US 30 analysis: the uptrend continues following a correction

The US 30 stock index is in a strong uptrend, showing no signs of a medium-term reversal. More details in our US 30 price forecast and analysis for next week, 25-29 November 2024.

US 30 forecast: key trading points

- Recent data: initial jobless claims totalled 213,000 in the previous week

- Economic indicators: this is a key measure of the US labour market’s health

- Market impact: the labour market’s condition directly influences monetary policy decisions by the US Federal Reserve, which are crucial for the stock market

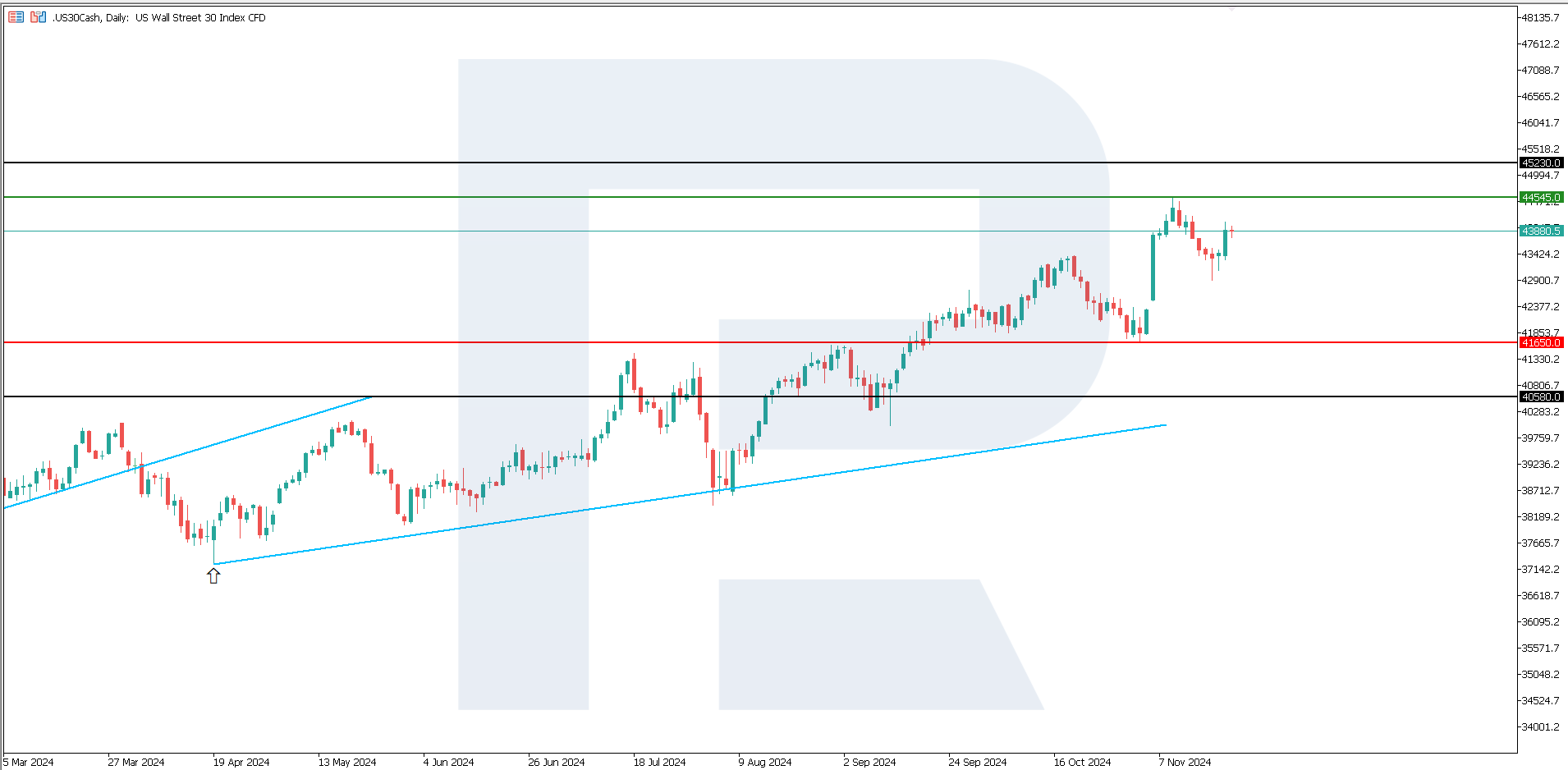

- Resistance: 44,545.0, Support: 41,650.0

- US 30 price forecast: 45,230.0

Fundamental analysis

Initial jobless claims amounted to 213,000, below the forecasted 220,000 and the previous 217,000, highlighting the labour market’s resilience. Low readings typically signal stable employment levels, while higher figures may indicate an economic slowdown.

Source: https://tradingeconomics.com/united-states/jobless-claims

The decline in jobless claims indicates a robust labour market, which could bolster consumer demand. However, the Federal Reserve has already begun reducing the key rate, signalling that the focus is shifting towards economic stimulus. A strong labour market may raise doubts about the necessity of further monetary easing.

If investors believe labour market data might slow the pace of Federal Reserve rate cuts, this could trigger a sell-off in rate-sensitive sectors, including technology. Nevertheless, low initial jobless claims boost confidence in the economy’s resilience, supporting the stock market. This environment may strengthen positive investor sentiment amid ongoing Fed rate cuts while increasing caution about future regulatory actions. The US 30 index forecast remains moderately positive.

US 30 technical analysis

The uptrend in the US 30 index persists following a correction. According to technical analysis, the US 30 index could reach a new all-time high. While a minor correction near the 44,545.0 resistance level is possible, it will not hinder further growth.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 41,650.0 support level could push the index down to 40,580.0

- Optimistic US 30 forecast: a breakout above the 44,545.0 resistance level could drive the price up to 45,230.0

Summary

Initial jobless claims amounted to 213,000, indicating a resilient labour market. If investors perceive that the labour market data may slow the pace of Federal Reserve rate cuts, this could negatively impact the technology sector. However, a strong labour market increases confidence in economic resilience, supporting the stock market. The US 30 stock index is now in a steady uptrend.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.