Brent crude oil prices await data on oil reserves

The price continues a corrective wave ahead of the crude oil reserves data release. Negative data may trigger a new growth wave.

Brent trading key points

- US crude oil reserves: forecasted at 0.700M, with a previous reading of -12.157M

- Excessive oil inventories in Cushing (Oklahoma, the US): the previous reading was 0.345M

- A speech by US Federal Reserve Chair Jerome Powell

- Brent price targets: 83.26, 84.84, and 82.10

Fundamental analysis

Brent prices continue a corrective wave in anticipation of crude oil inventory data from the Energy Information Administration (EIA). As the US is the largest oil consumer, declining reserves could impact oil prices and trigger a new round of increases.

While the data on excessive oil reserves from Cushing pertain to WTI, it also affects Brent. Increased reserves indicate reduced oil consumption and processing by US companies, affecting both benchmarks globally. Weekly data releases typically have short-term effects on oil prices.

A speech by US Federal Reserve Chair Jerome Powell may negatively impact the US dollar, thereby influencing oil prices.

Brent technical analysis

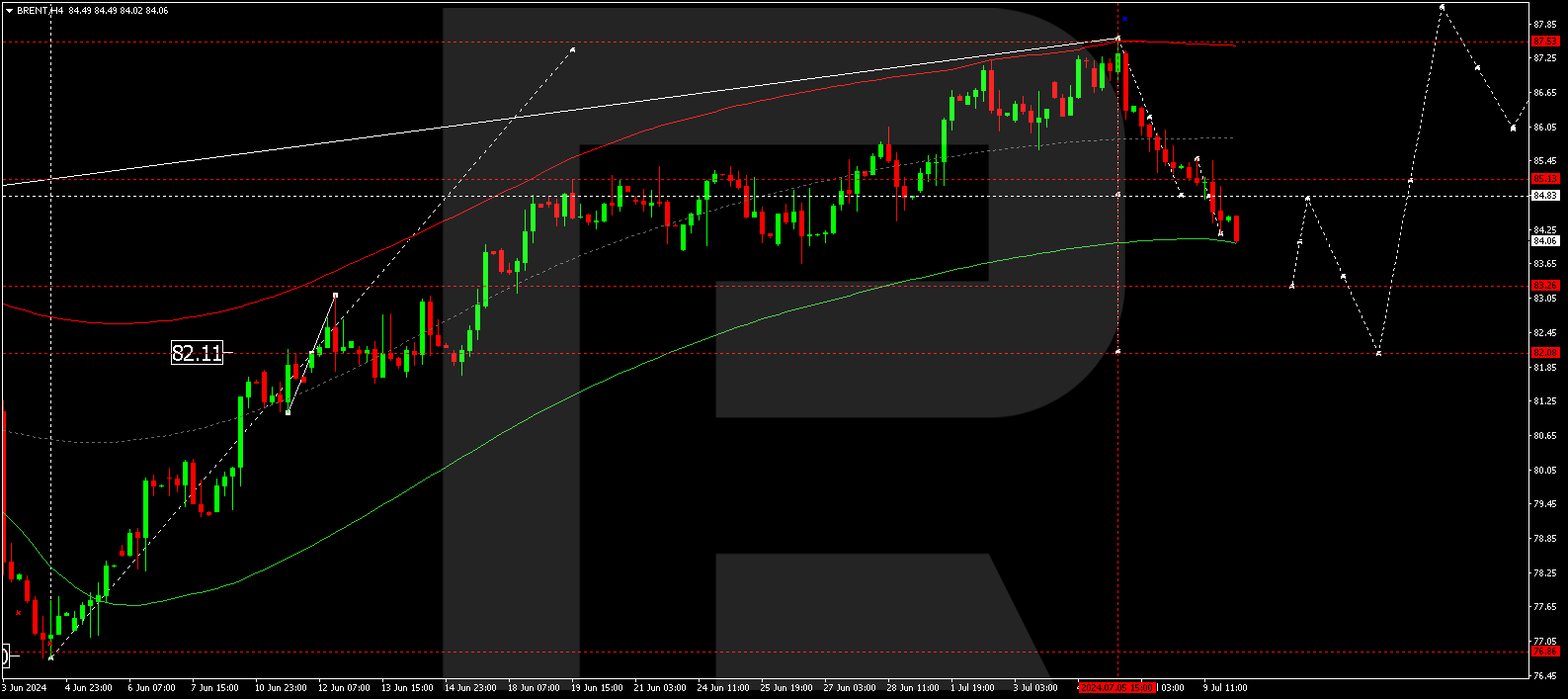

On the H4 chart, Brent continues to correct towards 83.26. Today, 10 July 2024, the price is expected to reach this level and rise to 84.84 (testing from below). Subsequently, another decline structure could develop, targeting 82.10. Once this correction is complete, a new growth wave is anticipated, aiming for 88.00 and potentially extending to 90.00.

Summary

Forecasts on oil inventories and technical indicators suggest a potential correction in Brent crude oil towards the 82.10 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.