Gold (XAUUSD) is below 2,500 USD, but the trend remains upward

Despite XAUUSD's price falling below 2,500 USD on Monday, growth prospects remain. This week, the market will focus on US employment data. Find out more in our analysis dated 2 September 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting US employment market statistics this week

- Current trend: although gold is trading within an uptrend, there are risks of a downward correction

- XAUUSD forecast for 2 September 2024: 2,532 and 2,483

Fundamental analysis

XAUUSD quotes remain within an uptrend, supported by expectations of a September Federal Reserve interest rate hike. However, the price has yet to reach the all-time high of 2,532 USD, as it encounters active selling pressure near this level. The US employment market statistics due this week could influence further gold price movements.

Automatic Data Processing Inc. (ADP) will publish employment data on Thursday, with nonfarm payrolls and the unemployment rate scheduled for release on Friday. A decline in employment will put pressure on the USD and help strengthen gold, while job growth will conversely support the US dollar, sending XAUUSD into a downward correction.

XAUUSD technical analysis

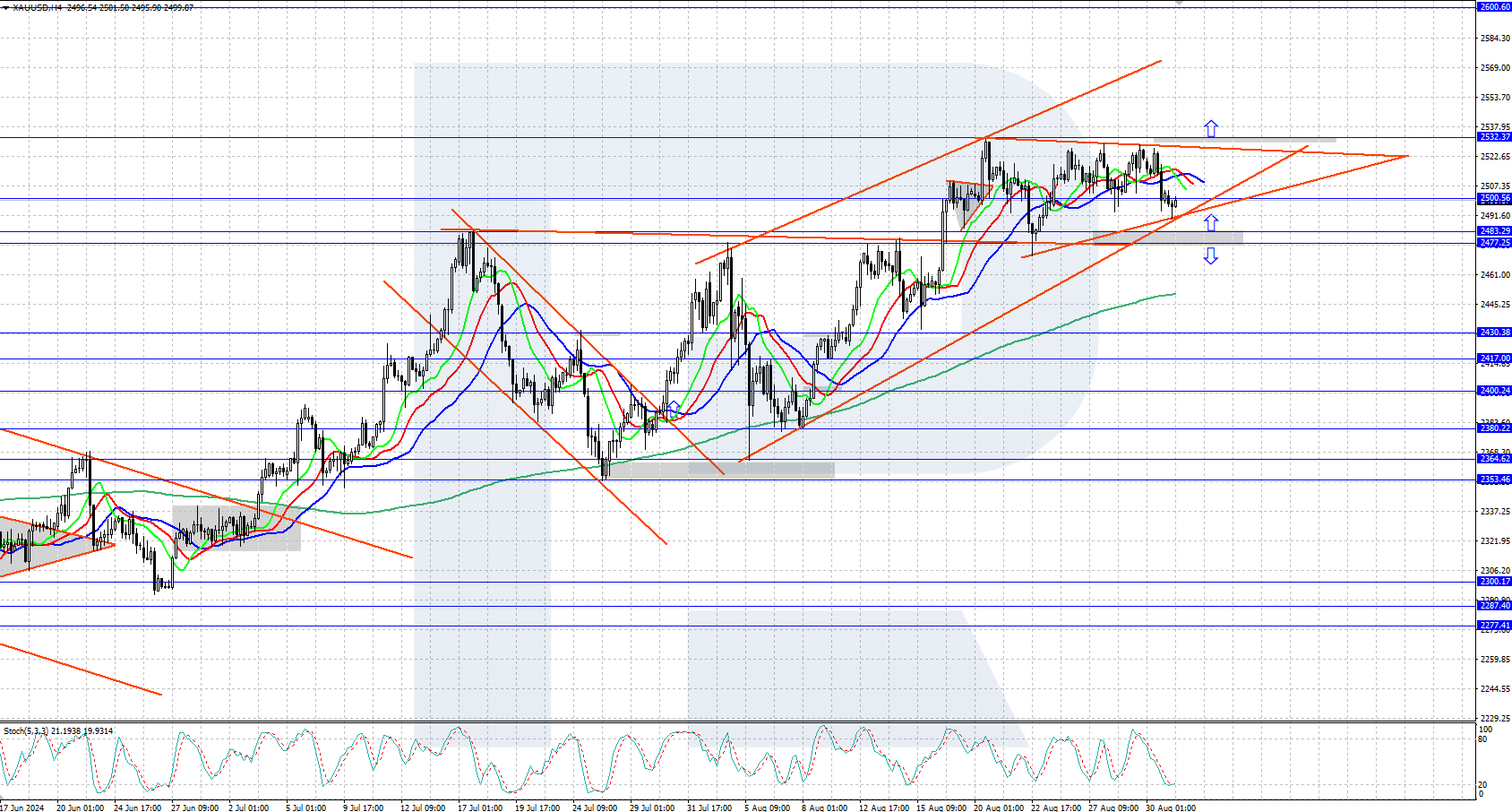

On the H4 chart, XAUUSD is trading within an ascending price channel just below 2,500 USD but above the upper boundary of the completed triangle pattern. Gold has yet to surpass the all-time high of 2,532 USD, as gold quotes, as it encounters active selling pressure in this area and retraces.

The short-term XAUUSD price forecast suggests that the price could reach the 2,600 level in the near term if bulls hold above the upper boundary of the triangle and surpass the high of 2,532 USD. A decline below the crucial 2,483-2,477 USD support area will invalidate this scenario and create conditions for a downward correction.

Summary

Although XAUUSD has fallen below 2,500 USD, there is still potential for growth. This week, market participants will focus on the US employment market data, which could drive further gold price movements.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.