Gold (XAUUSD) is consolidating within a narrow range ahead of the ADP data

Gold is trading within a narrow sideways range; market participants are awaiting today’s US ADP Research Institute employment data.

XAUUSD trading key points

- Current trend: the XAUUSD pair is experiencing growth after receiving support at 2,300 USD

- Market focus: market participants are awaiting today’s US ADP Research Institute employment data

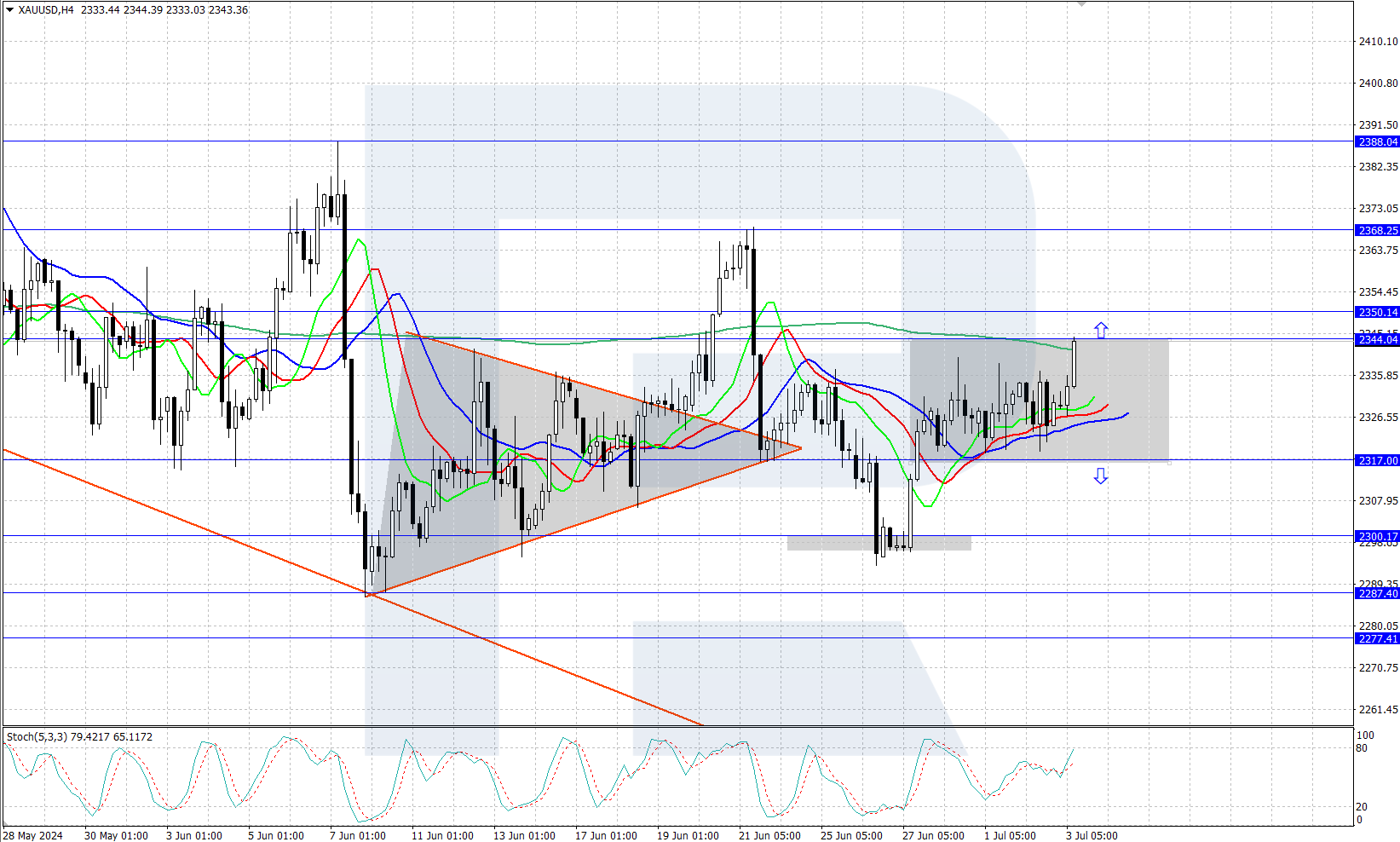

- Price dynamics: gold is consolidating within a narrow sideways range of 2,317-2,344 USD at the start of the week

- XAUUSD price targets: 2,368, 2,300 USD

XAUUSD fundamental analysis

Gold trades within a limited sideways range at the start of the week. During today’s American trading session, market participants await June’s US ADP Research Institute employment data release. The indicator will show changes in nonfarm payrolls.

According to experts’ forecasts, the indicator is expected to reach 160,000. Following this release, volatility in the XAUUSD pair may surge. If the reading is weaker than expected, the pair’s rate may rise; conversely, the quotes will decline in the case of more favourable data.

XAUUSD technical analysis

On the H4 chart, after rising from the 2,300 support level, gold quotes are consolidating within the range of 2,317-2,344 USD per troy ounce. The price is now hovering at 2,343, close to the range’s upper boundary, while market participants are awaiting the release of US employment statistics.

According to a short-term forecast, volatility might sharply increase after the ADP data release, with gold exiting the sideways range. An upward breakout of the range will open the way for growth to the 2,368 resistance level, while a downward breakout will create conditions for a decline to the 2,300 support level.

Summary

Gold’s price consolidates within a limited range at the start of the week, with market participants awaiting US employment data. The statistics to be released will determine the XAUUSD rate’s future prospects.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.