Brent crude oil is in a consolidation phase as investors factor risks into prices

The commodity market has started the week on a neutral tone, with prices reflecting decreasing geopolitical risks and a US economic slowdown.

Brent trading key points

- US employment statistics have raised doubts in the market

- The Middle East news is exerting pressure on commodity prices

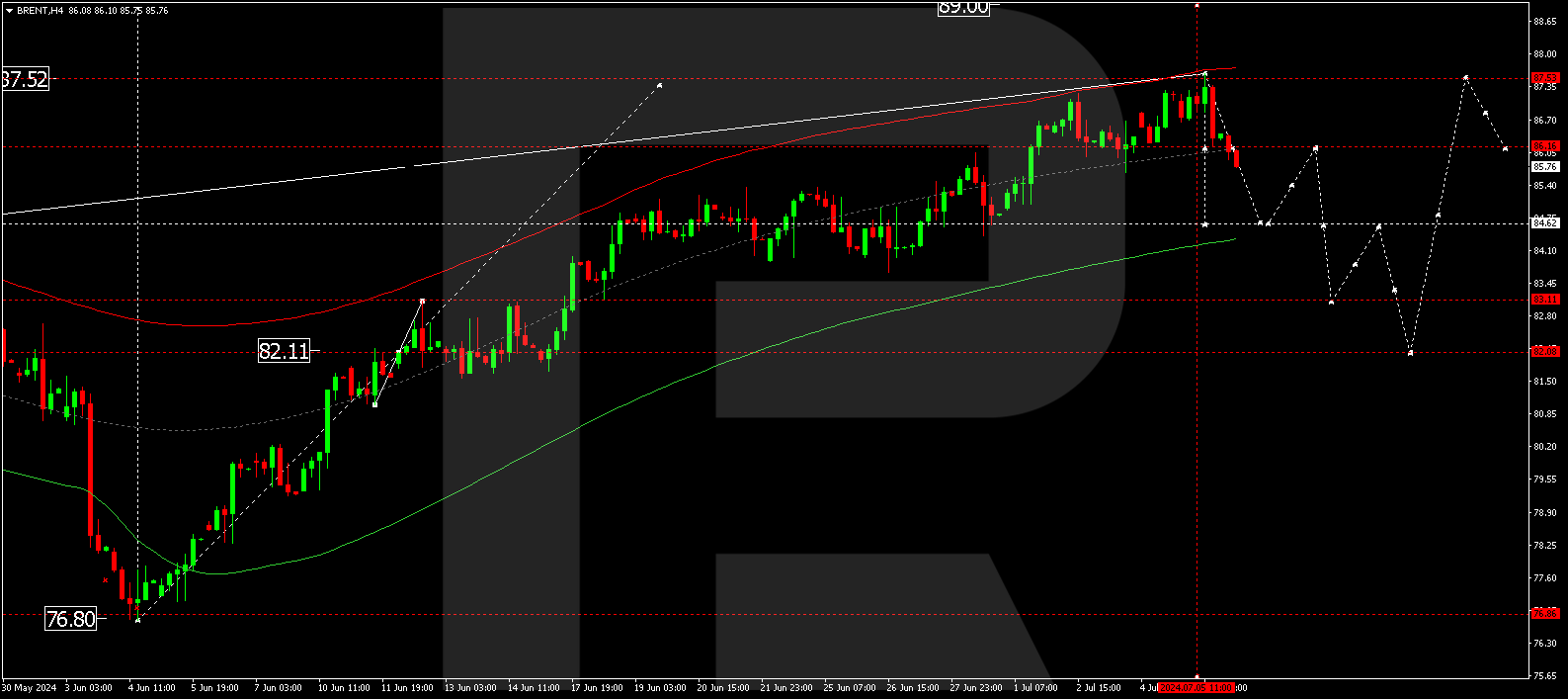

- Brent price targets: 84.64, 83.11, and 82.12

Fundamental analysis

The price of Brent crude oil is stable on Monday, hovering at 86.45 USD per barrel. Previously, commodity prices have experienced a minor correction following steady growth.

The market continues to assess the mixed US June employment market data. Friday’s reports showed that the unemployment rate remained at a two-and-a-half-year peak while earnings growth slowed to a three-year low. Nonfarm payroll data exceeded expectations. Overall, the mixed data released raised concerns about a US economic slowdown. This, in turn, is crucial for the oil market as the US is the largest oil consumer. An economic downturn may decelerate the commodity market’s growth rate and negatively impact demand.

The largest Texas ports remain closed due to tropical storm Beryl. The market is factoring in the current risks to energy supplies.

Positive geopolitical developments include the potential for a ceasefire in the Gaza Strip. The reduction in these risks exerts local pressure on oil prices.

Brent technical analysis

On the H4 chart, Brent has completed the first growth wave with a target of 87.60. The price has declined to 86.16. A narrow consolidation range might form around this level today, 8 July 2024. The price is expected to break below the range and continue the wave to 84.64, representing the first target for correction. After reaching this target, the price could rise to 86.16 (testing from below). Subsequently, a correction is possible, aiming for 83.11 as the local target.

Summary

Fundamental conditions allow for a decline in oil prices. Technical indicators for Brent crude oil point to a high probability of correction to the 84.64, 83.11, and 82.12 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.