Brent crude oil is trading around 80.00 USD; focus on US employment market data today

Brent price is consolidating within a limited range near 80.00 as market participants await US nonfarm payrolls and unemployment rate data. Find out more in the Brent analysis for today, 2 August 2024.

Brent trading key points

- US data: the market awaits employment market statistics today

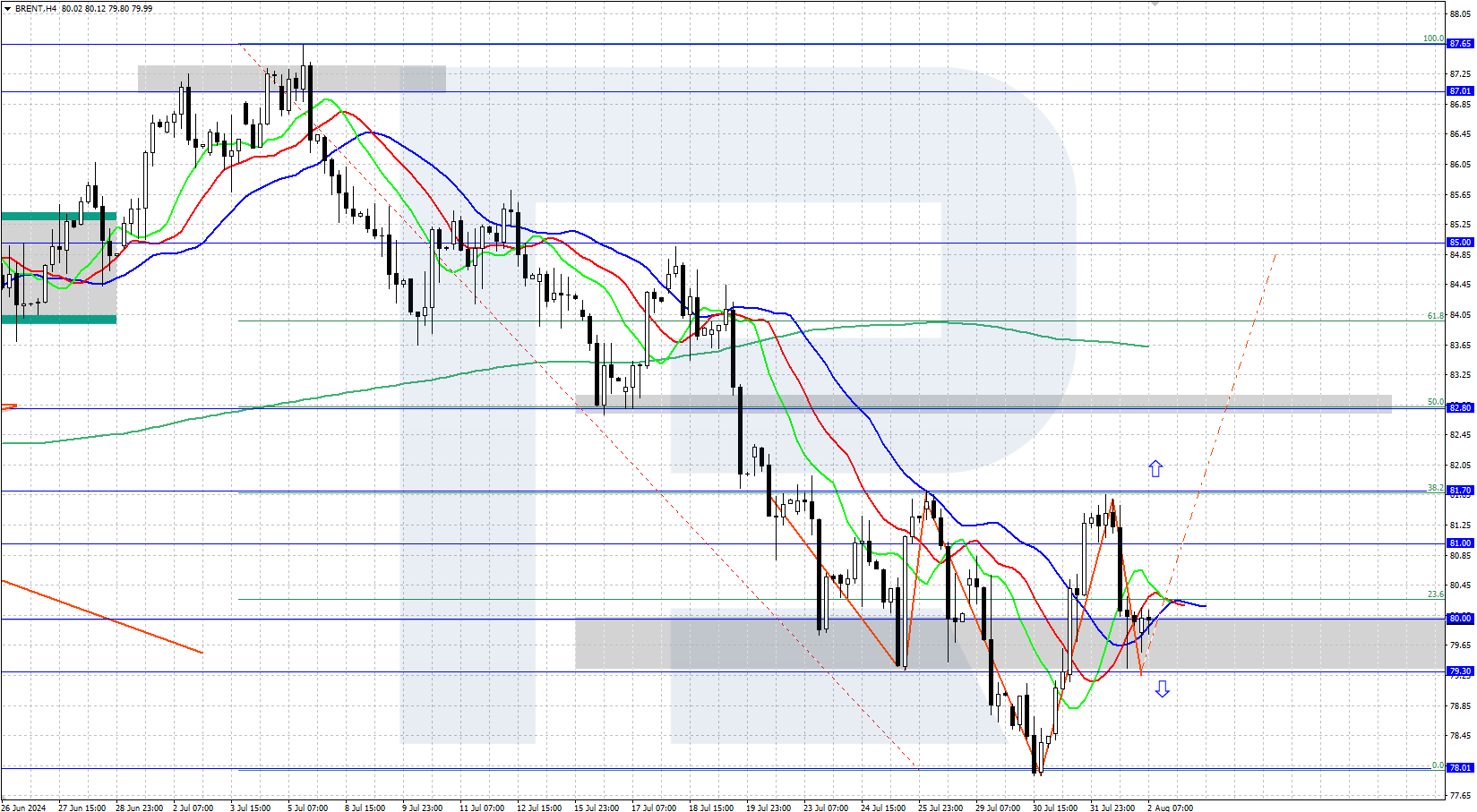

- Brent forecast for 2 August 2024: 82.80 and 78.00

Fundamental analysis

Brent quotes halted their decline as part of a downward correction after reaching a local low of 78.00. This week’s US oil stock data from the American Petroleum Institute (API) and Energy Information Administration (EIA) showed a decrease in oil inventories by 4.49 and 3.43 million barrels, respectively.

Today, market participants are awaiting the release of US July employment statistics, which will reveal nonfarm payrolls and the unemployment rate. Oil prices will likely be influenced by the reaction of the US stock market to employment data: a rise in the stock market will help strengthen Brent’s price, while a decline would push prices lower.

Brent technical analysis

Brent price is currently consolidating within the range of 78.00-81.70. The daily decline has stopped, and bulls have reversed the price upwards from a local low of 78.00. The H4 chart shows potential for the formation of an inverse head and shoulders reversal pattern.

The short-term Brent price forecast suggests that if bulls surpass the 81.70 resistance level and secure a position above it, this will open the way for growth to 82.80 and then to 85.00. If bears push the price below 78.00, this will invalidate the growth scenario and could enable the price to reach a daily low of 76.80 later.

Summary

Brent price has found local support and is consolidating within the 78.00-81.70 range. Today, market participants will focus on US employment market data, which could drive further movements in oil prices.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.