Gold (XAUUSD) is rising rapidly, reaching a new all-time high of 2,532 USD

XAUUSD price exited a sideways range yesterday, subsequently surpassing an all-time high of 2,532 USD. Gold may continue its ascent. Find out more in our XAUUSD analysis for today, 13 September 2024.

XAUUSD forecast: key trading points

- Market focus: market participants await US statistics today, with the Michigan consumer sentiment index scheduled for release

- Current trend: there is strong upward momentum after the price has exited the sideways range

- XAUUSD forecast for 13 September 2024: 2,600 and 2,532

Fundamental analysis

XAUUSD quotes are trading in an uptrend, supported by demand from global central banks and the beginning of the US Federal Reserve monetary policy easing. The consumer price index (CPI) and the producer price index (PPI) released this week showed a moderate fall in US inflation compared to last year.

Easing inflationary pressures in the US confirm the prospects for future Federal Reserve interest rate cuts. Following the inflation data release, gold received a good incentive for growth and hit an all-time high of 2,532 USD, with the quotes trading around 2,570 USD today.

XAUUSD technical analysis

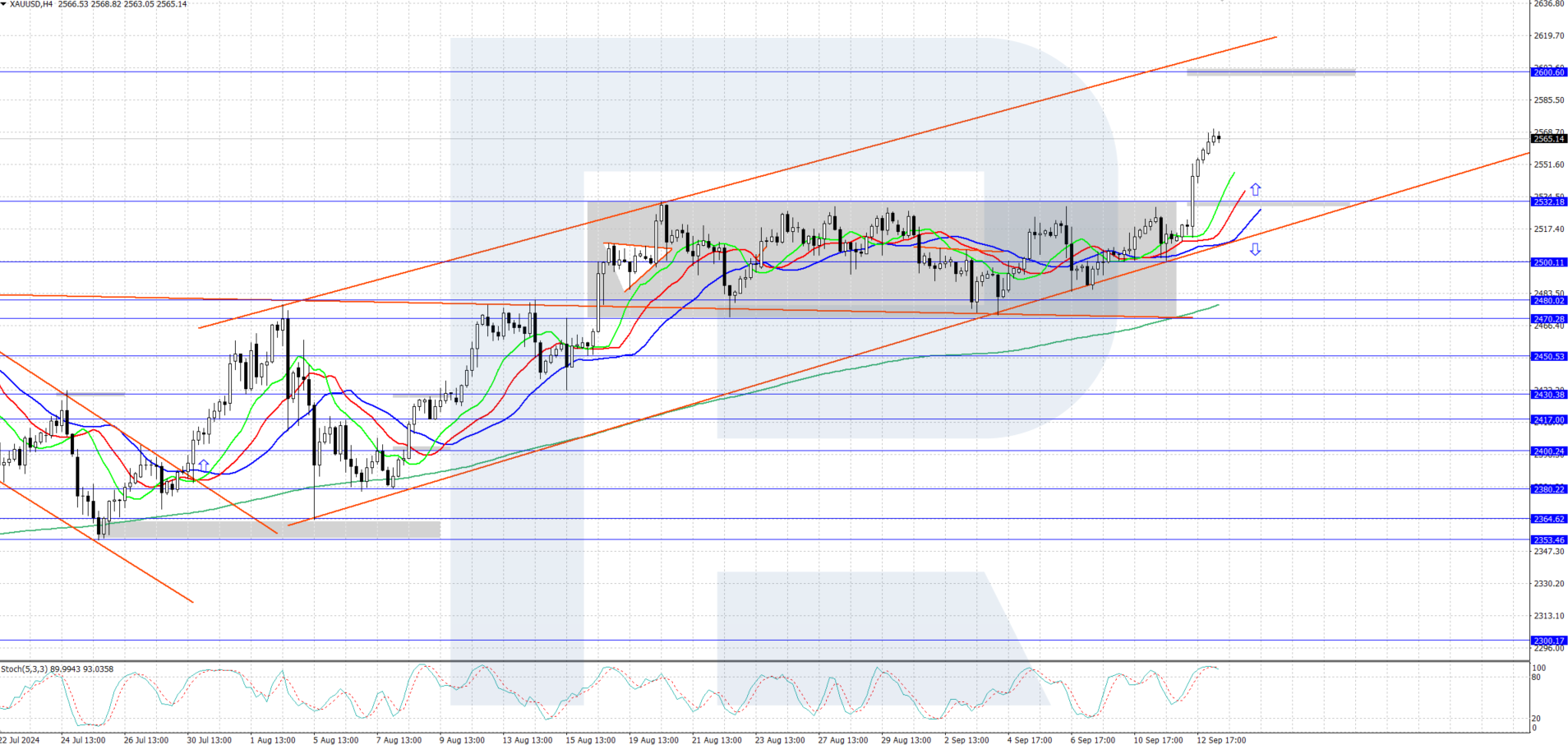

The XAUUSD H4 chart shows a sideways price range, with boundaries at 2,532 USD and 2,470 USD. Following the release of US inflation data, gold prices rose and broke above the range’s upper boundary, indicating the potential for further upward movement.

The short-term XAUUSD price forecast suggests that the price could rise further to 2,600 USD if bulls maintain control over the situation. If bears push the quotes below the 2,532 USD support level, there will be prospects for a downward correction towards 2,500 USD.

Summary

Gold prices are rising steadily, reaching an all-time high of 2,532 USD after the release of weaker-than-expected US inflation data. Markets may gain some momentum from US statistics on the Michigan consumer sentiment index today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.