Brent falls following the Federal Reserve’s statement, with the current price at 72.63 USD

Brent oil is correcting near the key support level of 72.45 USD. Find out more in our analysis for 19 December 2024.

Brent forecast: key trading points

- Brent prices are declining, erasing yesterday’s gains

- The Federal Reserve signals a slower pace of interest rate cuts in 2025

- US oil inventories decreased by 934 thousand barrels, missing analyst expectations

- Brent forecast for 19 December 2024: 71.00 and 70.30

Fundamental analysis

Brent prices plummeted on Thursday after the US Federal Reserve signalled a slower pace of interest rate cuts in 2025, which could dampen fuel demand.

The drop in Brent prices almost entirely erased the gains recorded the day before when prices rose on news of a decrease in US hydrocarbon reserves. Over the week, inventories declined by 934 thousand barrels to 421.00 million barrels, falling short of analysts’ projections of a 1.27 million barrel reduction.

At the same time, the Fed’s statement curbed growth. The regulator adopted a tougher stance on the 2025 outlook, further weighing on market sentiment. The Fed noted in its comments that economic activity continues to rise steadily. Despite some weakening in the labour market since the beginning of the year and rising unemployment, it remains low. Inflation has approached the FOMC’s target of 2.0% but still slightly exceeds it.

Brent technical analysis

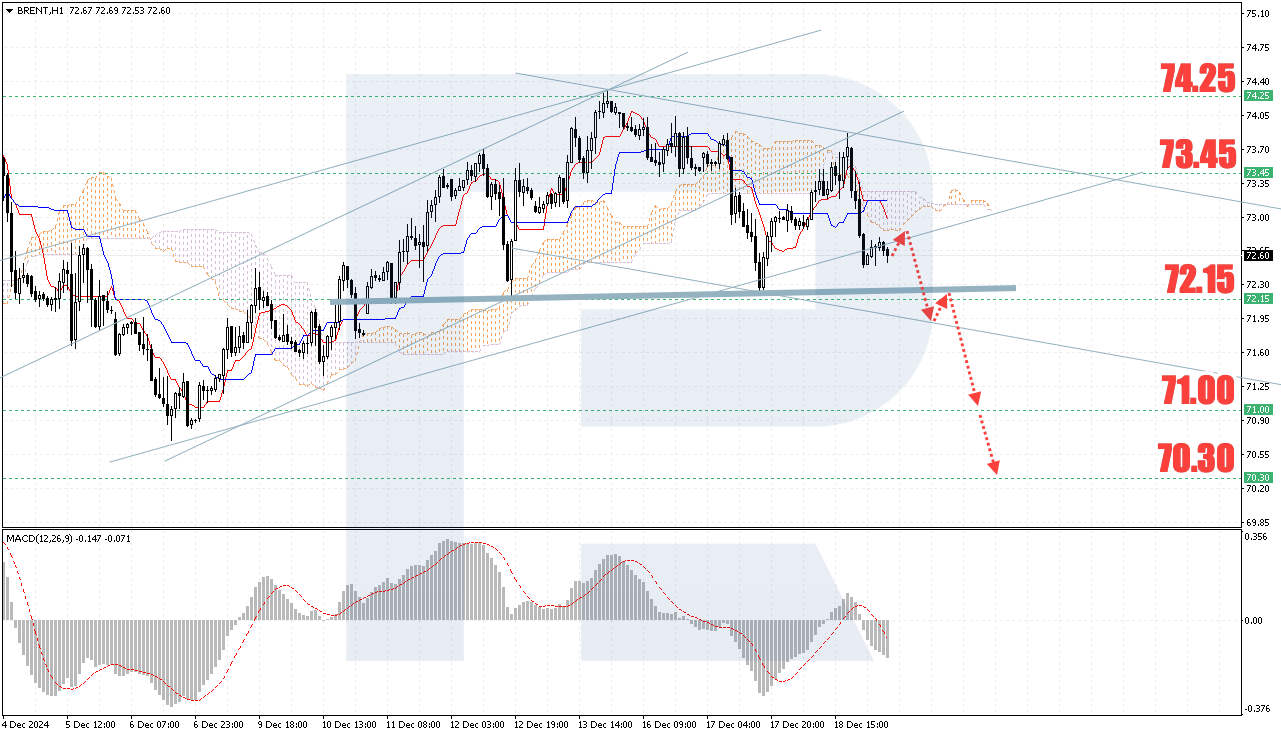

Brent prices secured a position below the lower boundary of the Ichimoku Cloud, suggesting a downtrend. Today’s Brent forecast anticipates a minor bullish correction, with prices testing the Cloud’s lower boundary at 72.85 USD before falling to 71.00 USD.

An additional signal favouring the bearish scenario is the formation of a head and shoulders reversal pattern. Sellers are now attempting to solidify their position below the pattern’s lower boundary. If prices breach the 72.15 USD level, the pattern could trigger a further decline towards 70.30 USD.

The MACD indicator analysis confirms that bearish sentiment dominates the oil market: the histogram is below zero and continues to decline. The scenario projecting a decline in Brent prices could be invalidated if the price breaks above the Cloud’s upper boundary and holds above 73.45 USD, signalling further growth towards 74.25 USD.

Summary

Brent prices are falling amid Federal Reserve statements about a slower pace of interest rate cuts in 2025, raising concerns about fuel demand. Despite a significant decrease in US oil inventories, the regulator’s hawkish comments continue suppressing price growth. Brent quotes are in a downtrend, remaining below the lower boundary of the Ichimoku Cloud, supported by bearish sentiment on the MACD indicator. If prices break below the 72.15 USD level, they could decline further to 70.30 USD in line with the reversal pattern. Conversely, a breakout above the 73.45 USD level will invalidate this scenario, indicating growth to 74.25 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.