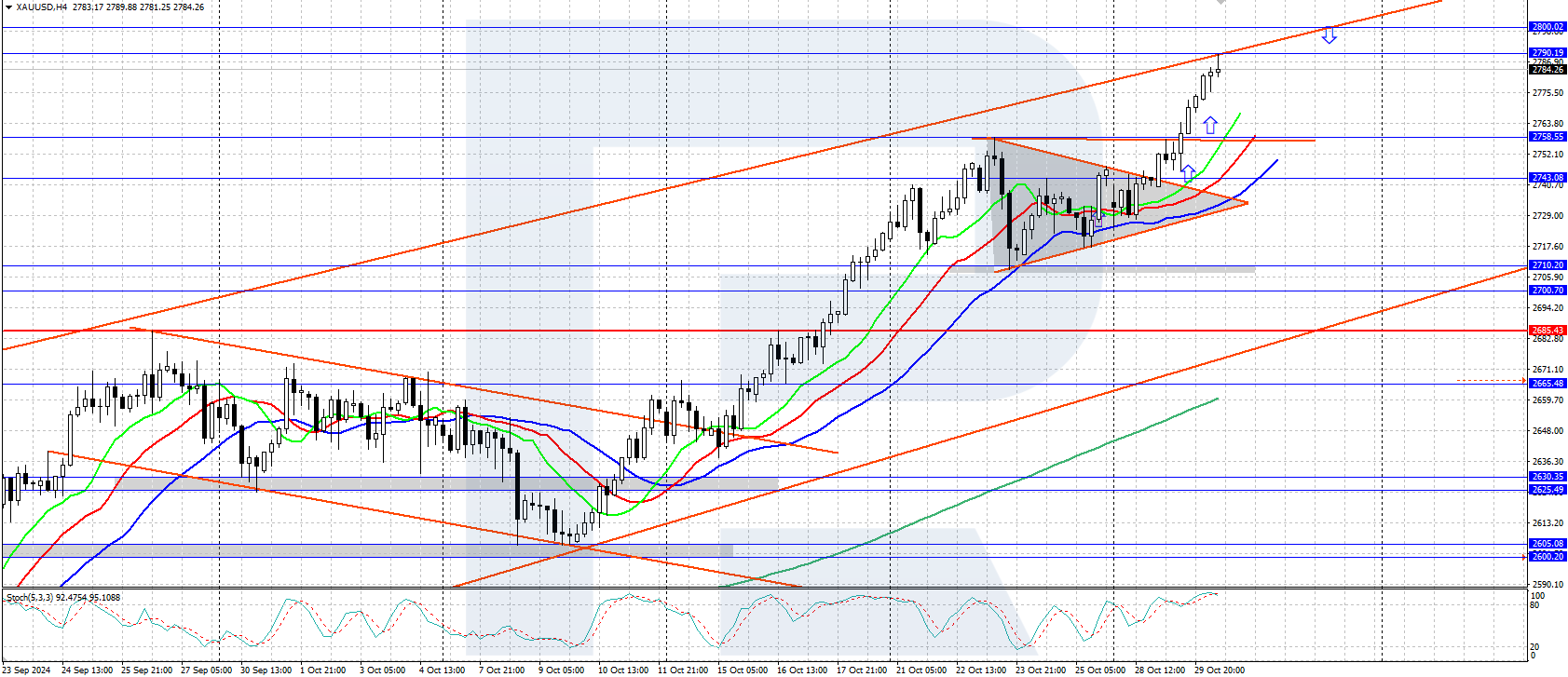

XAUUSD prices have completed a correction and are steadily rising, surpassing the previous all-time high of 2,758 USD. A triangle pattern has formed on the instrument chart. More details in our XAUUSD analysis for today, 30 October 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting the US labour market statistics this week, including the ADP report, nonfarm payrolls, and the unemployment rate

- Current trend: a strong uptrend is underway, with a triangle pattern formed on the chart

- XAUUSD forecast for 30 October 2024: 2,758 and 2,800

Fundamental analysis

XAUUSD quotes continue to trade in an uptrend, reaching another all-time high around 2,790 USD today. A downward correction is complete, and growth is likely to resume. The precious metal appears buoyant, supported by robust demand from central banks and investors.

The current Federal Reserve’s interest rate-cutting cycle, high geopolitical tensions, ongoing conflict escalation in the Middle East, and the upcoming US presidential election in November are all factors strengthening the prices of Gold.

US employment statistics from Automatic Data Processing Inc. (ADP) are scheduled for release during today’s American session. If data exceeds the forecast (+115,000 jobs), the US dollar will receive support, and the XAUUSD pair may enter a local correction again. If data falls short of the forecast, this will drive further growth in the XAUUSD pair.

XAUUSD technical analysis

On the H4 chart, the XAUUSD pair is trading within a strong uptrend, moving to the upper boundary of a price channel. A triangle pattern has formed in this channel, with the quotes breaking above its upper boundary and confidently moving towards the pattern’s target – the price area around 2,800 USD.

The short-term XAUUSD price forecast suggests that bulls will likely continue to push the quotes up to the area around 2,800 USD as part of the triangle pattern. If bears gain the initiative and reverse the quotes, a correction could follow, aiming for 2,758 USD.

Summary

Gold continues to rally, reaching another all-time high around 2,790 USD today. This week, the market will focus on US employment data, which may drive further movement in precious metal prices.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.