Gold (XAUUSD) is gaining momentum, a breakout above 3,035 USD signals growth

A decline in GDP and a rise in jobless claims in the US could trigger an XAUUSD rally towards 3,055 USD. Find out more in our analysis for 27 March 2025.

XAUUSD forecast: key trading points

- US Q4 GDP: previously at 2.3%, projected at 2.3%

- US initial jobless claims: previously at 223 thousand, projected at 225 thousand

- Current trend: moving upwards

- XAUUSD forecast for 27 March 2025: 3,055 and 3,010

Fundamental analysis

Fundamental analysis of XAUUSD for today, 27 March 2025, shows Gold breaking out of its sideways trend, testing the 3,035 USD level. This rise may be driven by growing demand for safe-haven assets.

The XAUUSD forecast for 27 March 2025 appears rather optimistic for Gold, suggesting the US GDP could hold steady at the previous 2.3% level. Should actual figures show a decline in GDP, this could weaken the USD.

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment.

The previous figure was 223 thousand, and today’s XAUUSD forecast does not appear positive, suggesting an increase to 225 thousand. While the change is minor, any result that meets or exceeds expectations could negatively impact the USD and cause XAUUSD quotes to continue the uptrend.

XAUUSD technical analysis

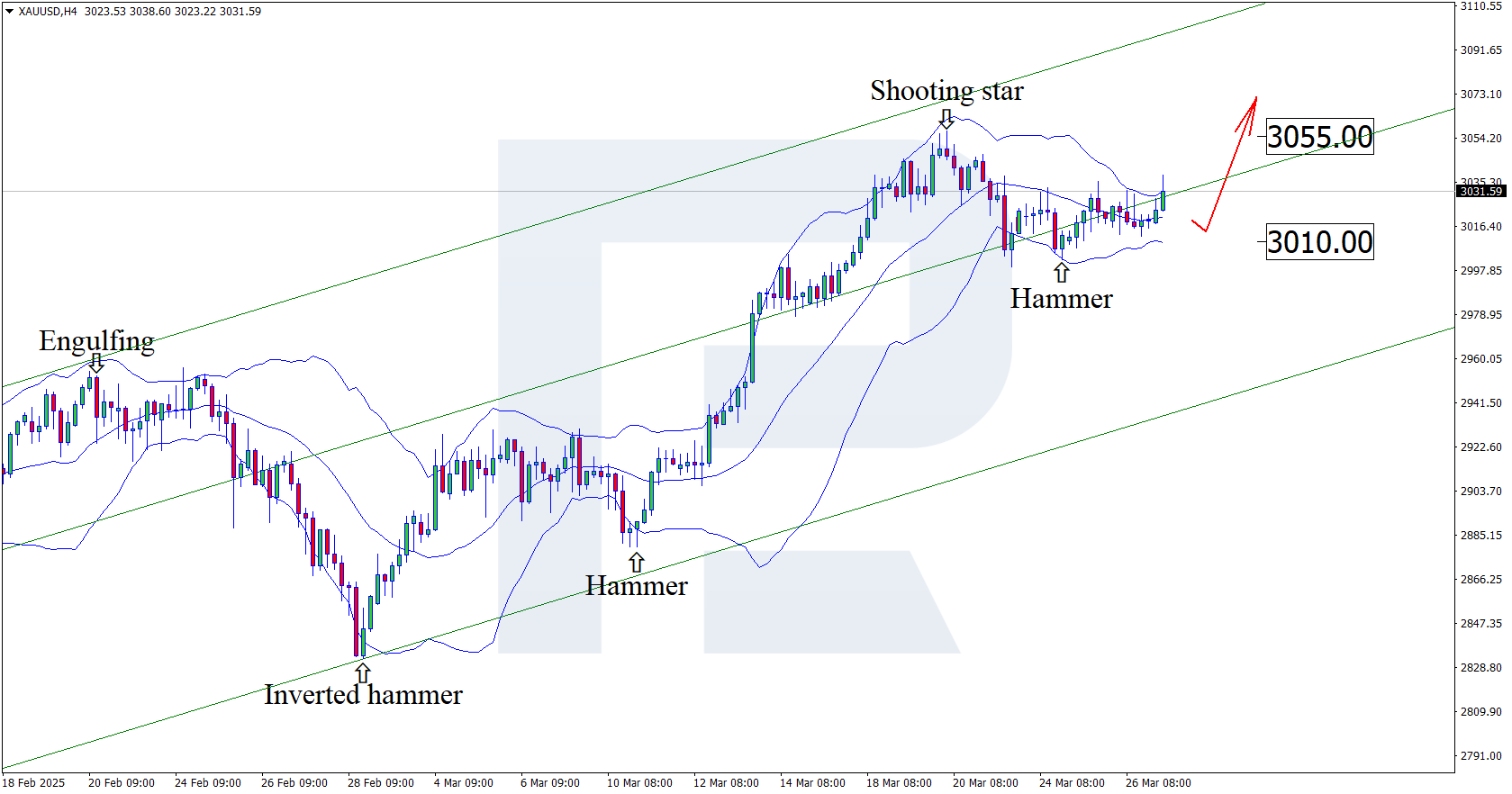

On the H4 chart, XAUUSD prices formed a Hammer reversal pattern near the lower Bollinger band. At this stage, it is forming an upward wave following the signal from the pattern. The uptrend will likely continue as XAUUSD quotes are moving within the ascending channel. At this stage, the upside target could be the 3,055 USD resistance level.

However, today’s XAUUSD technical analysis also considers a second scenario, where prices correct towards 3,010 USD before rising.

After testing the resistance level, XAUUSD prices may soon reach a new all-time high and head towards the 3,100 USD mark.

Summary

A rise in US initial jobless claims could weaken the US dollar. Today’s XAUUSD technical analysis suggests potential growth towards the 3,055 USD resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.