Brent prices continue to fall, dropping below 72.00 USD

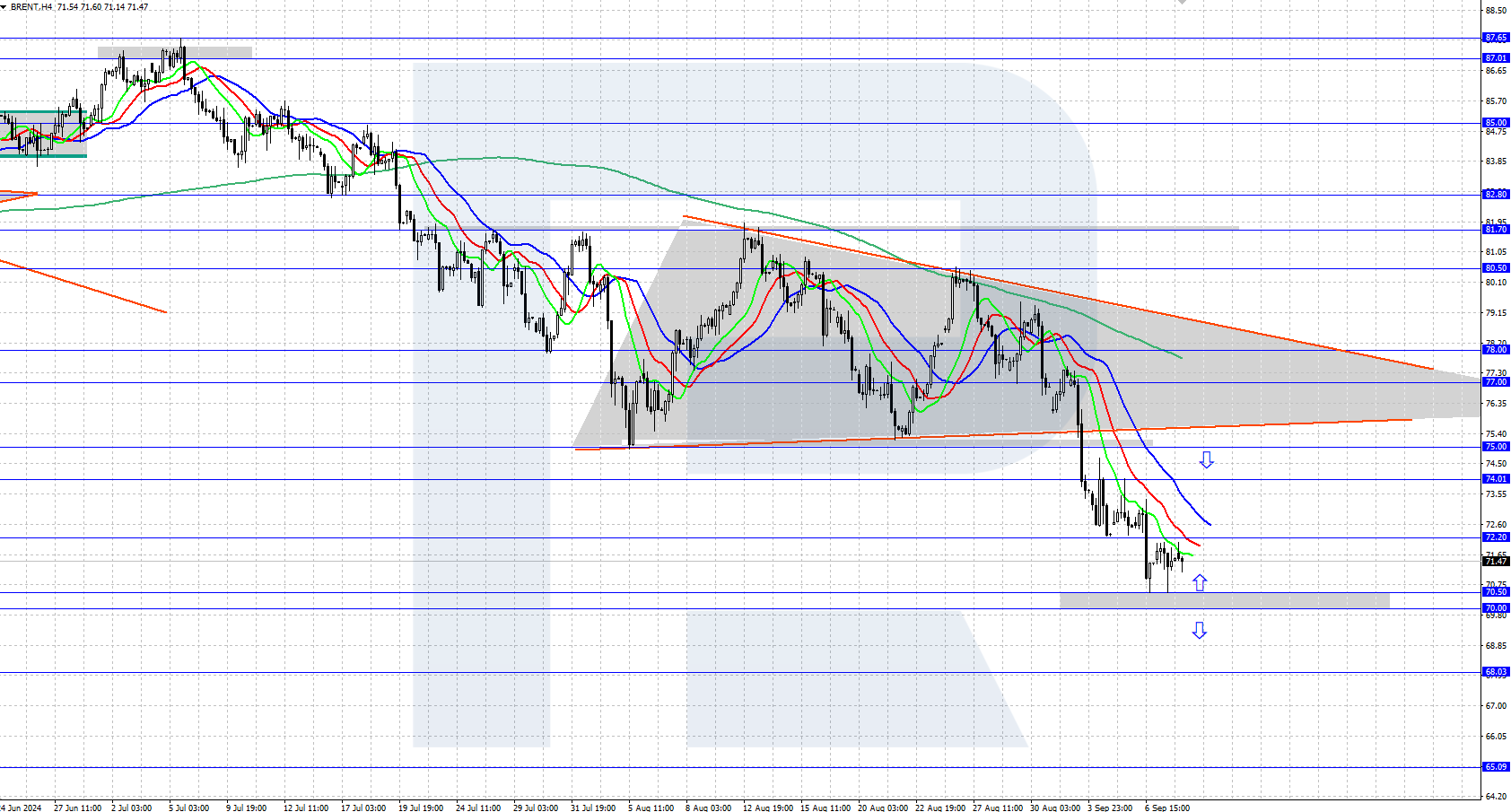

Brent’s price continues to decline within the downtrend, forming a triangle pattern on the chart. The market will focus on the US API crude oil stock change data today. Find out more in our Brent analysis for today, 10 September 2024.

Brent forecast: key trading points

- US data: the market is awaiting the API oil inventory statistics

- Current trend: the downtrend persists

- Brent forecast for 10 September 2024: 72.20 and 70.00

Fundamental analysis

Brent quotes continue to fall within the current downtrend. Oil prices are also under pressure from reduced global demand for raw materials, a decrease in seasonal consumption (typical for the end of summer), and a downward correction in US stock indices.

US oil inventory statistics from the American Petroleum Institute (API) are due today. A decrease in oil reserves may provide short-term support to Brent quotes, while an increase will push the asset price further down. Market participants will be awaiting US inflation data on Wednesday and Thursday.

Brent technical analysis

Brent continues to trade in a downtrend, with the quotes currently hovering slightly below 72.00 USD. A triangle pattern formed on the H4 chart and the quotes broke below it. The price is currently completing the pattern with a decline to 68.00 USD.

The short-term Brent price forecast suggests that an upward correction towards the 75.00 USD resistance level is likely if bulls hold the support near 70.00-70.50 USD. If bears push the price below 70.00 USD, a decline to the 68.00 USD support level will continue.

Summary

Oil prices are trading in a downtrend, falling below 72.00 USD. The US oil stock statistics from the American Petroleum Institute (API) may impact further movements today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.