Gold (XAUUSD) rises moderately, returning to the price area above 2,400 USD

XAUUSD price reversed upwards and closed yesterday’s session with a moderate gain, establishing a foothold above 2,400. The upward movement may continue. Find out more in our XAUUSD analysis for today, 9 August 2024.

XAUUSD trading key points

- Market focus: gold prices are rising amid geopolitical tensions in the Middle East

- Current trend: gold is trading within a broad range; the long-term trend is upward

- XAUUSD forecast for 9 August 2024: 2,400 and 2,450

Fundamental analysis

XAUUSD quotes experienced sustained growth yesterday, returning to the price area above 2,400 USD. The downward correction appears to be over, and gold may test its all-time high of 2,483 in the short term.

Fundamentally, the XAUUSD rate is supported by expectations for an imminent US Federal Reserve interest rate cut, which will gradually cause the US dollar to lose ground. Gold is also in demand as a safe-haven asset amid rising geopolitical tensions in the Middle East.

XAUUSD technical analysis

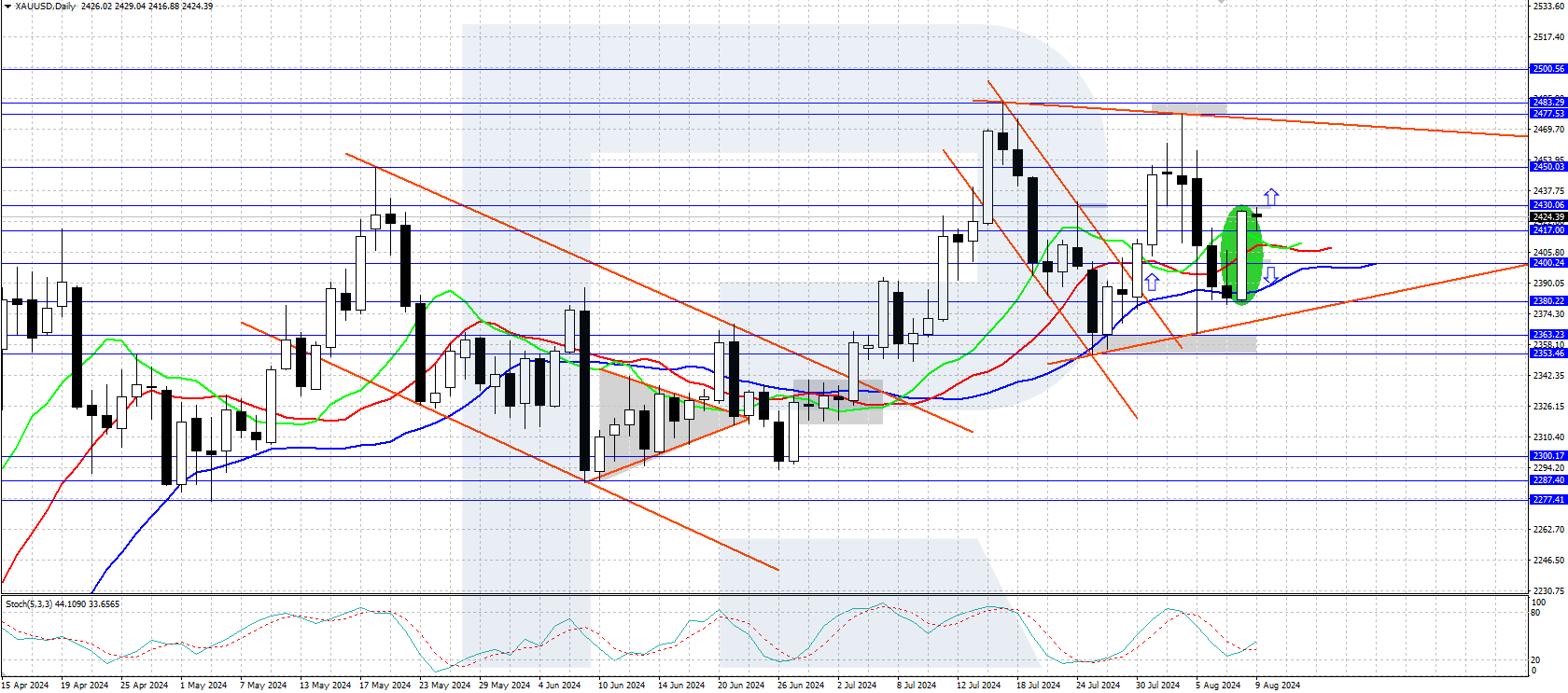

XAUUSD price halted its downward correction, finding support in the 2,353-2,363 area. A bullish engulfing candlestick pattern has formed on the daily chart, indicating the potential for price growth to a high of 2,483.

The short-term XAUUSD price forecast suggests that if the bulls surpass the 2,430 resistance level, the price could rise to 2,450 and 2,483. If bears repel a bullish attack and push the price below the 2,400 support level, it could decline to 2,380 and subsequently to the 2,353-2,363 support area.

Summary

A bullish engulfing candlestick reversal pattern on the XAUUSD daily chart signals a potential price rise. Expectations for a Federal Reserve interest rate cut and the escalating conflict in the Middle East support gold prices.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.