Brent price reversed upwards, receiving support at 80.00

Brent prices halted their decline and are forming a local upward reversal. Find out more in our analysis dated 26 July 2024.

Brent trading key points

- US data: Q2 GDP exceeded forecasts

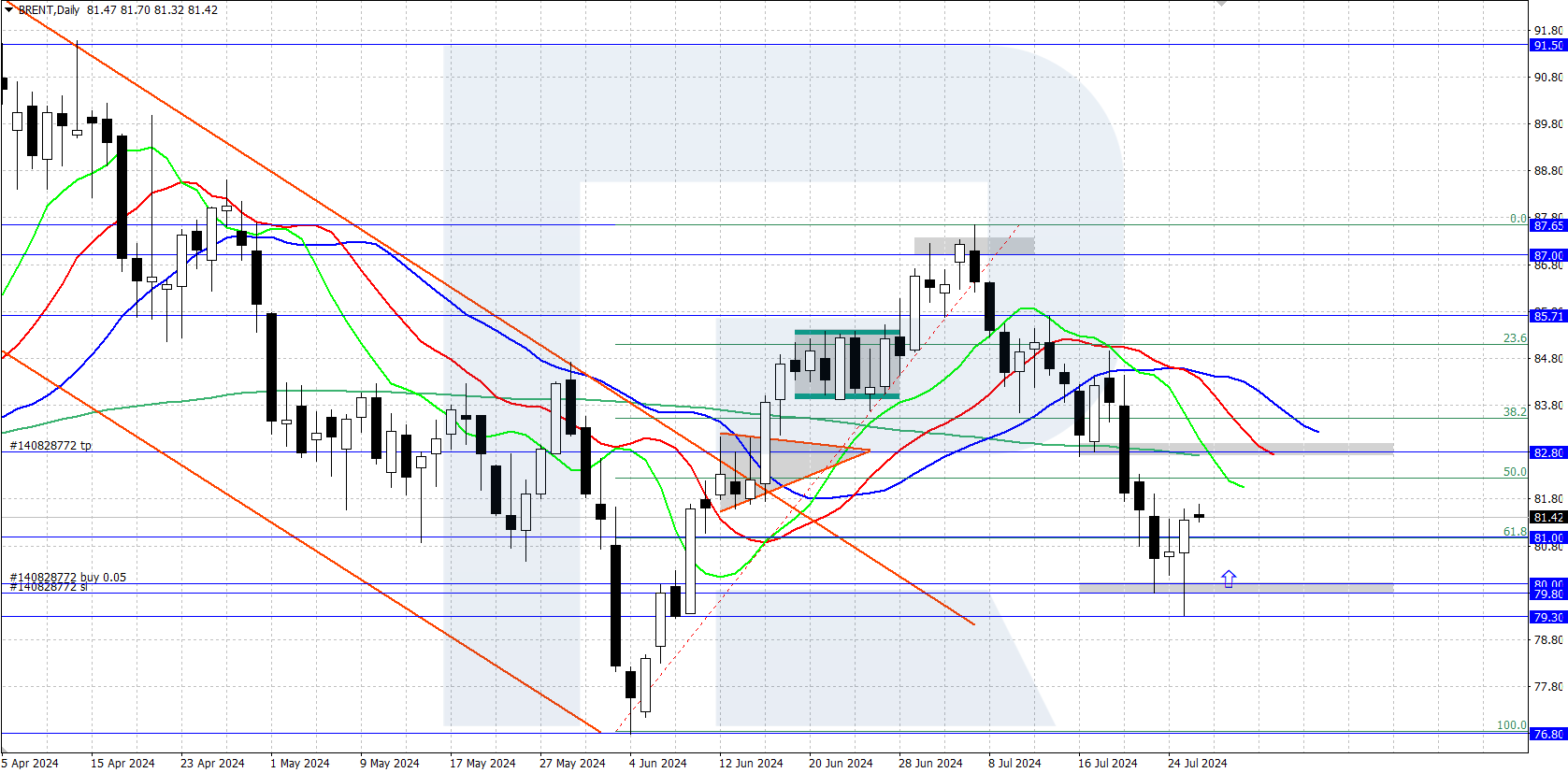

- Brent forecast for 26 July 2024: 80.00 and 82.80

Fundamental analysis

Brent’s price halted its two-week decline within a downward correction, finding support at 80.00. According to the Energy Information Administration (EIA) data and robust US Q2 GDP statistics, this reversal may have been influenced by a decrease in US oil inventories.

According to data released during yesterday’s American session, the US Q2 GDP rose by 2.8%, significantly exceeding the forecast of 2.0% and the Q1 result (1.4%). This is a positive development for Brent prices, as steady economic growth boosts demand for energy resources.

Brent technical analysis

Brent quotes halted their decline on the daily chart, currently hovering around 81.60. Bulls seized the initiative near the 80.00 support level yesterday and are now attempting to counterattack, reversing the price movement upwards.

The 79.30-80.00 area currently represents a crucial support level. In the short-term Brent price forecast, if bears reverse the price downwards and break through this support, this will open the way for further decline towards a daily low of 76.80. Conversely, if bulls can hold their positions, Brent prices may rise towards the 82.80 resistance level.

Summary

Brent quotes halted their decline, possibly supported by US statistics: a decrease in oil stocks (according to the EIA data) and sustained GDP growth in Q2. If bulls can maintain their positions, oil prices may increase further.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.