Brent crude oil price holds above 80.00 USD; focus this week on Fed meeting and US employment market data

Brent crude oil price has consolidated above 80.00, with a likely upward reversal. Find out more in the analysis for 29 July 2024.

Brent trading key points

- US data: the market awaits the Federal Reserve decision and US employment market statistics this week

- Brent forecast for 29 July 2024: 81.00 and 82.80

Fundamental analysis

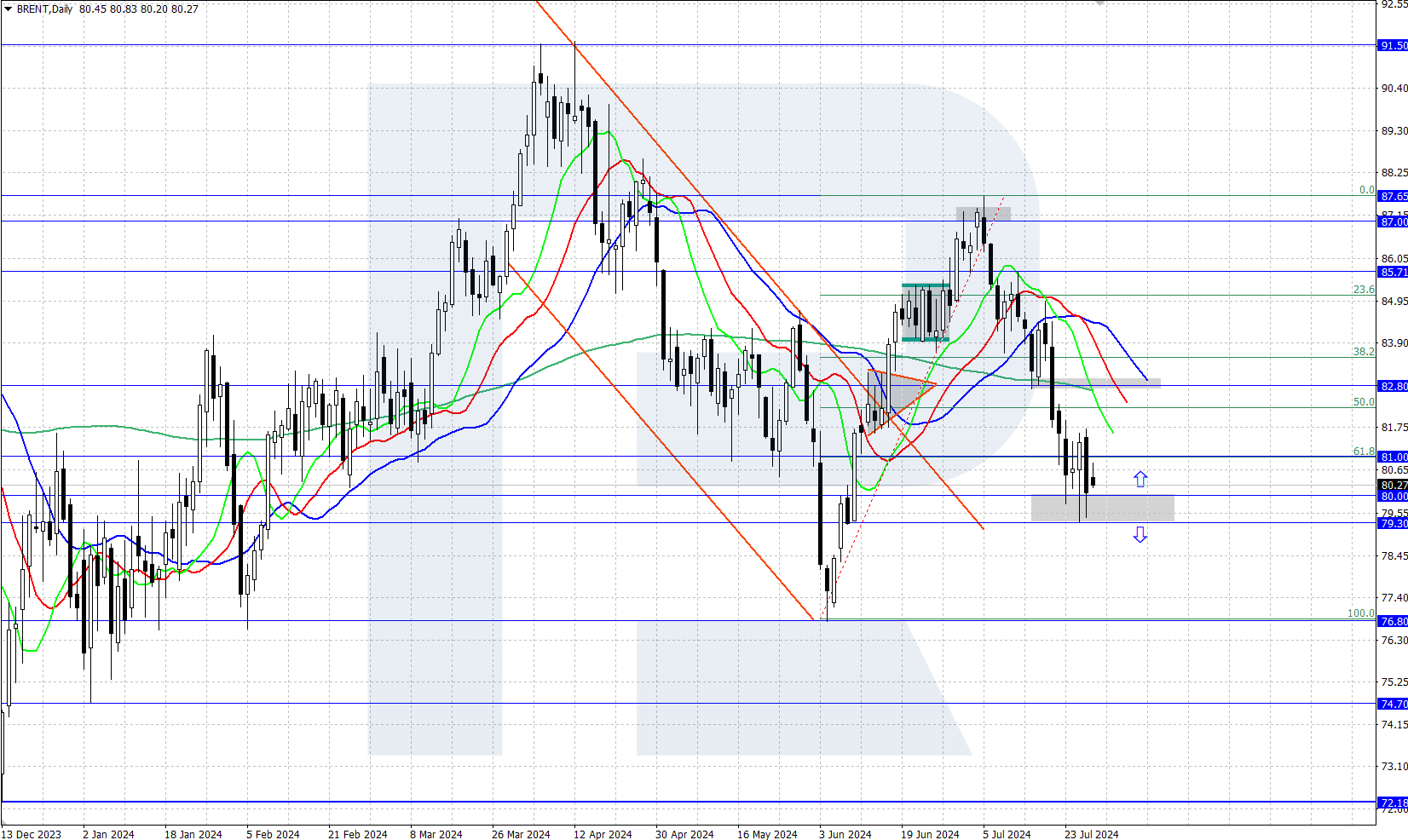

Brent prices have halted their decline within a downward correction, finding support in the 79.30-80.00 USD range. This week, US oil stock data from the American Petroleum Institute (API) and Energy Information Administration (EIA) will influence oil price movements.

Market participants also anticipate this week’s Federal Reserve interest rate decision and US employment statistics. The rate is not expected to change at this meeting. However, employment data may impact Brent prices: an increase in employment figures could strengthen the rate, while a decrease could exert pressure on the quotes.

Brent technical analysis

Although Brent has suspended its decline on the daily chart, it continues to trade within a downward correction. The price is currently hovering around 80.50. Bulls attempt to hold the price above the crucial 79.30-80.00 support area despite active resistance from bears.

A short-term Brent price forecast suggests that if bears surpass this support and secure below it, this will open the way for a decline to a daily low of 76.80. Conversely, if bulls maintain their positions, the price is expected to rise to the 82.80 resistance level.

Summary

Brent’s price has halted its decline, with local support forming in the 79.30-80.00 USD range. The Federal Reserve meeting, US employment market data, and oil stock statistics from the API and EIA may impact this week’s price movements.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.