Brent prices fall, driven by a sell-off of risky assets

Brent crude oil prices are dropping again. The market has experienced sales growth amid falling prices for risky assets and the US dollar strengthening.

Brent trading key points

- Brent prices are falling due to pressure from the US dollar

- China’s plenum did not outline measures to support the economy

- Brent price targets: 85.00, 85.40, 86.90, and 88.00

Fundamental analysis

The commodity market was again under pressure, with a barrel of Brent crude oil falling to 84.73 USD on Friday.

Investors took a more cautious stance when assessing the global economic outlook, resulting in sales in stock and commodity market sales, which contributed to the growth of the US dollar. Statistics showing stronger-than-expected growth in July’s industrial production and increased jobless claims amid seasonality also bolstered the USD.

Commodity goods are generally believed to be less profitable to purchase amid USD growth.

Chinese news failed to support the oil sector. China’s third plenum ended yesterday without providing any guidelines on measures to revive the country’s economy. As China is the world’s largest oil consumer, positive signals from this side could support commodity prices.

Brent technical analysis

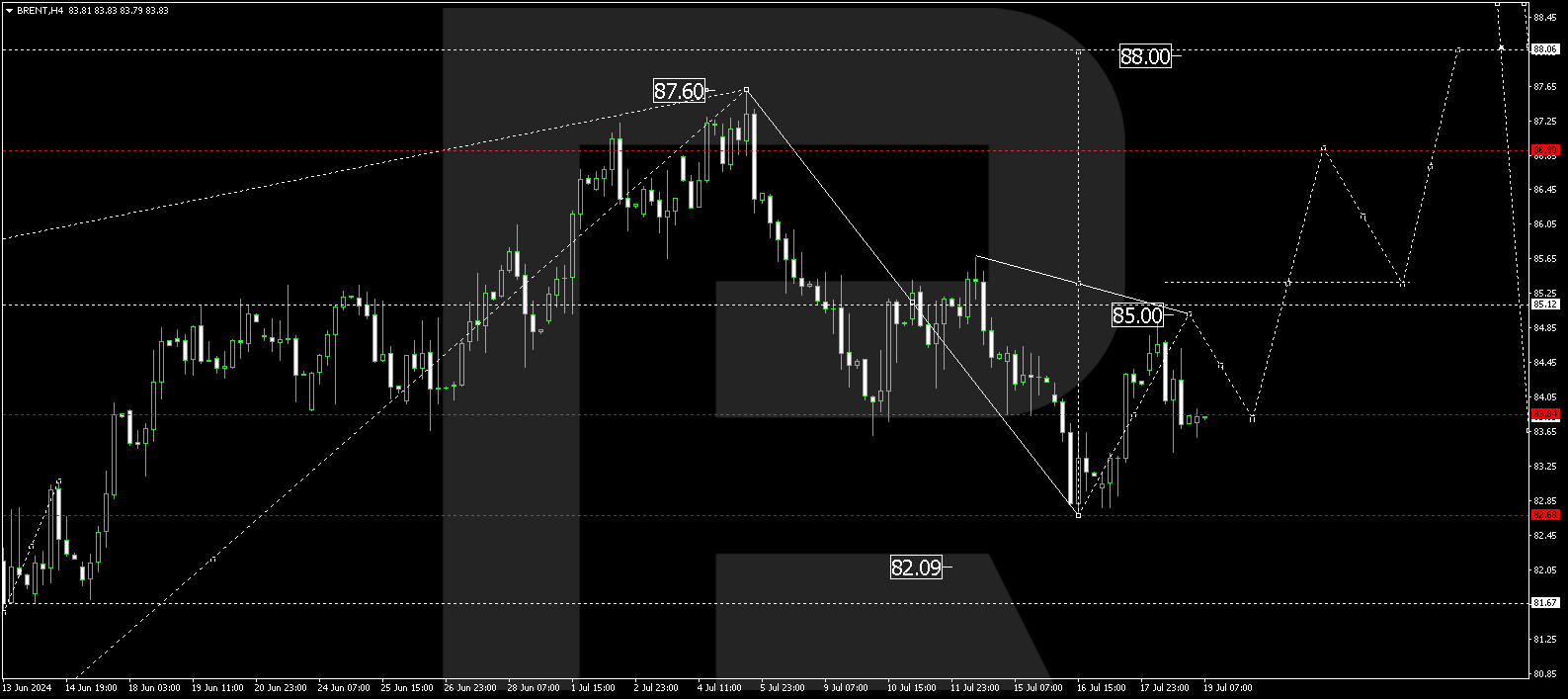

On the Brent H4 chart, a consolidation range formed around 84.30 and extended to 82.70. The price could rise to 85.00 today, 19 July 2024. With a downward breakout, a correction might continue to 81.00. An upward breakout will open the potential for a growth wave towards 85.40, potentially continuing to the 86.90 and 88.00 targets.

Summary

A rise in the US dollar and the absence of news from China exert pressure on oil prices. Technical indicators suggest the correction in Brent crude oil could be complete. A growth wave is expected to start, aiming for the 85.00, 85.40, 86.90, and 88.00 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.