Gold (XAUUSD): the asset is consolidating ahead of a rise

A potential rise in US inflation expectations offers hope for Gold to climb to 2,648. Discover more in our analysis for 20 December 2024.

XAUUSD forecast: key trading points

- The US core PCE Price Index: previously at 2.8%, projected at 2.9%

- The US Michigan inflation expectations: previously at 2.6%, projected at 2.9%

- XAUUSD forecast for 20 December 2024: 2,561 and 2,648

Fundamental analysis

The core PCE Price Index is a key US inflation gauge that tracks changes in the prices of goods and services, excluding food and energy. It reflects how consumer spending evolves under stable price trends and is the main reference point for monetary policy decisions. The core PCE represents the population’s real purchasing power and the level of economic stability, as it is less susceptible to short-term fluctuations.

The forecast for 20 December 2024 takes into account that the index may rise to 2.9%. The growth prospects are not substantial, as this is only a forecasted reading, and the situation will become clearer only after the actual value is released. A stronger-than-expected indicator will support the US dollar and push the XAUUSD rate lower.

Fundamental analysis for 20 December 2024 takes into account the upcoming US inflation release from the University of Michigan. The forecast anticipates a rise of 2.9% compared to the previous reading of 2.6%. If the actual figure aligns with or falls short of the forecast, this will negatively affect the US dollar, driving up Gold prices.

XAUUSD technical analysis

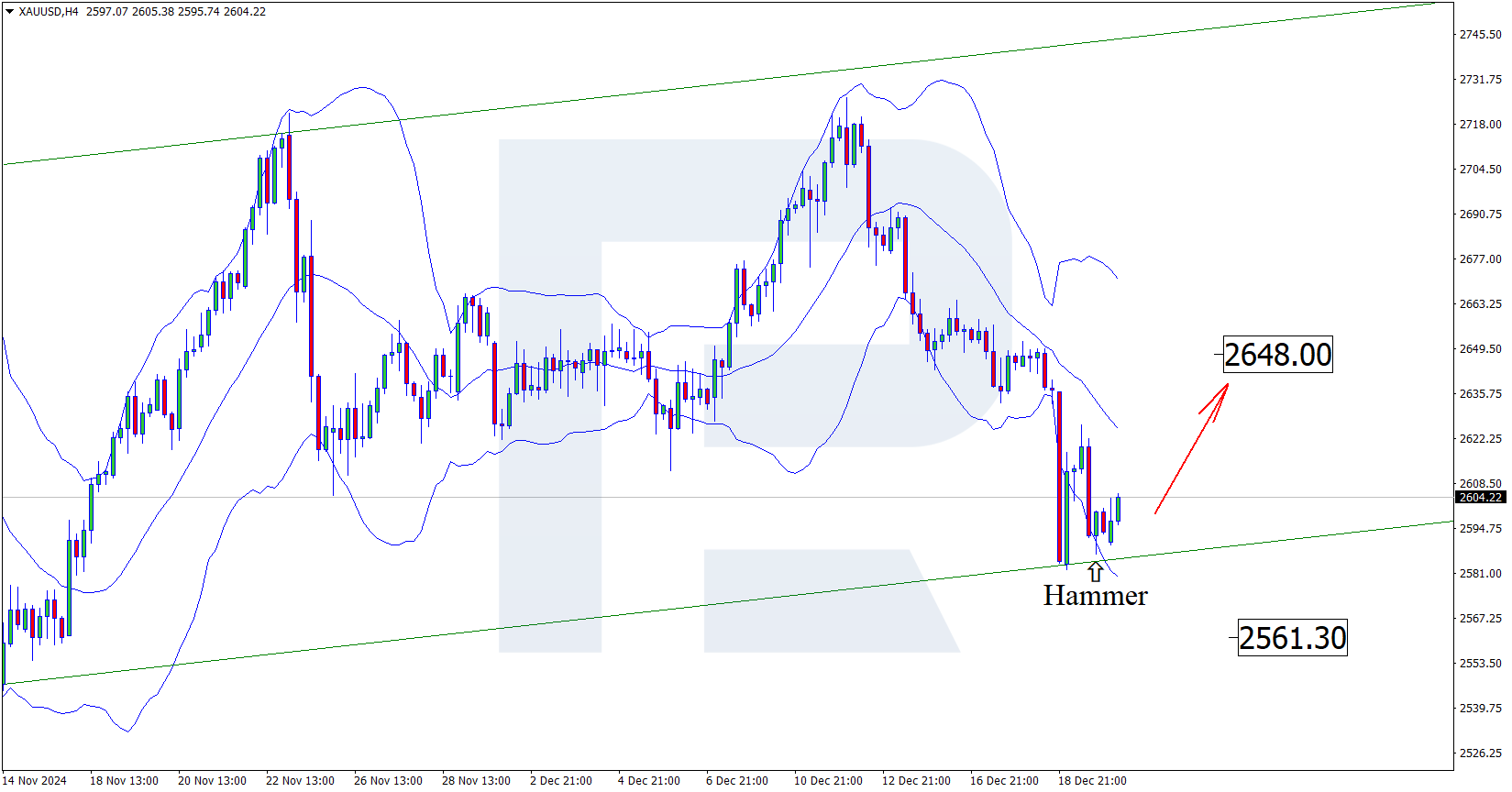

On the XAUUSD H4 chart, prices formed a hammer reversal pattern after testing the Bollinger band’s lower line. They continue their ascent at this stage, following a reversal pattern signal. This trend could develop further since the quotes are moving within an ascending channel.

The current growth target is at the 2,648 resistance level. A breakout would open the potential for a more substantial ascending wave.

However, the price may correct towards 2,561 before continuing its upward momentum. After completing a corrective wave, Gold could reach a new all-time high in the near term.

Summary

Possible US inflation growth, combined with XAUUSD technical analysis, suggests that prices could rise to 2,648 USD after a correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.