Brent crude oil recovers after decline; focus on API data today

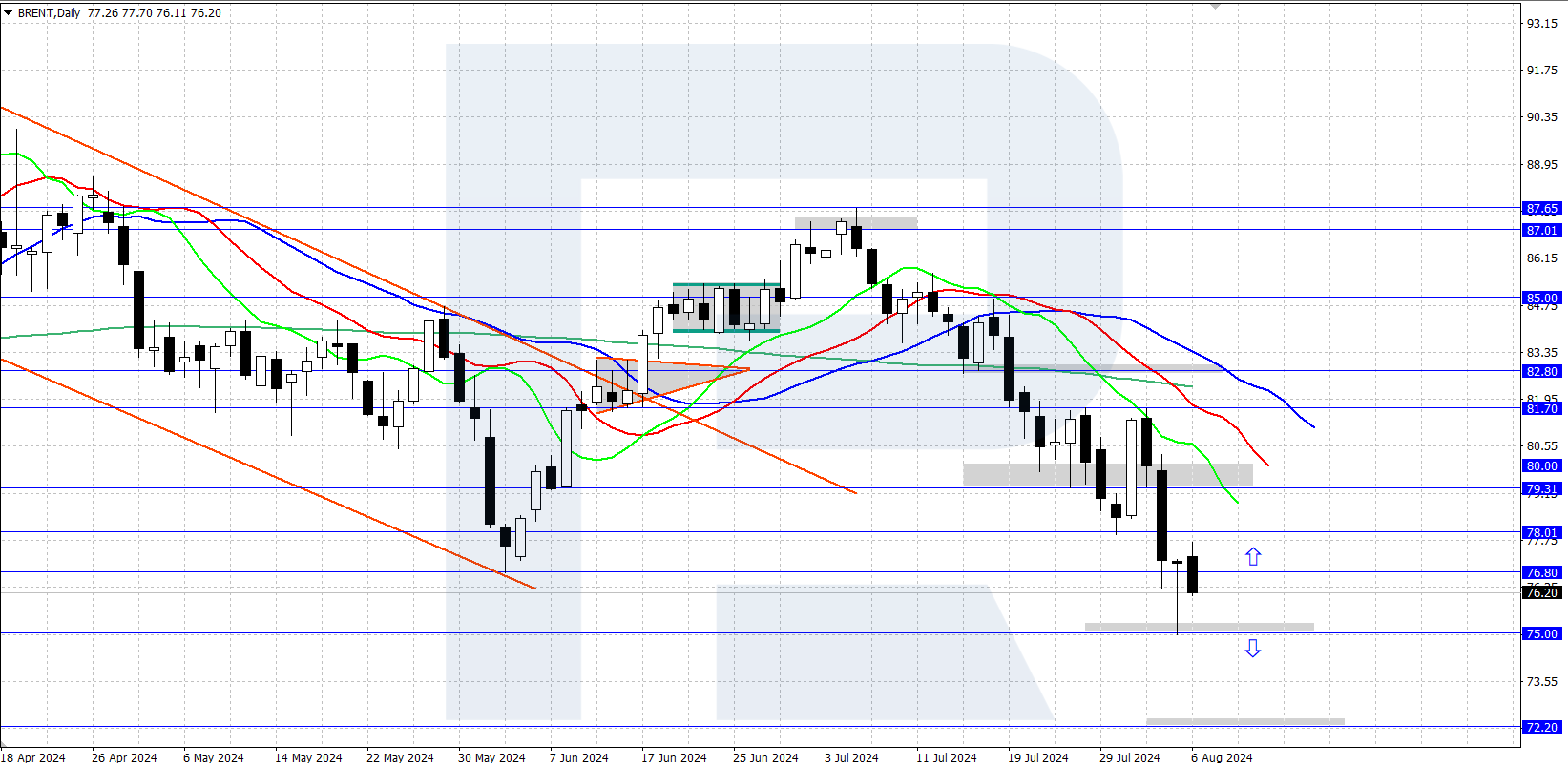

Brent price is consolidating near the 76.80 level after falling to 75.00 USD on Monday. Market participants are awaiting the US API oil stock data. Find out more in the Brent analysis for today, 6 August 2024.

Brent trading key points

- US data: the market awaits US API oil stock statistics today

- Brent forecast for 6 August 2024: 80.00 and 75.00

Fundamental analysis

Brent quotes dipped to 75.00 on Monday amid declining stock markets and mounting geopolitical tensions in the Middle East. By the end of the trading day, stock markets had recovered from their decline, and Brent prices also returned to the daily level of 76.80.

Today, market participants await the release of the US oil inventories statistics from the American Petroleum Institute (API). Last week's data showed a decrease of 4.49 million barrels in reserves. A further decline in inventories could drive up Brent prices, while an increase in oil stocks may push prices down.

Brent technical analysis

Oil prices are consolidating near the 76.80 level, with a prevailing downtrend on a daily basis. The price halted its decline after reaching a daily low of 75.00 yesterday, and bulls are now attempting to reverse the trend upwards, supported by recovering global stock markets.

The short-term Brent price forecast suggests an upward correction towards 80.00 could begin if bulls manage to hold above 75.00 and seize the initiative. Conversely, if bears push prices below 75.00, the decline might continue towards 72.20.

Summary

Brent crude oil hit another daily low near the 75.00 level amid declining global stock markets. Today, market participants await the release of the US API oil stock data, which could add to volatility in Brent prices.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.