Gold (XAUUSD) hits new record highs

Amid the Fed chairman’s speech, Gold may form a corrective wave before rising to 2,965 USD. Discover more in our XAUUSD analysis for today, 11 February 2025.

XAUUSD forecast: key trading points

- US Federal Reserve Chairman Jerome Powell’s speech

- US FOMC member Michelle Bowman’s speech

- Current trend: moving upwards

- XAUUSD forecast for 11 February 2025: 2,895 and 2,965

Fundamental analysis

Today’s XAUUSD analysis shows that XAUUSD prices broke above 2,942 USD, with the pair likely to maintain its upward trajectory.

US Federal Reserve Chairman Jerome Powell is expected to deliver a speech today, 11 February 2025. As the head of the Fed, which controls short-term interest rates, his statements could significantly impact the US dollar and global financial markets.

Investors are awaiting signals regarding the future US monetary policy, with a special focus on Powell’s comments on inflation, economic growth, and possible interest rate changes. Markets may react with increased volatility depending on how Powell’s statements are interpreted.

Thus, today’s speech may significantly influence investor sentiment and financial markets.

FOMC member Michelle Bowman’s speech is also scheduled for today, 11 February 2025.

Bowman is known for her conservative views and has previously advocated for a gradual reduction in interest rates, supporting a 0.25 basis point rate cut.

Given the current economic conditions, it is worth paying attention to her comments on inflation, the labour market, and the Fed’s future actions.

Bowman’s report may provide additional signals about the direction of US monetary policy and affect the market sentiment.

XAUUSD technical analysis

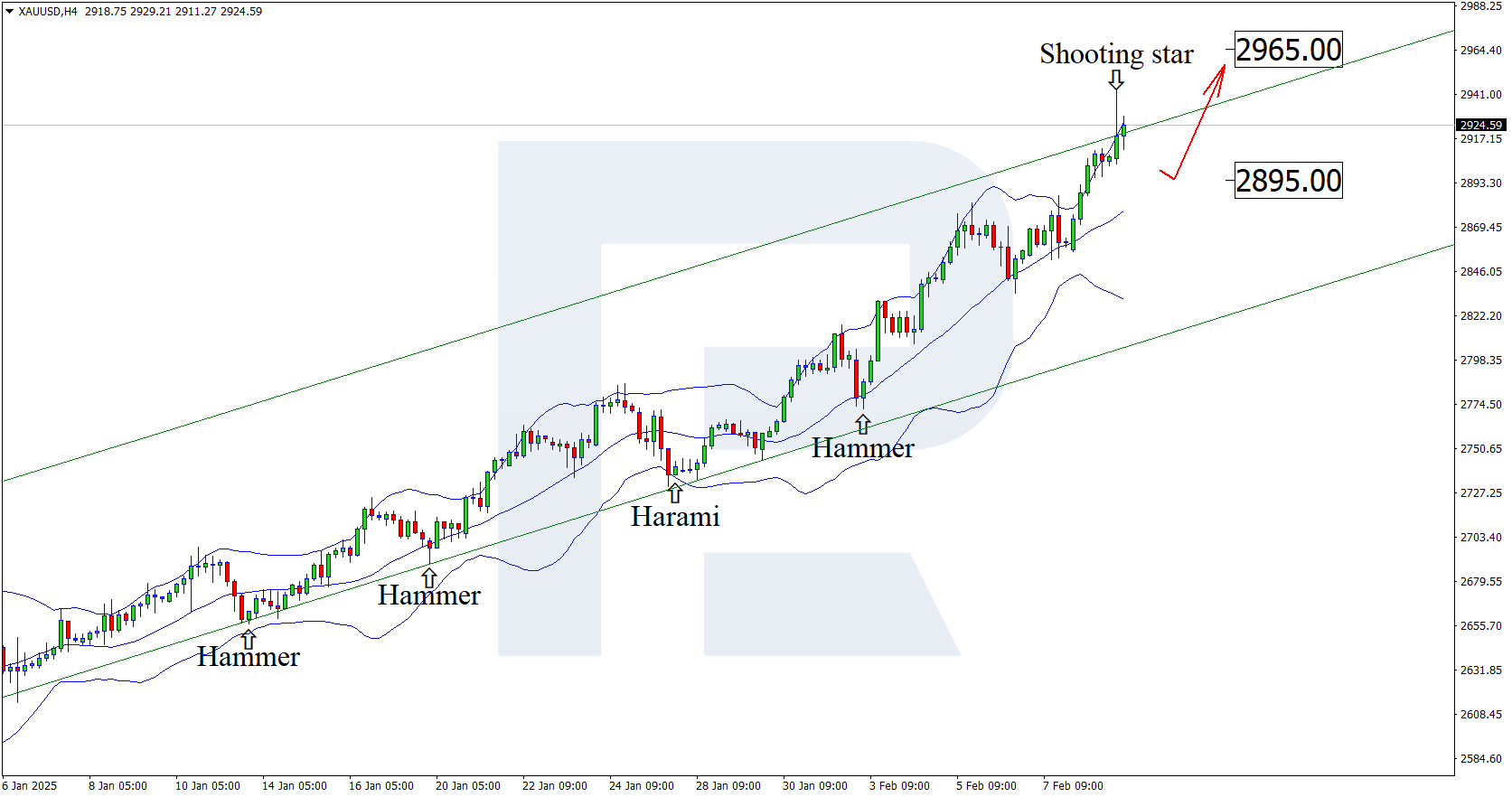

On the H4 chart, XAUUSD prices formed a Shooting Star reversal pattern near the upper Bollinger band. At this stage, they continue to correct following the signal from the pattern. The uptrend is expected to continue after a pullback as XAUUSD quotes remain within the ascending channel.

The target for a correction could be the 2,895 USD support level.

However, today’s XAUUSD technical analysis suggests another scenario, where prices rise to 2,965 USD. After testing the resistance level, XAUUSD prices could reach a new all-time high in the near term and head towards 3,000 USD.

Summary

Together with technical analysis, the speeches of the Fed and FOMC officials suggest that XAUUSD prices could rise to 2,965 USD after forming a corrective wave.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.