Gold (XAUUSD) continues its upward rally; price climbs above 2,650 USD

The XAUUSD price reached a new all-time high this morning at 2,670 USD. The trend for gold remains upward, though a downward correction may start soon – read about it in our XAUUSD analysis for today, 25 September 2024.

XAUUSD forecast: key trading points

- Market focus: gold is steadily rising following the US Fed rate cut

- Current trend: a strong uptrend is underway

- XAUUSD price forecast for 25 September 2024: 2,640 and 2,700

Fundamental analysis

XAUUSD quotes are steadily rising, reaching a new all-time high of 2,670 USD after the US Fed cut its interest rate by 0.50% last week. The onset of the rate-cut cycle is putting pressure on the US dollar.

Gold’s growth is also supported by weak economic data from the US – Yesterday’s Consumer Confidence index from the Conference Board was worse than expected: instead of the anticipated 103.9 points, the index came in at 98.7. As a result, the precious metal closed the day with solid gains against the US dollar.

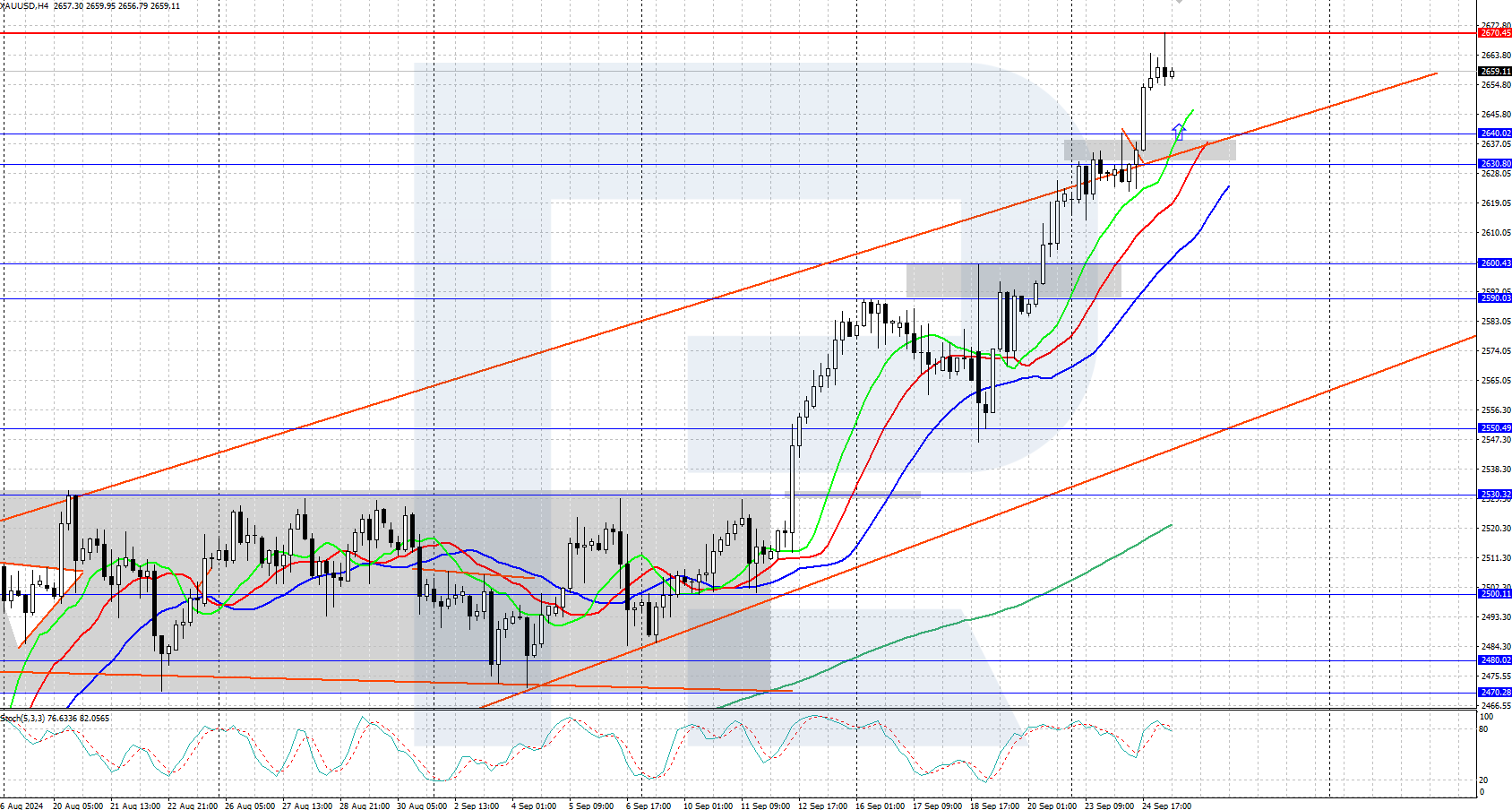

XAUUSD technical analysis

On the daily chart, XAUUSD is trading within a strong uptrend, having risen above the upper boundary of the price channel. Local resistance is at 2,670 USD, and support is within the 2,630-2,640 USD range. After sharp gains in gold over recent days, a downward correction may occur at any moment.

The short-term forecast for the XAUUSD price suggests that if the bulls maintain upward momentum and push the price above 2,670 USD, further growth will follow towards the 2,700 USD level. However, if the bears gain control and initiate a local reversal, a downward correction towards the support level in the 2,630-2,640 USD range may begin.

Summary

Gold prices have rallied strongly, reaching a new all-time high of 2,670 USD. XAUUSD quotes are supported by demand from global central banks, the Fed’s decisive policy on reducing key interest rates, and weak economic data from the US.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.