Brent is falling below 75.00 USD following the OPEC report

Brent prices plummeted to 74.00 USD amid the release of the OPEC report and easing tensions in the Middle East. Find out more in our Brent analysis for today, 15 October 2024.

Brent forecast: key trading points

- OPEC cut its 2024 global oil demand forecast for the third time

- Current trend: correcting as part of an uptrend

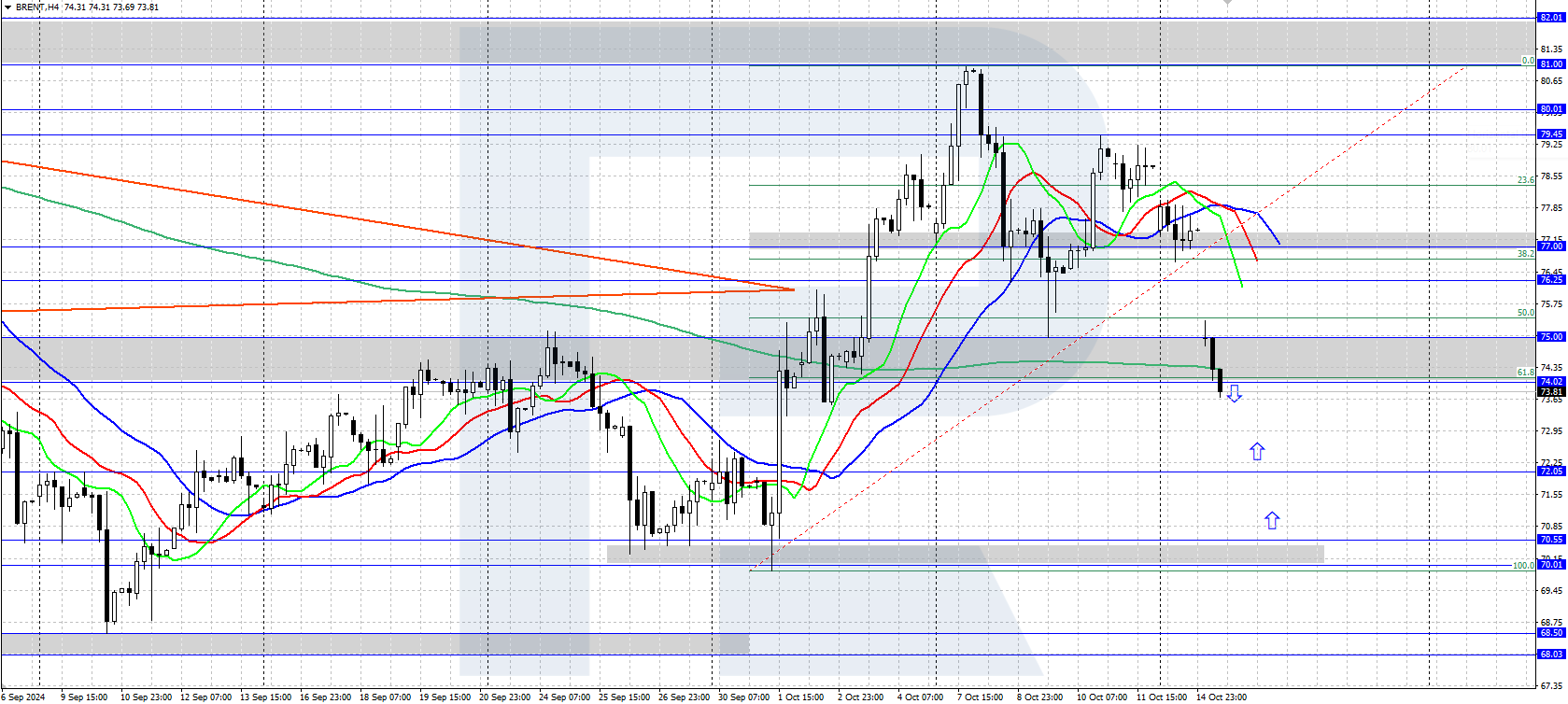

- Brent forecast for 15 October 2024: 72.00 and 77.00

Fundamental analysis

In its report released yesterday, OPEC revised down its 2024 global oil demand forecast for the third time, cutting it by 106,000 barrels per day to 1.9 million. This adjustment was primarily due to lower demand expectations in some regions of the world. Brent prices reacted negatively to this news, falling to the 74.00-75.00 USD support area.

Additionally, oil came under pressure from media reports that Israel is unlikely to strike Iranian oil facilities. This risk had already been factored into oil prices, with easing concerns also contributing to a price decline. Today, the market will receive a global oil demand/supply report from the International Energy Agency (IEA).

Brent technical analysis

Brent prices have sharply reversed downwards and are experiencing strong downward momentum following the OPEC report, which underwhelmed the market, and easing tensions in the Middle East. The commodity is trading around 74.00 USD, with bears holding the initiative and attempting to surpass the 74.00-75.00 USD support area.

The short-term Brent price forecast suggests that the decline could continue towards 72.00 USD if the price closes below the 74.00-75.00 USD price range as part of the current downward momentum. If bulls hold at the 74.00-75.00 USD area and reverse the price upwards, the instrument could recover and reach the 77.00 USD level.

Summary

Oil took a hit from the OPEC report and plunged to the price area around 74.00 USD. However, the trend is still upward, and growth will likely continue after the downward momentum is complete.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.