Brent analysis: the price approached a key level of 80 USD per barrel

After declining sharply, Brent crude oil continues to correct in anticipation of energy market forecasts from the OPEC and the International Energy Agency (IEA). Given political uncertainty in the Middle East, the Brent price forecast is moderately optimistic.

Brent trading key points

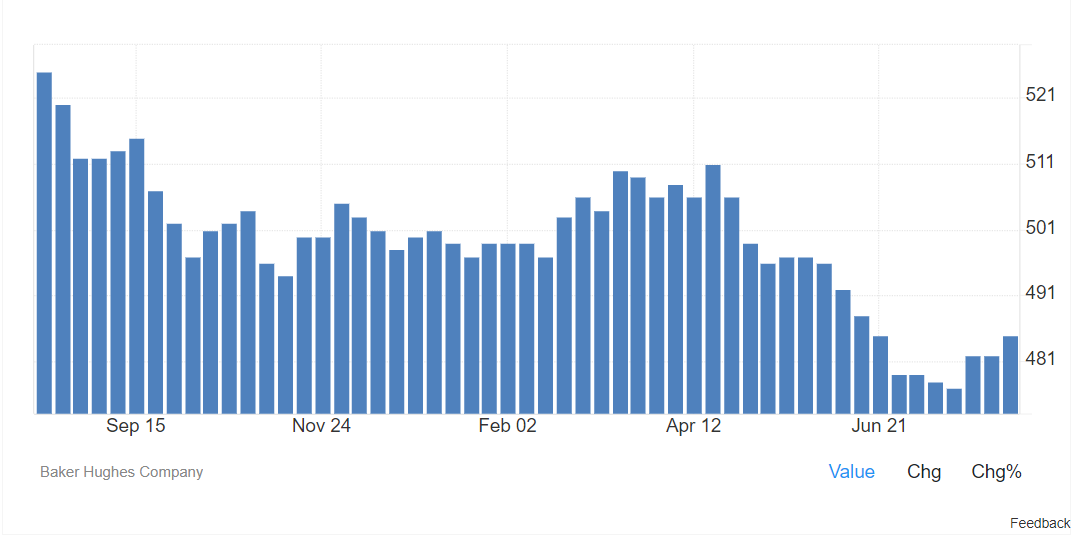

- Recent data: Baker Hughes oil rig count reached 485

- Economic indicators: the US became one of the largest oil exporters, so oil rig count data helps assess producer sentiment

- Market impact: an increase in this indicator shows confidence in high prices and demand from oil consumers

- Resistance: 81.35, Support: 75.50

- Brent forecast for 12 August 2024: 84.80

Fundamental analysis

Oil has stabilised after a weekly rise. The market still awaits Iran’s response to the Hamas leader’s murder in Tehran last month. This week’s OPEC and IEA reports will provide more insight into the prospects. Oil prices dropped below 80 USD per barrel in August, a level lower than required by most OPEC+ members, including the Organization of Petroleum-Exporting Countries and its allies like Russia, to balance their budgets.

As official data showed on Wednesday, oil imports to China reached 10.89 million barrels over the first seven months of 2024, down 2.4% from the last year. According to Reuters calculations based on government valuations, by July, daily oil consumption in the US increased by 220,000 barrels from last year, averaging 20.25 million barrels. Demand needs to rise for the government’s target of 20.50 million barrels per day to be reached this year. With such expectations, the Brent forecast for 12 August 2024 will remain moderately positive.

Brent technical analysis

Brent quotes have been experiencing strong growth since the middle of last week. At the start of today's trading session, the price per barrel approached the critical 80 USD level. If the quotes secure above this level, this will indicate a reversal in the market sentiment and the beginning of the uptrend. A breakout above the 81.35 resistance level will confirm this signal.

Key levels for today’s Brent analysis:

- Resistance level: 81.35 – a breakout above this level could drive the price up to 84.40

- Support level: 75.50 – a breakout below the support level might push the price down to 72.60

Summary

Brent price approached the 80 USD level. Market participants remain concerned about escalating events in the Middle East. This week’s reports from OPEC and IEA will offer further insights into prospects. While oil demand in China remains slightly lower than last year, it is rising in the US, leading to a moderately optimistic Brent price forecast.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.