Brent crude oil prices rise amid decreased US inventories

Oil prices have risen for the third consecutive day due to a decline in inventories and an upward revision in the IEA demand outlook.

Brent trading key points

- US oil stocks decreased by 3.444 million barrels

- According to the IEA forecast, global oil demand is expected to rise in 2024

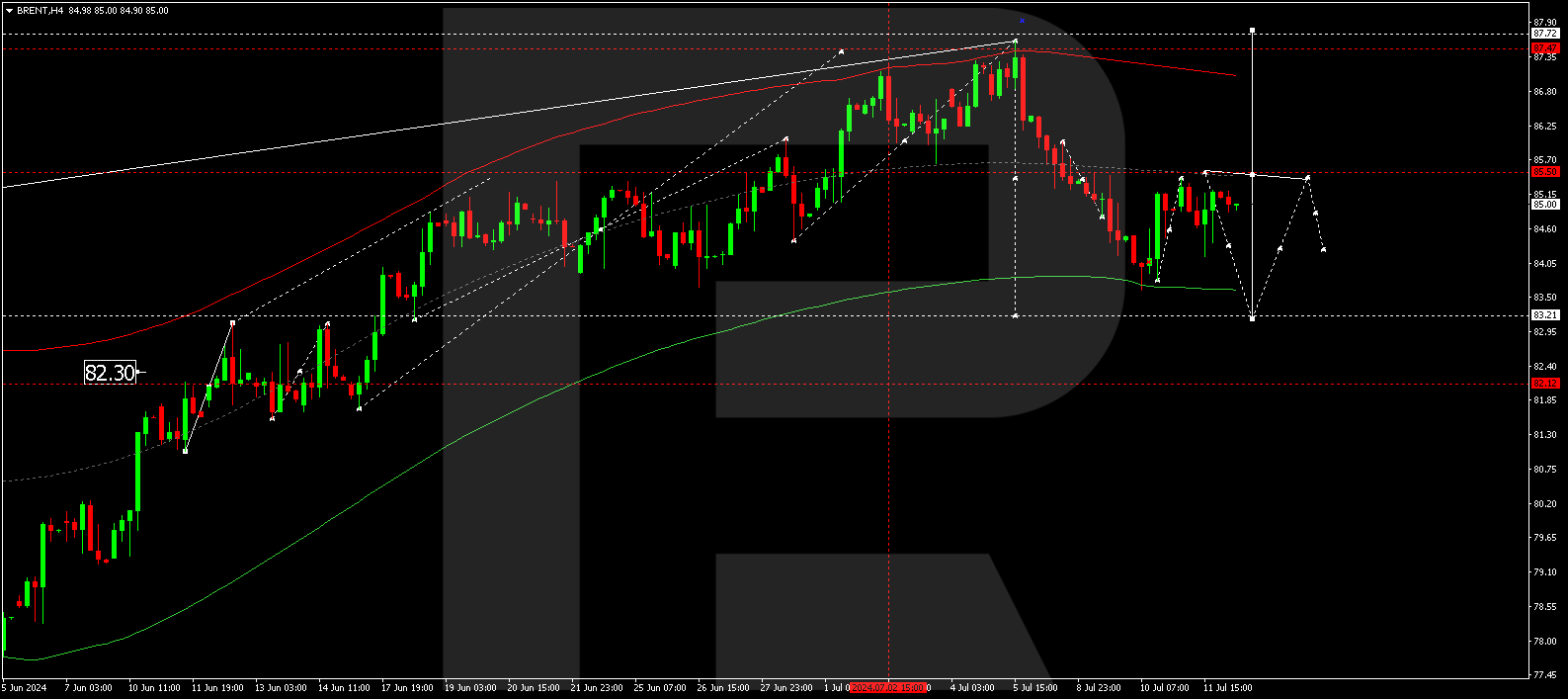

- Brent price targets: 85.50 and 83.22

Fundamental analysis

According to the US Department of Energy, commercial oil inventories fell by 3.444 million barrels last week, and petroleum reserves decreased by 2.006 million.

The International Energy Agency’s raised outlook for global oil demand was the second factor significantly supporting the oil market. New data indicates a daily demand forecast of 974,000 barrels in 2024, exceeding the previous estimate of 962,000.

However, these positive signals are tempered by reduced oil consumption in China, which has long been the primary driver of the global hydrocarbon market. According to the IEA report, China’s oil consumption in Q2 2024 is estimated to be slightly lower than last year’s corresponding period.

Brent technical analysis

On the H4 chart, Brent underwent a correction to 85.40. Another growth structure could develop today, 12 July 2024, aiming for 85.50 (testing from below). Subsequently, the price might fall to 83.22, marking the completion of the downward potential. Once this level is reached, a new upward wave could begin, targeting 87.72 and potentially continuing to 90.00.

Summary

While oil prices are rising due to decreased US inventories and an increased IEA demand forecast, this upturn may be constrained by reduced consumption in China. Technical indicators suggest a further correction in Brent crude oil prices towards the 83.22 target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.