Gold (XAUUSD) reverses down from resistance at 2,670 USD

Gold (XAUUSD) experienced a reversal after attempting to break through the resistance at 2,670 USD. Today, market participants will shift their focus to the US labour market data from ADP, which could significantly impact the XAUUSD outlook. Read more in our analysis for today, 2 October 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting today's Automatic Data Processing Inc. (ADP) statistics on the US labour market, which will serve as a potential signal for the next moves in XAUUSD

- Current trend: a correction within the uptrend is underway

- XAUUSD forecast for 2 October 2024: 2,685 and 2,630

Fundamental analysis

XAUUSD quotes are currently in a moderate downward correction after reaching an all-time high of 2,685 USD last week. Yesterday, XAUUSD prices surged due to heightened geopolitical tensions in the Middle East.

Today's employment data from ADP is expected to reveal 120,000 new jobs. If the data falls below the forecast, it could pressure the USD and strengthen gold, signalling a bullish trend for XAUUSD. Conversely, if job growth exceeds expectations, it would bolster the US dollar, contributing to a bearish XAUUSD prediction and potentially signalling a decline in gold prices.

XAUUSD technical analysis

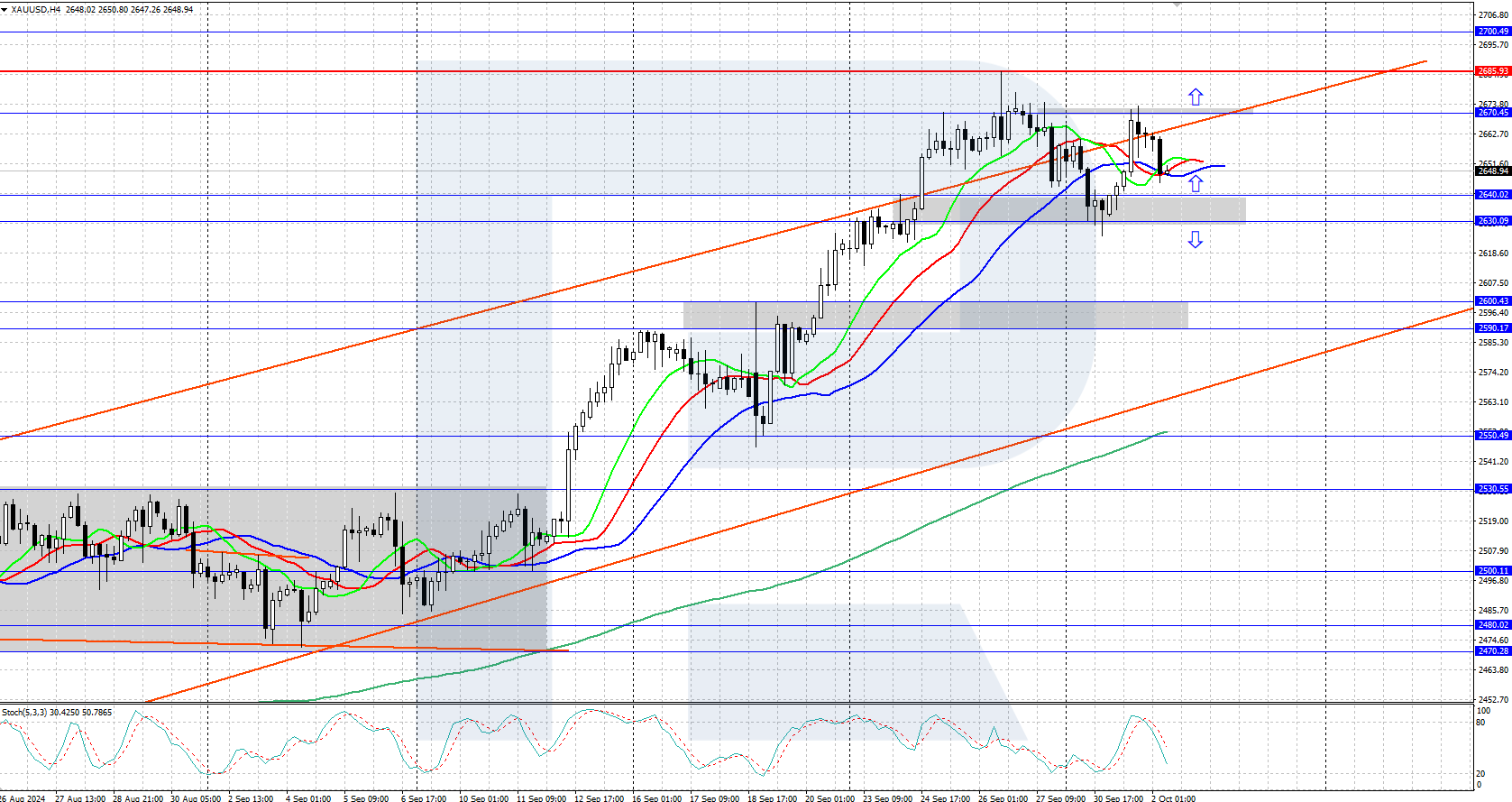

On the daily chart, XAUUSD remains in a strong uptrend, although a local downward correction is unfolding. The price recently tested the support zone at 2,630-2,640 USD, where buyer demand emerged. Following this, XAUUSD rallied to 2,670 USD, where sellers became active, preventing further gains.

The short-term XAUUSD forecast suggests that if bullish momentum persists and gold manages to break above the 2,670 USD resistance, we could see a further rise towards the historical maximum of 2,685 USD. However, if bearish forces push the price below the 2,630-2,640 USD support area, a further decline towards the 2,600 USD level is possible.

Summary

The XAUUSD analysis indicates that while gold prices actively rose yesterday, they faced strong resistance at 2,670 USD. Today's key driver for XAUUSD’s next movement will likely be the ADP labour market statistics. A miss in the data could provide a bullish signal for gold, while stronger-than-expected numbers may signal a bearish outlook for the precious metal.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.