US 500 analysis: the index has reached an all-time high and attempts to consolidate above 6,000 points

The US 500 index surpassed the 6,000.0 level within the ongoing uptrend. More details in our US 500 price forecast and analysis for next week, 9-13 December 2024

US 500 forecast: key trading points

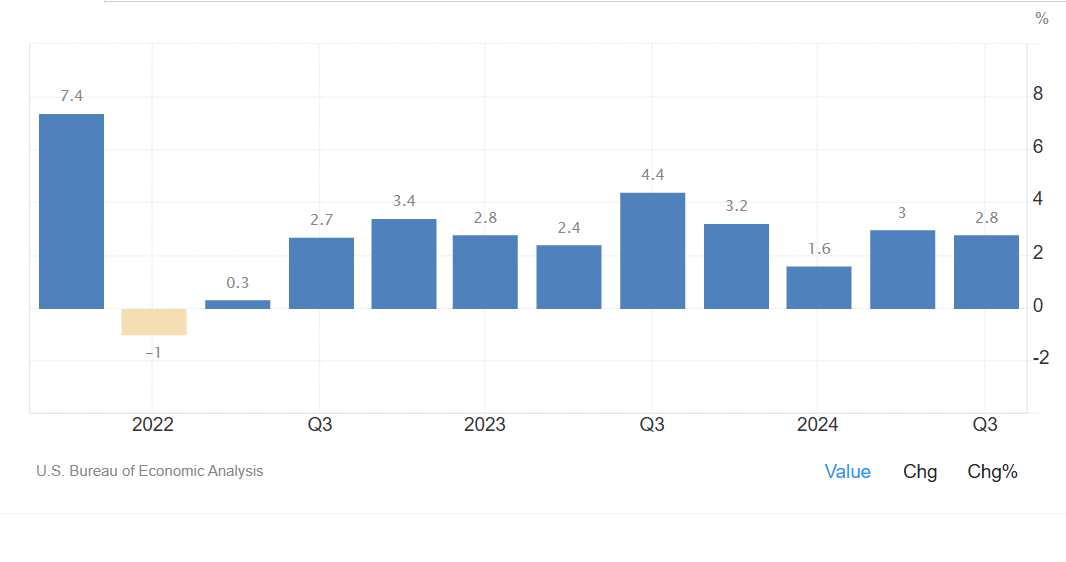

- Recent data: US GDP rose by 2.8% in Q3 2024 year-on-year

- Economic indicators: this figure reflects overall economic growth

- Market impact: positive data increases investor confidence in issuers’ earnings growth and boosts demand for their stocks

- Resistance: 6,035.0, Support: 5,985.0

- US 500 price forecast: 6,115.0

Fundamental analysis

According to preliminary data from the Bureau of Economic Analysis, US GDP grew by 2.8% year-on-year in Q3 2024, in line with market analysts’ forecasts. This growth was driven by a 3.5% rise in consumer spending.

Source: https://tradingeconomics.com/united-states/gdp-growth

Although household spending remains substantial, its growth forecast has been revised downwards. At the same time, business investment in research and development was revised upwards. The GDP report highlights the economy’s stability and resilience to the political risks associated with Donald Trump’s re-election. A slowdown in the pace of inflation reduction is also notable.

Core PCE inflation reached 2.8%, indicating that consumer prices have stabilised. The likelihood of a second inflationary wave is high. In this situation, the US Federal Reserve’s actions will be constrained by limitations arising from national debt growth. The US 500 index forecast is cautiously optimistic.

US 500 technical analysis

The US 500 stock index continues to rise, reaching another all-time high within the current uptrend. US 500 technical analysis shows further growth is likely if quotes consolidate above the breached 6,035.0 resistance level. Otherwise, a short-term correction could occur.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,985.0 support level could push the index down to 5,855.0.

- Optimistic US 500 forecast: if quotes consolidate above the breached 6,035.0 resistance level, they could rise to 6,115.0

Summary

According to preliminary data from the Bureau of Economic Analysis, US GDP grew by 2.8% year-on-year in Q3 2024, while core PCE inflation matched this figure at 2.8%. These economic trends enable the US Federal Reserve to continue its key rate-cutting cycle, supporting the stock market in the long term.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.