Gold (XAUUSD) reaches new highs: a new peak is highly likely

Gold prices rose to 2,928 USD. The stock market and physical demand for Gold remains high. Discover more in our XAUUSD analysis for 14 February 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) is poised to close higher for the seventh consecutive week

- Market concerns about growing global trade tensions support the asset

- XAUUSD forecast for 14 February 2025: 2,943

Fundamental analysis

Gold (XAUUSD) prices rose to 2,928 USD on Friday, marking the seventh consecutive week that Gold has closed with gains.

One of the key growth drivers for Gold prices is US President Donald Trump’s plans to introduce retaliatory tariffs on countries that levy taxes on US imports. This increases the odds of a major trade confrontation, which benefits Gold.

Yesterday, the US released PPI data for January, which confirmed accelerating inflation and increased expectations that the Federal Reserve will not ease monetary policy until the second half of 2025. Gold is traditionally considered a safe-haven asset that hedges against inflation and economic uncertainty. However, Gold becomes less attractive as interest rates rise.

Due to rising global Gold prices, jewellery sales in India fell during the wedding season. Sellers in China, in turn, give big discounts on jewellery and goldware.

The Gold (XAUUSD) forecast appears favourable.

XAUUSD technical analysis

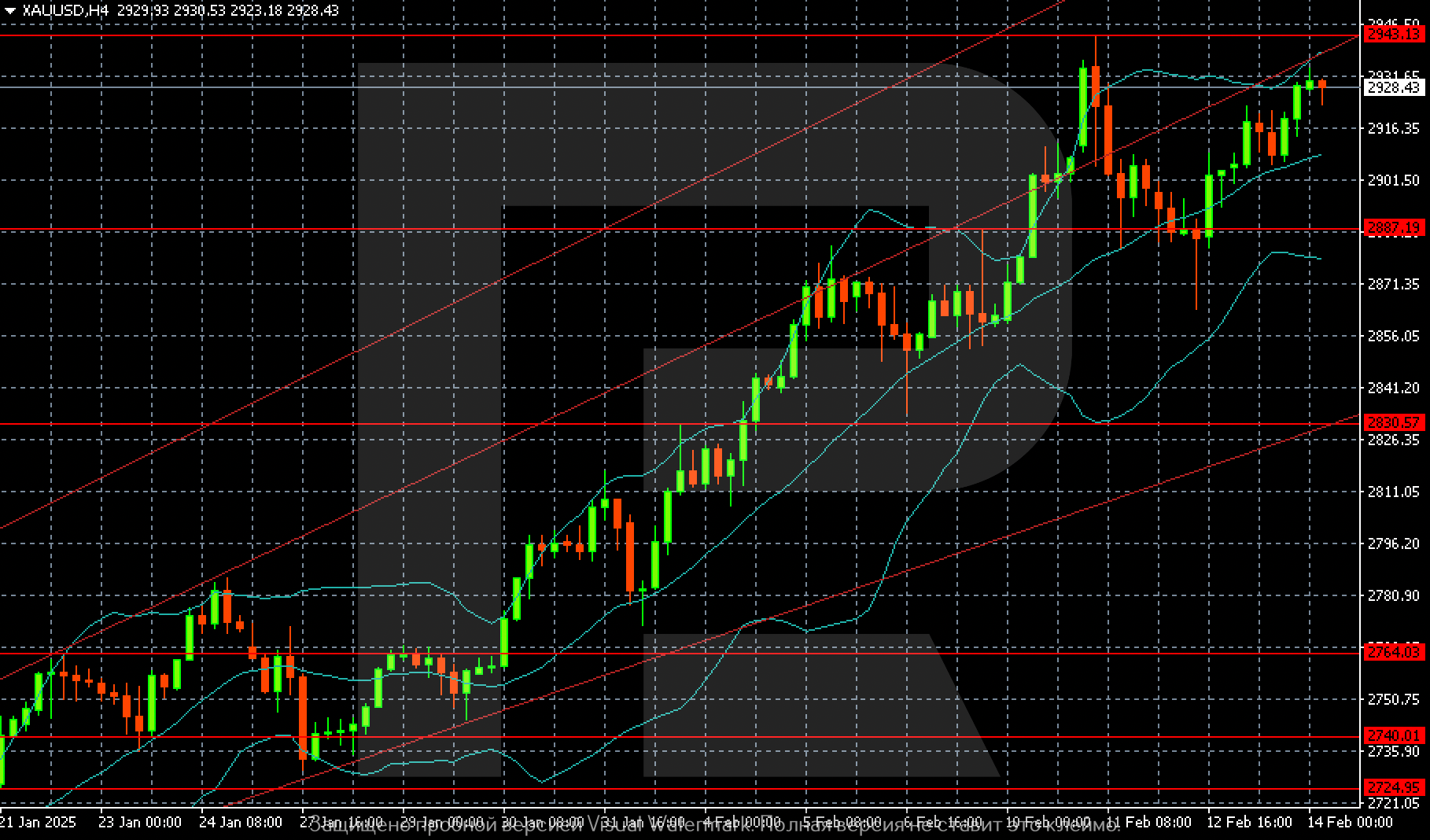

On the Gold (XAUUSD) H4 chart, the main upside target remains the 2,943 USD level.

The asset becomes increasingly overbought as it approaches the global target of 3,000 USD, which increases the likelihood of a correction. In this case, it is necessary to monitor the 2,887 USD support level. A breakout below this level will open the way to 2,830 USD.

Summary

Gold (XAUUSD) prices close the seventh consecutive week with gains. Investors remain interested in safe-haven assets. The Gold (XAUUSD) forecast for today, 14 February 2025, confirms the grounds for a movement towards 2,943 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.