Brent corrects following a decline, rising above 71.00 USD

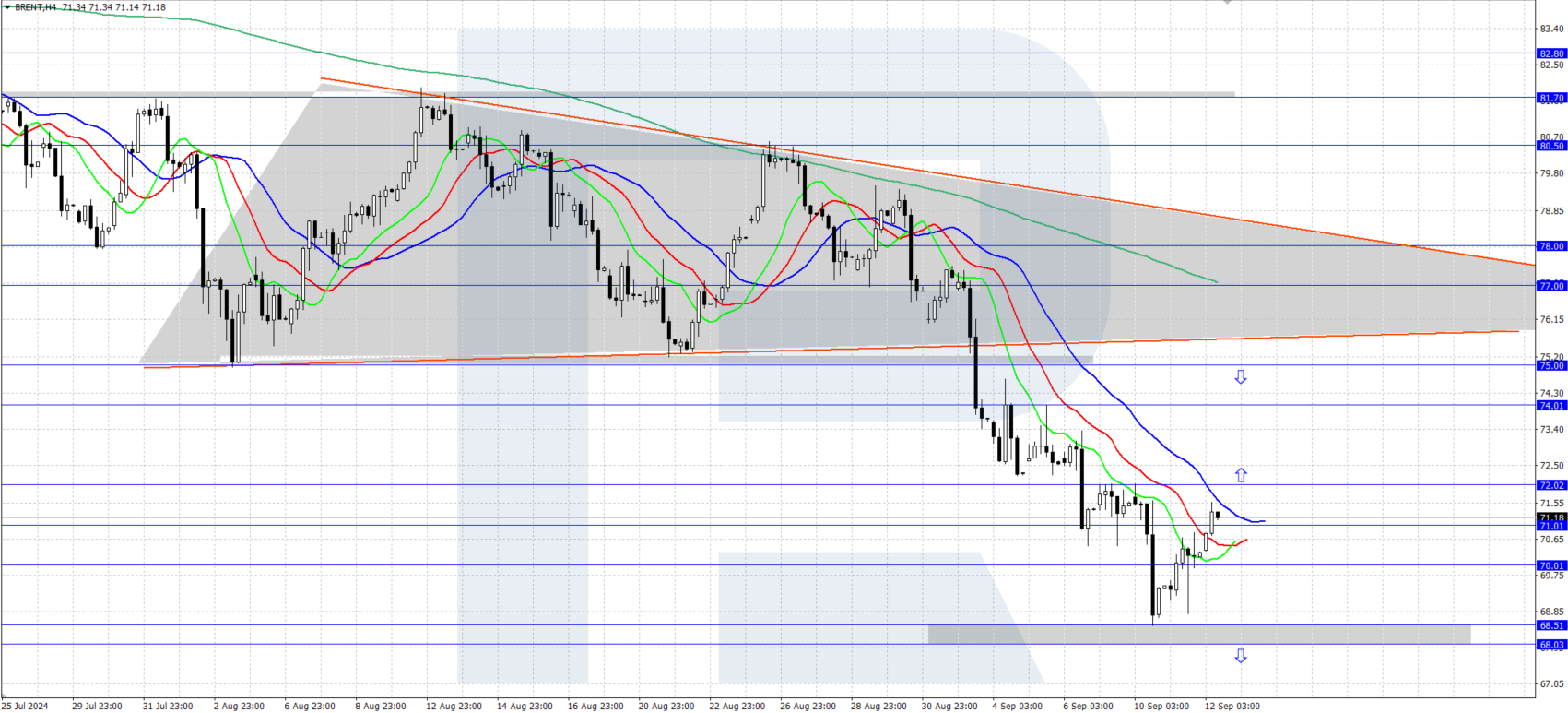

Brent’s price fell as part of the downtrend, completing a target movement in line with the triangle pattern. The quotes are now undergoing an upward correction. However, once it is complete, the decline may continue. Find out more in our Brent analysis for today, 12 September 2024.

Brent forecast: key trading points

- US data: the producer price index (PPI) is due today

- Current trend: a correction in the downtrend is underway

- Brent forecast for 12 September 2024: 75.00 and 68.00

Fundamental analysis

Brent quotes are experiencing a corrective rise after falling to 68.00 USD. Oil prices were supported by an upswing in the US stock market following yesterday’s results. US oil stock data released by the Energy Information Administration (EIA) yesterday showed an increase of 0.70 million barrels.

Market participants are awaiting US inflation statistics today, with the producer price index (PPI) scheduled for release. Oil will likely focus on the reaction of the US stock market to the released data. A rise in the market will help strengthen Brent prices, while a decline will send them lower.

Brent technical analysis

Brent continues to trade in a downtrend, with the quotes currently hovering slightly above 71.00 USD. A triangle pattern formed on the H4 chart and the quotes broke below it, falling to the target area at 68.00 USD. The pattern has been completed, with an upward correction currently underway.

The short-term Brent price forecast suggests that an upward correction towards the 75.00 USD resistance level is likely if bulls gain a foothold above the 72.00 USD level. If bears push the price below the 68.00-68.50 USD support area, the decline could continue, targeting 65.00 USD.

Summary

Brent quotes are correcting following a decline, rising above 71.00 USD. US oil inventory statistics may impact further movements today, with the PPI scheduled for release.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.