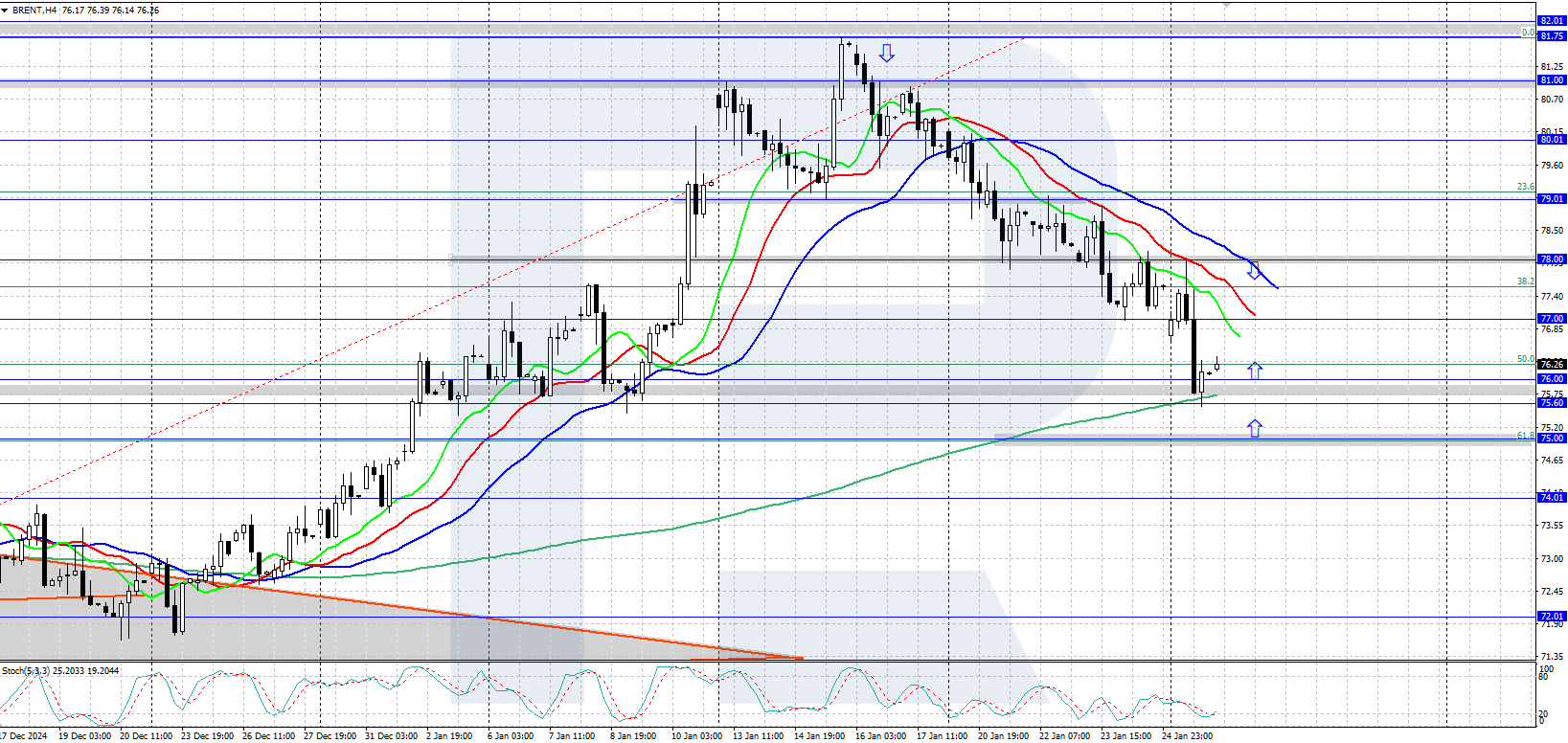

Brent declined to the 76.00 USD support level

Brent quotes continue to decline within a downward correction, with the asset finding support from buyers in the 75.60-76.00 USD area yesterday. More details in our Brent analysis for today, 28 January 2025.

Brent forecast: key trading points

- Current trend: a downward correction continues

- The US oil inventories statistics from the American Petroleum Institute (API) will be released today

- Brent forecast for 28 January 2025: 75.60 and 77.00

Fundamental analysis

Brent prices declined to a two-week low within the current downward correction. Oil prices are under pressure from concerns about falling demand from China, the world’s largest oil importer, and the tough economic policy of Donald Trump, who calls on OPEC to cut oil prices.

The US API oil inventories statistics will be published today, with the Energy Information Administration (EIA) data scheduled for release tomorrow. A decrease in oil reserves may support Brent quotes, while growth will push the asset prices lower.

Brent technical analysis

Brent continues to trade within a downward correction, falling to a strong support area between 75.60 and 76.00 USD yesterday. Here, the bulls managed to stop the decline and they are attempting to reverse the quotes upwards today. The weekly trend is still upward, with the asset likely to continue its ascent after the correction is complete.

The short-term Brent price forecast suggests that prices could rise to 77.00-78.00 USD if the bulls stay above the 75.60-76.00 USD support area. However, a decline to 75.00 USD is possible if the bears gain a foothold below 75.60-76.00 USD.

Summary

Brent oil continues to decline within a downward correction, falling to a strong support area between 75.60 and 76.00 USD yesterday. Today, the market will focus on the US API oil inventories statistics.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.