Gold (XAUUSD) may set another record: the target is 2,900 USD

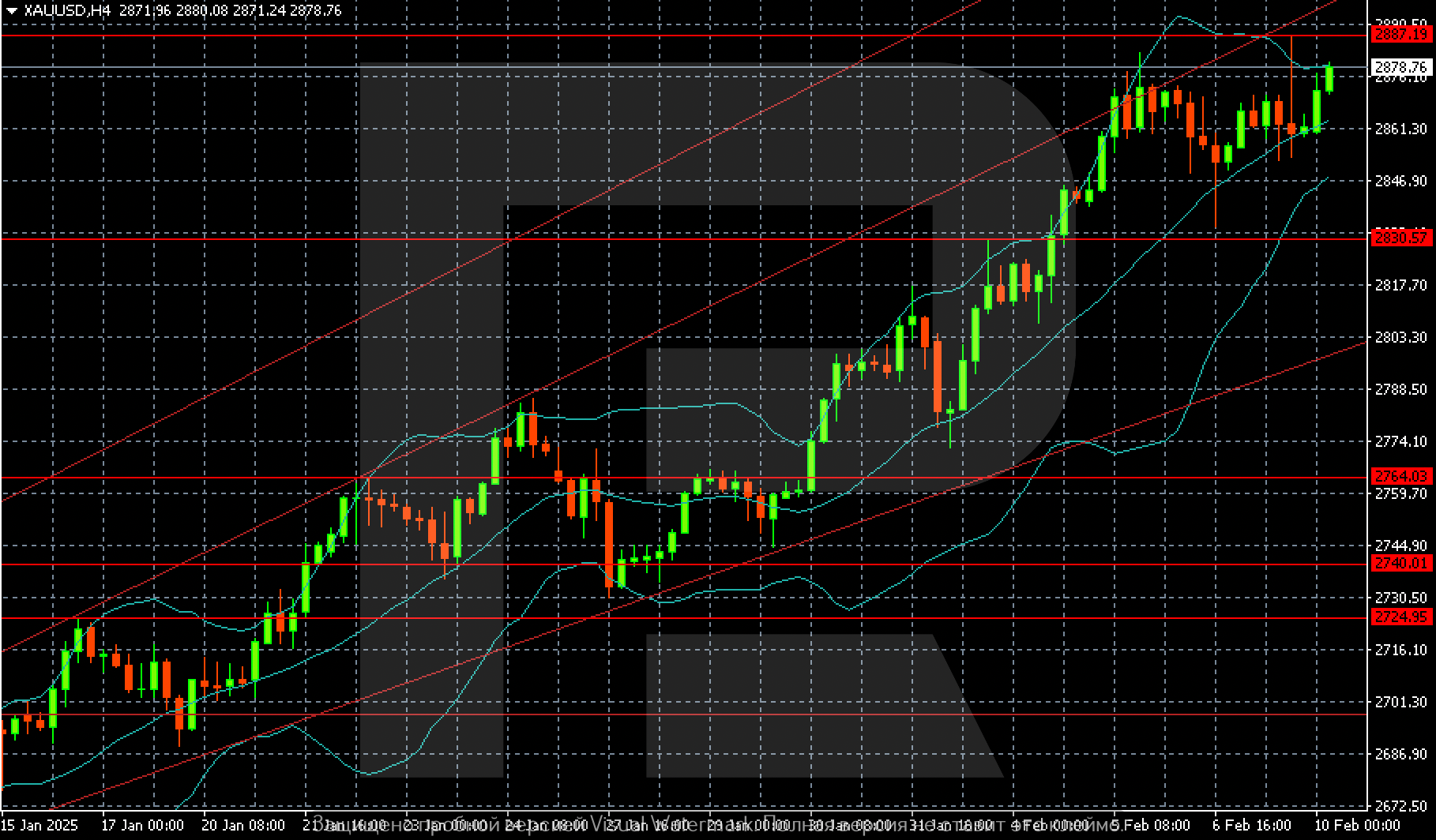

Gold (XAUUSD) quotes rose to 2,878 USD on Monday as the world needs safe-haven assets. Find out more in our analysis for 10 February 2025.

XAUUSD forecast: key trading points

- Gold prices continue their ascent

- The market needs safe-haven assets and stocks up on precious metal

- XAUUSD forecast for 10 February 2025: 2,887 and 2,900

Fundamental analysis

Gold (XAUUSD) prices have climbed to 2,878 USD and may rise even higher. Investors’ appetite for safe-haven assets is only expanding as global risks grow. After US President Donald Trump announced 25% tariffs on all steel and aluminium imports, the likelihood of trade implications has increased.

Prices are also bolstered by demand for Gold from global central banks. In January, the People’s Bank of China increased its Gold reserves for the third consecutive month, which is a good signal for the global trend in Gold.

Expectations that major central banks will maintain a soft approach to monetary policy in 2025 provide additional support. For example, the Federal Reserve is expected to cut interest rates twice. Last week, the Bank of England lowered its interest rate, and the Indian central bank made the first rate cut in five years.

The Gold (XAUUSD) forecast appears positive.

XAUUSD technical analysis

On the H4 chart, XAUUSD has grounds for maintaining its upward momentum, with the target at 2,887 USD. To achieve 2,900 USD, the market should consolidate above 2,890 USD.

If this does not happen, the market interest will shift to selling, with the target at the 2,830 USD support level.

Summary

Gold (XAUUSD) prices are rising rapidly, bolstered by interest in safe-haven assets and the growing risk of global trade implications due to the US stance. The XAUUSD forecast for today, 10 February 2025, suggests that the upward wave could continue to 2,887 USD and then to 2,900 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.