China’s sluggish domestic demand and economic slowdown jeopardise oil prices

Brent crude oil prices fall on Wednesday, 17 July 2024, declining for the fourth consecutive trading session.

Brent trading key points

- Declining demand in China: oil imports decreased to 46.45 million tons in June

- A slowdown in China’s GDP growth: GDP growth rates in Q2 fell to 4.7%

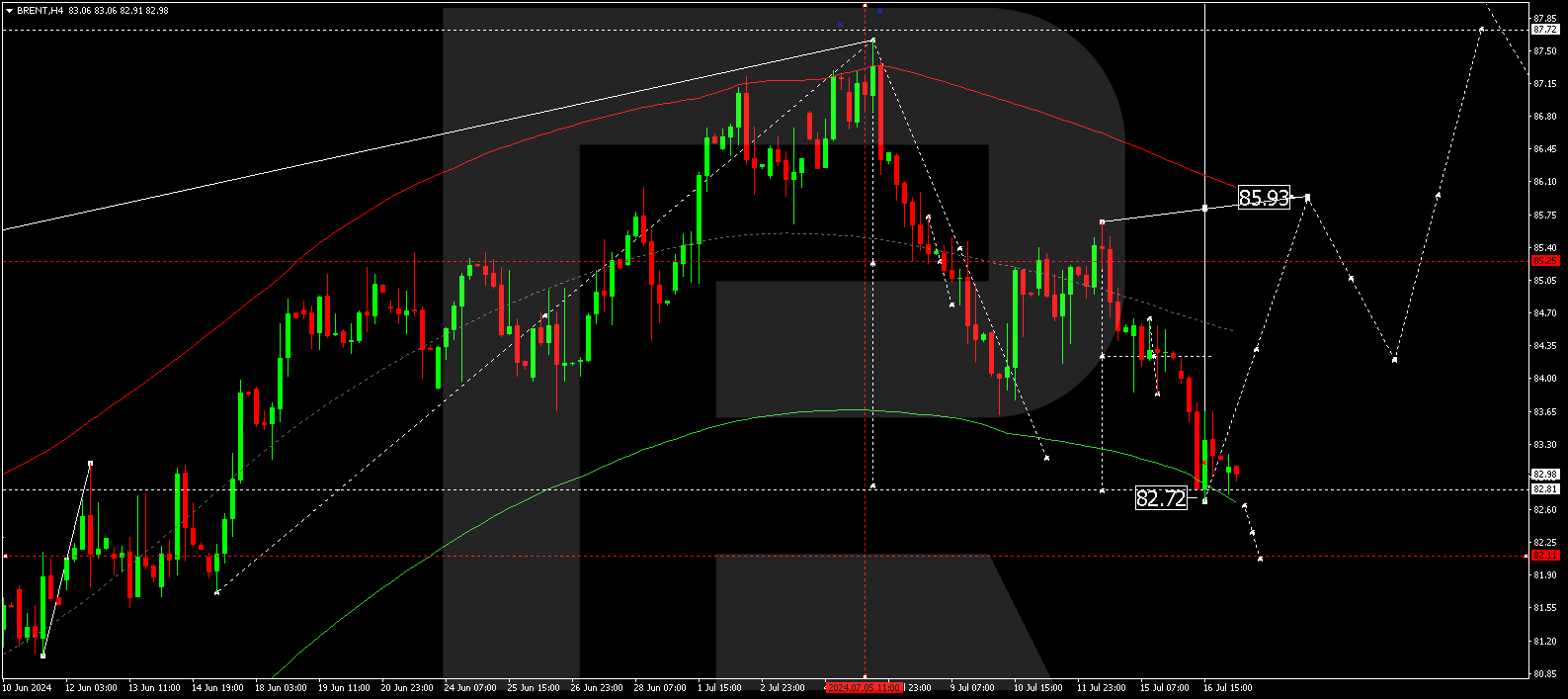

- Brent price targets: 85.90 and 87.72

Fundamental analysis

Recent data on China’s oil imports and GDP growth rates raised concerns in the global oil market. Oil imports to China, which is the world’s largest consumer of crude hydrocarbons, declined to 46.45 million tons in June, indicating sluggish domestic demand in the country. The slowdown in China’s GDP growth rates to 4.7% in Q2, below the 5.3% recorded in Q1, adds to pessimism.

The Chinese economy has traditionally been the driver of global economic activity and fuel demand. The weakening of these indicators could lead to oil oversupply in the market, which will negatively impact the prices. Although the Chinese authorities are taking action to stimulate the economy, it is not clear how quickly these measures will help revive fuel demand.

Brent technical analysis

On the Brent H4 chart, a consolidation range has formed around 84.24. Breaking below the range, the price reached the estimated decline target of 82.72. A new consolidation range could form above this level today, 17 July 2024. With a downward breakout, the range might extend to 82.10 (testing from above). Subsequently, a new growth wave could start, aiming for 85.90 and potentially continuing to 87.72.

Summary

Lowering China’s oil imports and slowing GDP growth signal a potential decline in global fuel demand, which could lead to a further fall in oil prices. Technical indicators suggest that the correction in Brent crude oil could be complete. A growth wave is expected to start, aiming for 87.72.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.