Silver (XAGUSD) prices corrected towards 30.00 USD

XAGUSD prices are trading within a downward correction, edging down to the support area near 30.00 USD. The focus is now on US inflation data. Our XAGUSD analysis for today, 10 October 2024, provides further details and insights.

Silver forecast: key trading points

- Market focus: market participants await the US Consumer Price Index (CPI) statistics

- Current trend: a local correction is underway as part of the uptrend

- XAGUSD forecast for 10 October 2024: 30.00 and 31.00

Silver fundamental analysis

XAGUSD quotes are undergoing a local downward correction after rising relatively steadily in September. The correction was driven by the US dollar strengthening against the entire range of financial instruments amid robust US labour market statistics and escalating geopolitical tensions in the Middle East.

Today, market participants will receive US inflation statistics, with the Consumer Price Index (CPI) scheduled for release. A weaker-than-forecasted reading will exert pressure on the USD and help strengthen silver, while an increase in the reading will, conversely, support the US dollar, potentially sending XAGUSD prices into a deeper correction.

XAGUSD technical analysis

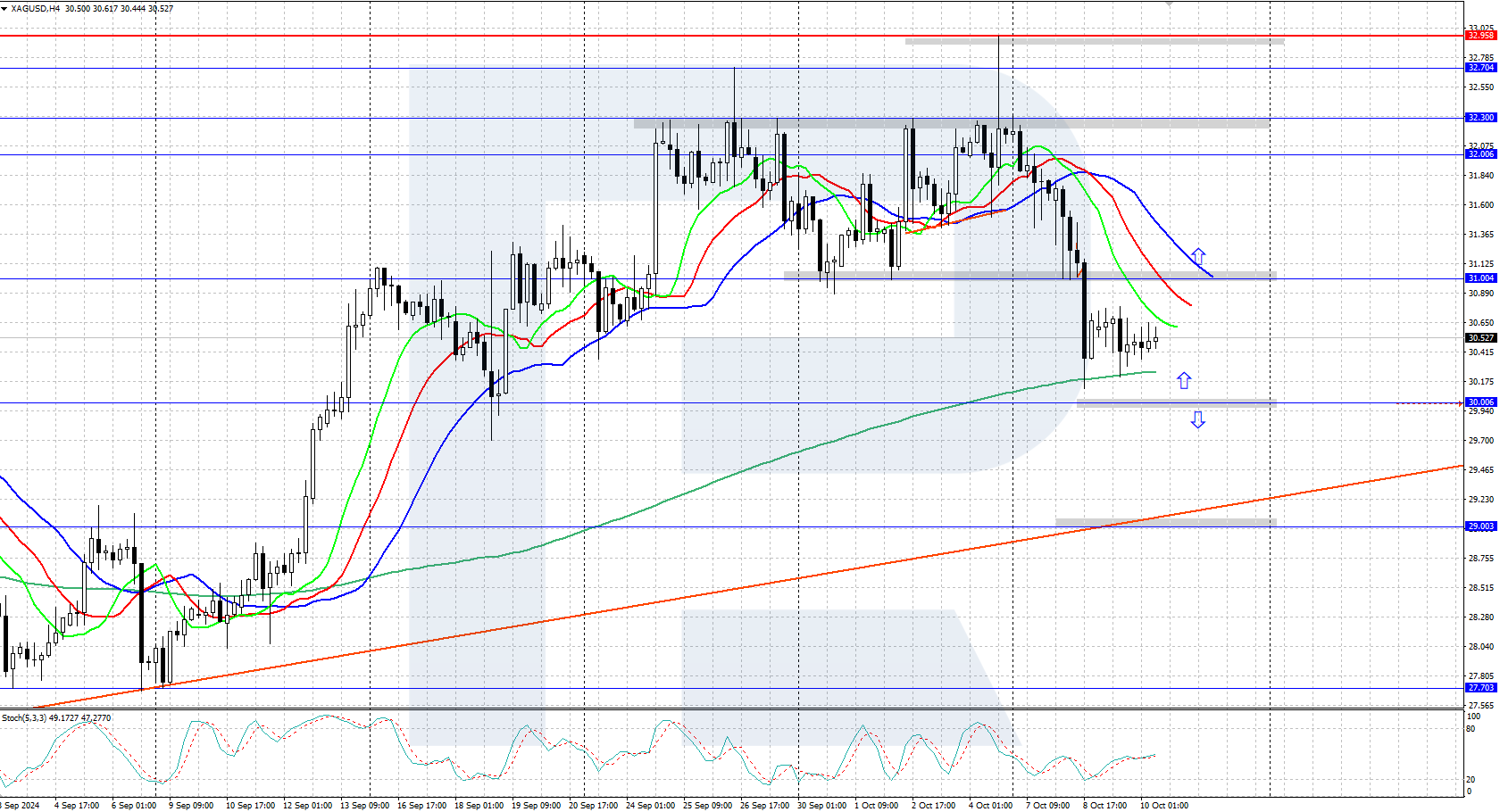

On the H4 chart, silver is trading within a strong uptrend. A local downward correction from the annual high of 32.95 USD is underway, with the quotes declining to the area near the psychologically crucial level of 30.00 USD, where they encountered demand from buyers.

The short-term XAGUSD price forecast suggests that prices could rise further to the annual high of 32.95 USD if bulls seize the initiative and rise above 31.00 USD. If bears gain a foothold below the 30.00 USD support level, the decline could continue towards 29.00 USD.

Summary

Silver prices have declined to the vicinity of the 30.00 USD mark during the correction; however, the daily uptrend remains intact, and a reversal upwards could occur at any moment. Today’s US inflation data may influence further price dynamics.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.