Gold (XAUUSD) corrects down from an all-time high at 2,685 USD

The XAUUSD price set another all-time high yesterday at 2,685 USD. Today, market participants will focus on the US inflation growth rate data - read about it in our XAUUSD analysis for today, 27 September 2024.

XAUUSD forecast: key trading points

- Market focus: today, market participants are awaiting US inflation data – the Core Personal Consumption Expenditures (PCE) Price Index will be published

- Current trend: a strong uptrend is in progress

- XAUUSD forecast for 27 September 2024: 2,685 and 2,640

Fundamental analysis

The XAUUSD quotes are steadily rising, having set a new all-time high yesterday at 2,685 USD after the US Fed cut the interest rate by 0.50% last week. The beginning of the rate cut cycle exerts pressure on the US currency.

The Core Personal Consumption Expenditures (PCE) Price Index will be released today. It is expected to grow by 0.2% month-on-month and 2.7% year-on-year. The release of lower-than-expected data will put pressure on the US dollar and contribute to the growth of XAUUSD. Conversely, data that is higher than expected will support the dollar, and the downward correction in gold may continue.

XAUUSD technical analysis

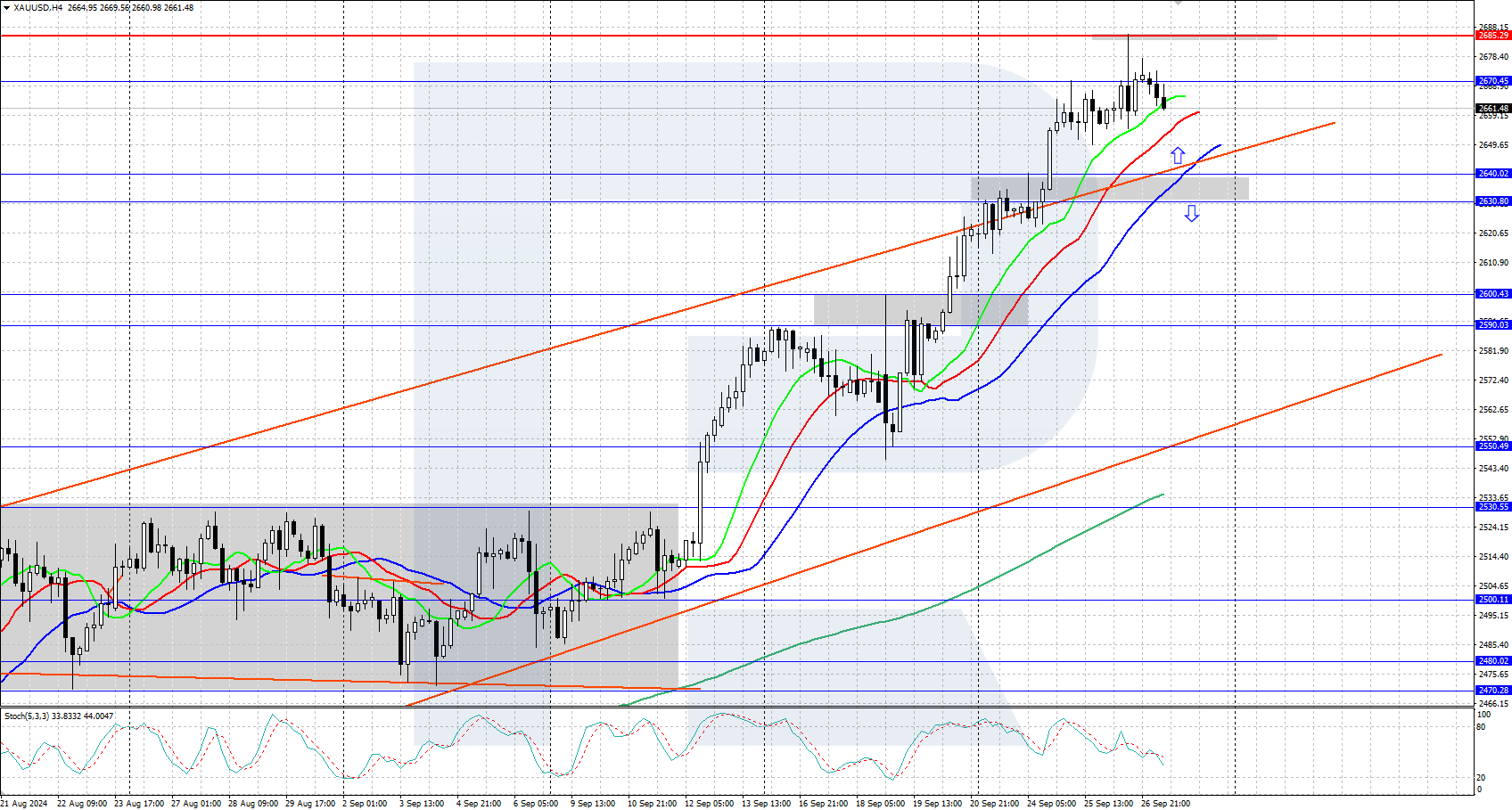

On the daily chart, the XAUUSD pair is trading within a strong uptrend, having risen above the upper boundary of the price channel. Local resistance is at 2,685 USD, and support is at the price range of 2,630-2,640 USD. Gold is now trading near 2,665 USD, with a moderate downward correction.

In the short-term XAUUSD price forecast, we assume that if the bulls continue to move upwards and rise above 2,685 USD, further growth to 2,700 USD will follow. Conversely, if the bears receive support from Core PCE Price Index data that exceeds the forecasted values, the downward correction to the support in the area of 2,630-2,640 USD may continue.

Summary

Gold (XAUUSD) prices demonstrate a strong upward rally, establishing another historical high yesterday at 2,685 USD. Today’s publication of US inflation data may influence the dynamics of gold prices.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.