XAUUSD forecast: gold trades near the annual high of 2,600 USD after the Fed rate cut

The XAUUSD price hit another historic high at 2,600 USD after the US Federal Reserve cut the interest rate by 0.5%. The current trend of XAUUSD is upward, and further upward movement may continue. For more information, check out our XAUUSD forecast for today, 20 September 2024.

XAUUSD forecast: key trading points

- Market focus: gold is rising following the US Fed rate cut and comments from the Federal Reserve chief

- Current trend: solid upward momentum is developing as the price has broken out of the sideways range

- XAUUSD forecast for 20 September 2024: the target levels are set at 2,630 and 2,550

Fundamental analysis

The news on XAUUSD shows that the pair is trading in a strong uptrend, reaching a new historic high of 2,600 USD. This rise is due to demand from global central banks and the start of the US Federal Reserve’s monetary policy easing. The Fed announced the first rate cut of 50 basis points at its September meeting.

In a subsequent press conference, Fed Chair Jerome Powell hinted at further rate cuts, with two more 0.25% cuts expected before the end of the year. However, further rate cuts will depend on incoming economic data. The Fed’s current monetary policy suggests a bullish outlook for the XAUUSD pair, supporting gold prices.

XAUUSD technical analysis

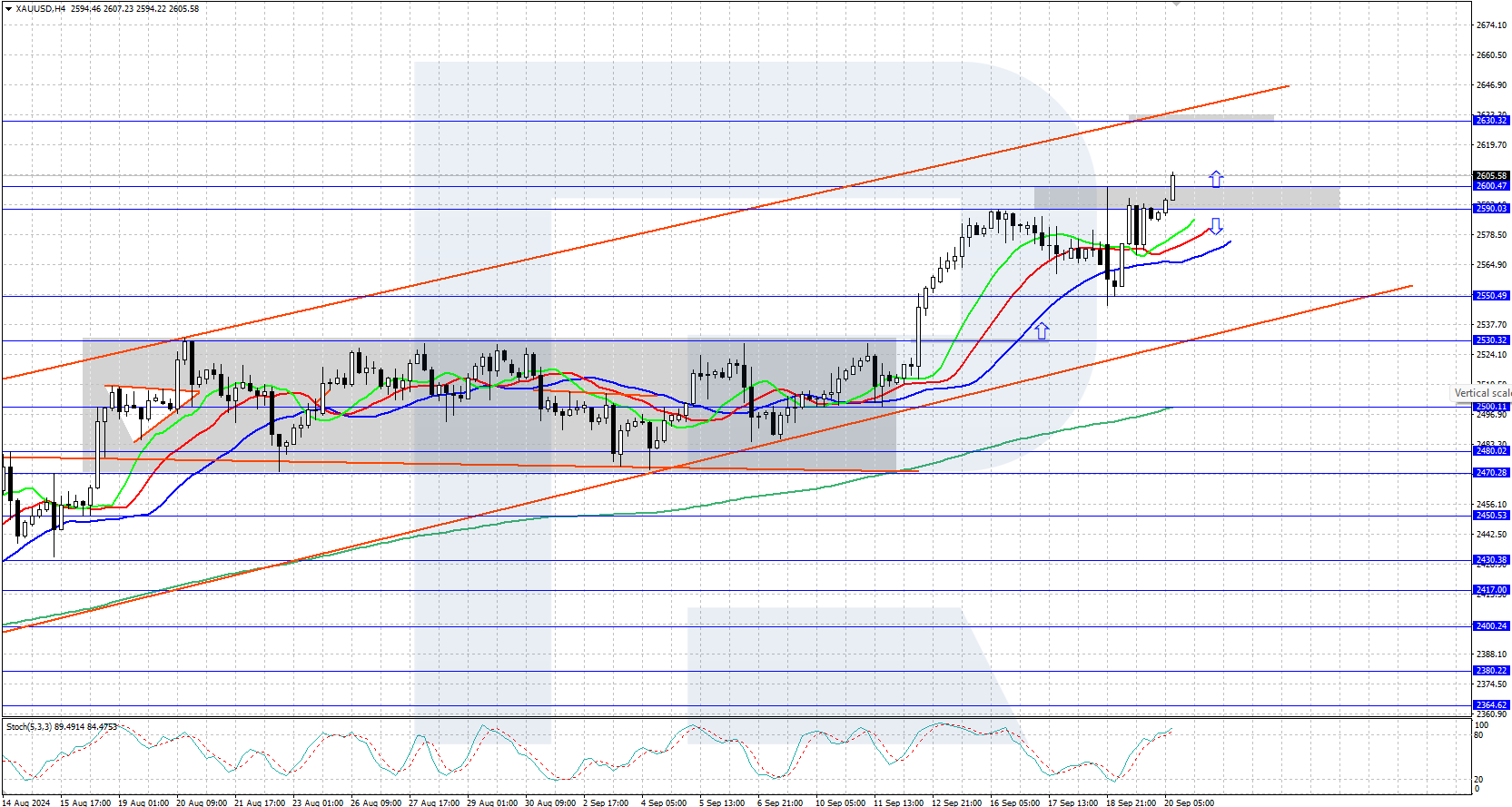

On the daily chart, the XAUUSD pair is trading within an ascending price channel, with quotes currently around 2,600 USD. After exiting the sideways range last week, gold steadily rose towards the target level of 2,600 USD, which aligns with the previously identified Triangle pattern.

Based on the XAUUSD prediction, if the bullish trend continues, the next target is the upper boundary of the price channel near 2,630 USD. However, if bearish sentiment prevails, a correction towards the support level of 2,550 USD may occur.

Summary

Gold (XAUUSD) prices continue to show a solid upward rally, setting a new historic high at 2,600 USD. Price growth is fuelled by the US Federal Reserve’s clear course of reducing key interest rates. As global economic dynamics evolve, the XAUUSD outlook suggests continued volatility but with a strong upward bias in the near term.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.