Brent reversed downwards, with prices falling below 75.00 USD

Brent prices are declining, falling to the support area at 75.00 USD. Find out more in our analysis for 13 February 2025.

Brent forecast: key trading points

- According to the Energy Information Administration (EIA), US crude oil inventories rose by 4.1 million barrels last week

- OPEC+ maintained its oil demand growth forecast at 1.45 million barrels per day in 2025

- Current trend: moving downwards

- Brent forecast for 13 February 2025: 74.00 and 75.00

Fundamental analysis

Yesterday’s US inflation data showed rising inflation risks, with the Consumer Price Index (CPI) up 0.5% month-on-month and 3.0% year-on-year (expected at 0.4% and 2.9%, respectively). Accelerating inflation may negatively impact US economic growth, putting pressure on oil prices.

Brent was also affected by the release of the latest EIA report on US crude oil inventories. The data showed that oil stocks increased by 4.1 million barrels last week, exceeding the expected growth of 3.0 million. OPEC+ maintained its oil demand growth forecast at 1.45 million barrels per day in 2025.

Brent technical analysis

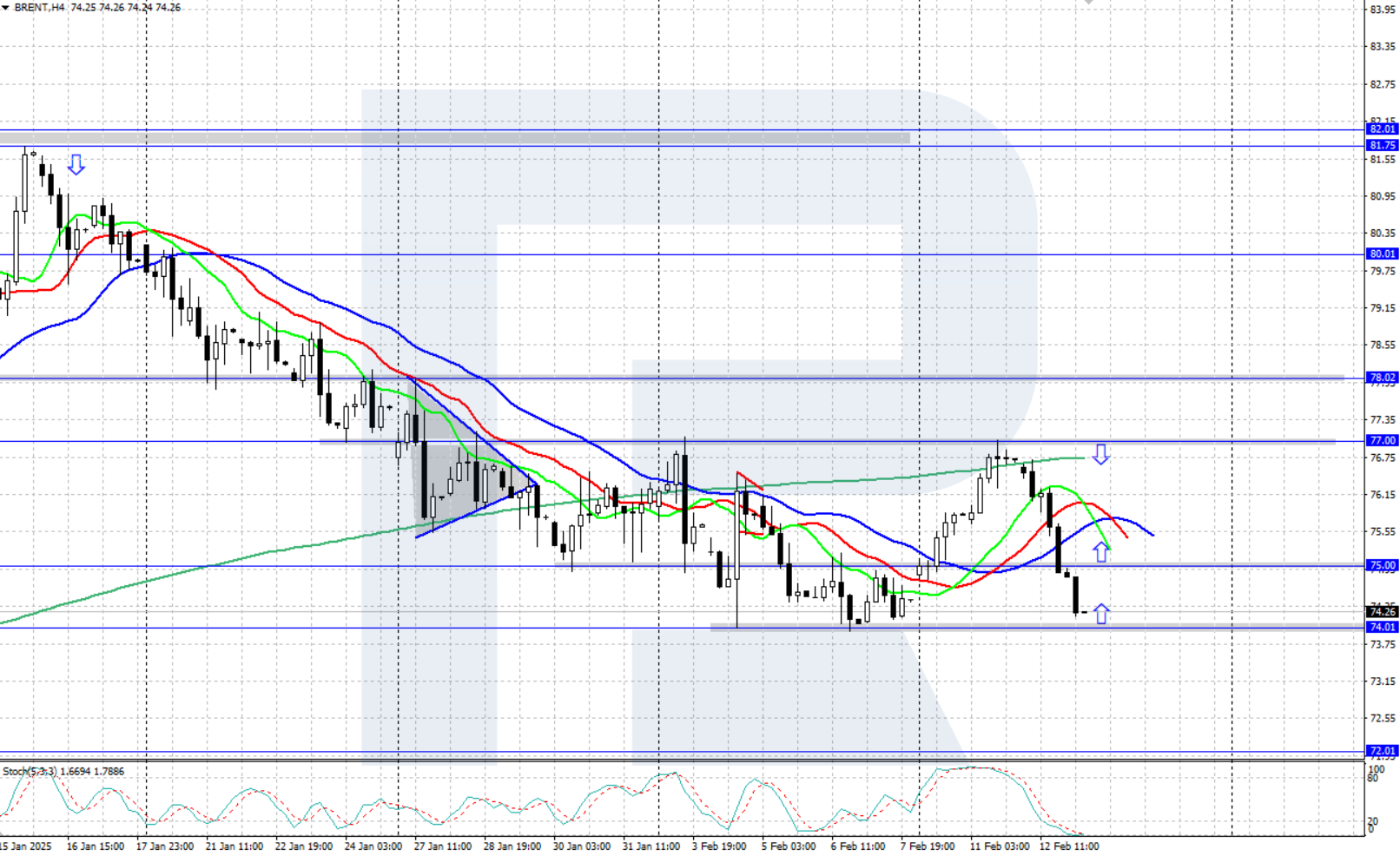

Brent crude oil is moving downwards, dropping to the 74.00 USD support level. The Alligator indicator is also directed downwards, confirming the downward momentum. A strong resistance level is at 77.00 USD. The direction of the price movement out of the 74.00-77.00 USD range will determine further prospects for oil prices.

The short-term Brent forecast suggests that the quotes could rise to the 77.00 USD resistance level if the bulls hold above the 74.00 USD support level. Conversely, if the bears gain a foothold below 74.00 USD, the decline could continue towards 72.00 USD.

Summary

Brent crude oil is moving downwards, falling to the 74.00 USD support level. If this level breaks, prices could decline further to 72.00 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.