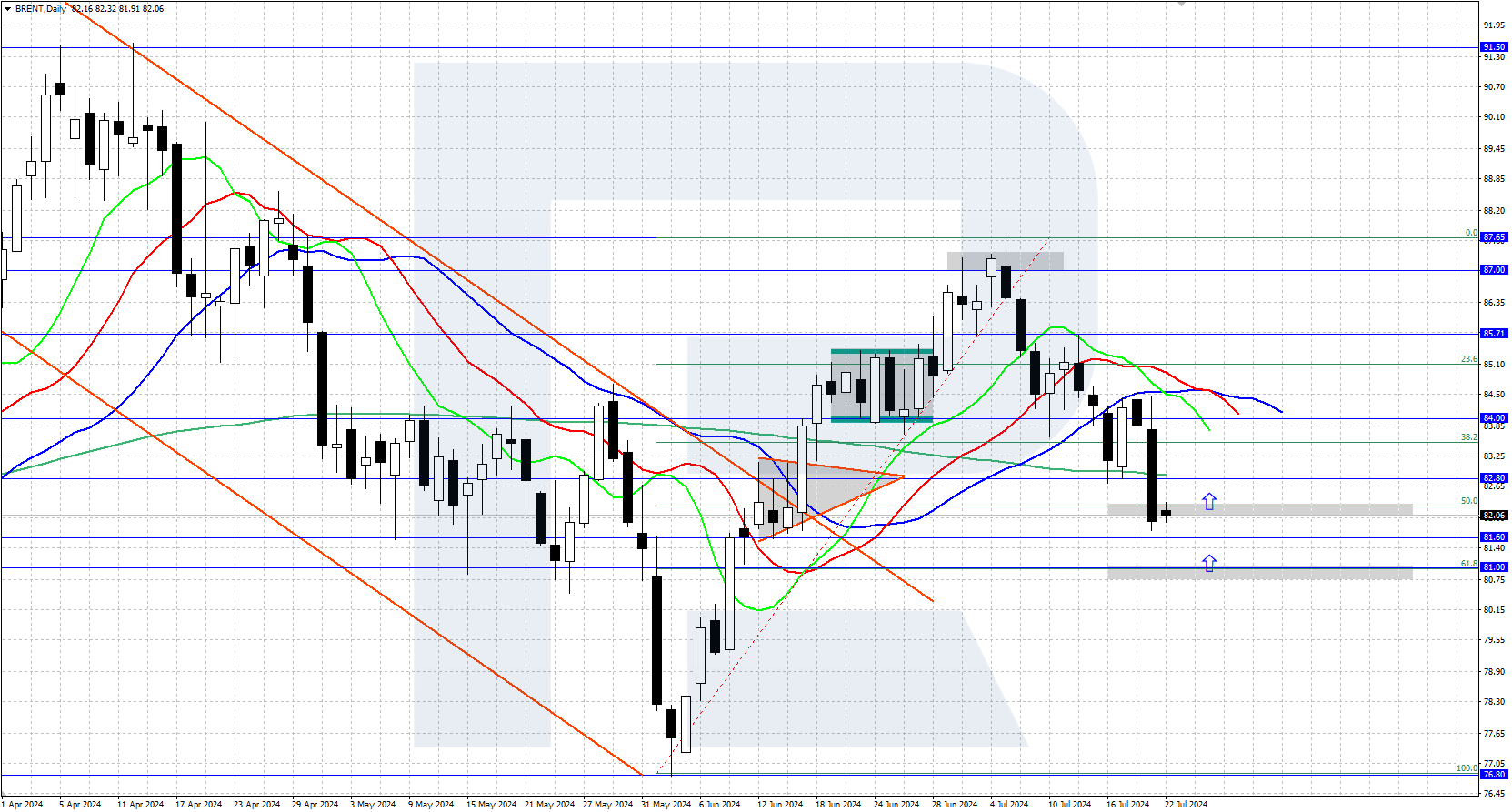

Brent fell to the 50.0% Fibonacci level as part of a correction

Brent crude oil prices experienced a decline of approximately 3% last week.

Brent trading key points

- Current trend: a downward correction is underway as part of a long-term uptrend

- Market focus: geopolitical tensions in the Middle East are rising

- Price dynamics: bulls will probably attempt to reverse the price up at the current price level

- Brent price targets: 81.00 and 82.80

Fundamental analysis

According to API and EIA data, Brent crude oil prices fell moderately last week due to the ongoing downward correction despite decreasing US oil inventories. The decline in oil prices is driven by a fall in US stock indices.

However, the long-term oil trend remains upward, so the correction can be expected to end at any time, with the quotes reversing upwards. Potential growth can be additionally supported by another escalation of the Middle East conflict, with Israel striking an oil depot terminal in western Yemen’s Hodeida port.

Brent technical analysis

A downward correction is underway on the daily Brent chart after the price reached a local high of 87.65. The commodity is trading around 82.00, with the nearest support level at 81.60 and the resistance level at 82.80.

The price fell to the 50.0% Fibonacci level from previous growth and could move towards the 61.8% retracement level near 81.00. It is now essential to monitor further movements in Brent prices near the 50.0-61.8% Fibonacci retracement levels as bulls may attempt to seize the initiative and reverse the quotes up.

Summary

Brent crude oil prices are declining as part of a downward correction. The quotes have reached an area where upward reversal attempts may be expected. Another escalation of tensions in the Middle East may support oil.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.