Gold (XAUUSD) underwent a downward correction after ADP data

XAUUSD prices are moderately declining from a new all-time high of 2,882 USD amid stronger-than-expected US ADP employment statistics. Find out more in our XAUUSD analysis for today, 6 February 2025.

XAUUSD forecast: key trading points

- Gold quotes set a new all-time high of 2,882 USD

- The number of new jobs in the US increased by 183 thousand in January (according to ADP)

- Current trend: a strong uptrend

- XAUUSD forecast for 6 February 2025: 2,850 and 2,882

Fundamental analysis

Gold continues to strengthen against the US dollar, reaching another all-time high of 2,882 USD on Wednesday. Gold is in high demand from investors and central banks amid geopolitical tensions and the tariff war of the new US President Donald Trump.

The data from Automatic Data Processing Inc. (ADP) released yesterday during the American trading session showed an increase of 183 thousand in US new jobs, above the forecast of 150 thousand. Positive data provided local support to the US dollar, with the market currently awaiting Friday’s data on Nonfarm Payrolls and the unemployment rate.

XAUUSD technical analysis

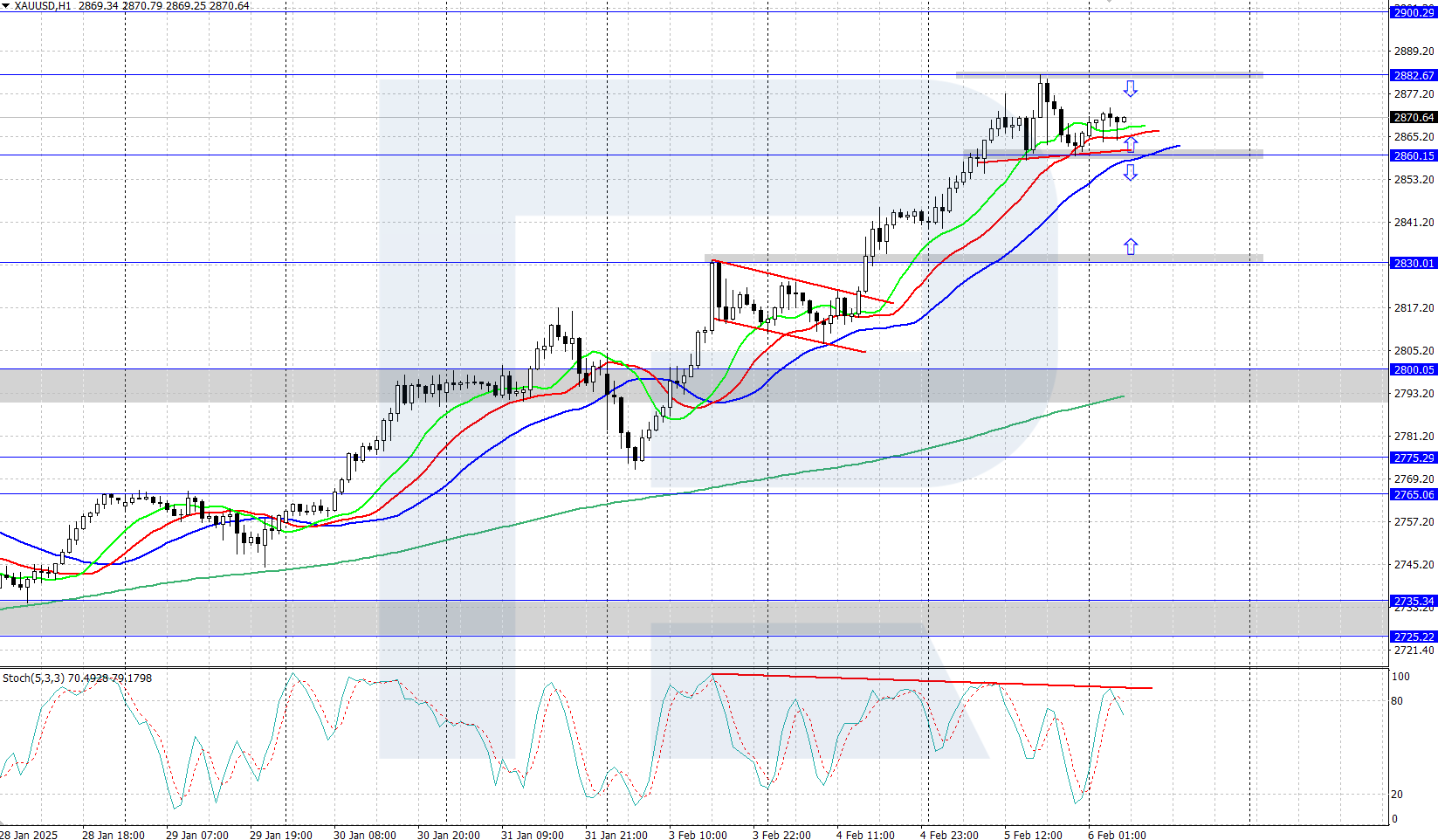

XAUUSD quotes continue to maintain their upward momentum on the daily chart, reaching a new all-time high of 2,882 USD. A Triangle pattern previously formed, and XAUUSD prices subsequently broke above its upper boundary to achieve the target near 2,900 USD.

The Alligator indicator lies below the price chart and is moving upwards, confirming the bullish trend. However, the Stochastic Oscillator shows a bearish divergence, which indicates a potential downward correction after the recent strong growth.

The short-term XAUUSD price forecast suggests that the pair may continue its ascent towards 2,900 USD if bulls retain the initiative. However, a downward correction is possible if bears gain control and bring prices back into the area below 2,850 USD.

Summary

Gold is moderately declining from the area of the new all-time high of 2,882 USD. There is a strong uptrend, with the asset likely to continue its upward trajectory after some downward correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.